US Oil Exports Have Analysts At Odds Over What It Means For You

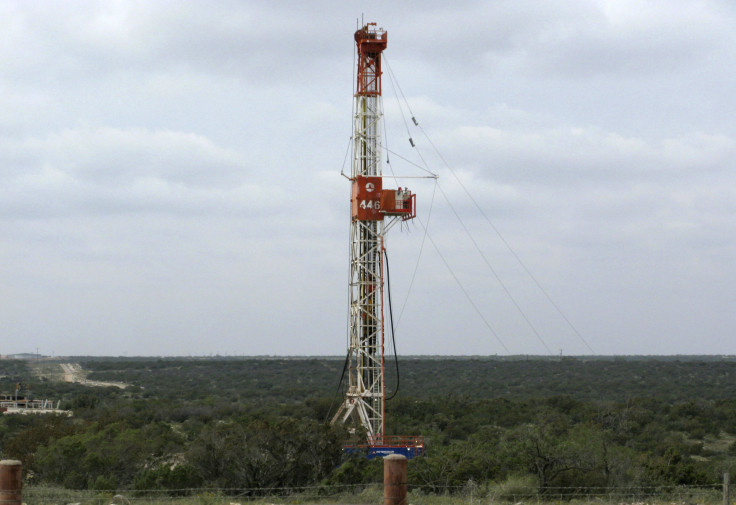

The Commerce Department granted two Texas oil companies permission to sell an ultralight variety of oil, the kind produced in abundance from shale rock, as soon as August, and energy analysts couldn't disagree more over the significance of the move.

The Obama administration's decision does not alter a ban on U.S. oil exports dating back to the 1970s-- the ban applies only to unprocessed crude, not gasoline, diesel and other petroleum products-- but the permissions toe the limits of the ban because the condensate to be exported needs only minimal processing.

After the news broke Tuesday, oil refiner stocks fell 6 percent to 10 percent, and oil producer stocks rose 2 percent to 3 percent, but “investors jumped the gun,” according to Fadel Gheit, an oil and gas analyst for Oppenheimer.

“The market exaggerated the impact,” he said Thursday. “It’s much ado about nothing.”

Andrew Weissman, senior energy adviser at Haynes and Boone, called the ruling “very, very significant,” saying the stock market reacted fairly strongly and appropriately.

In private rulings earlier this year, the Obama administration permitted Pioneer Natural Resources Co. and Enterprise Products Partners LP to ship a variety of ultralight oil known as condensate to foreign buyers, the Wall Street Journal first reported Tuesday.

Though permits are not needed to export petroleum products, the private ruling gives the companies legal protection and greater certainty over what the government defines as a condensate.

“It does not constitute a loosening of the ban on crude oil exports,” Benjamin Salisbury, senior energy policy analyst at FBR Capital Markets & Co, told clients in a research note Tuesday. “Processing oil, including condensate, through a distillation tower has been the defining feature of a product allowable for export for years under Department of Commerce rules.”

However, the move could calm oil producers’ fears of an oversupply of condensate in the U.S. that would cause oil prices to drop, he added.

“From a legal standpoint, from what’s been disclosed, the ruling really opens the door to anyone in the U.S. who wants to export condensate and has the equipment to process it,” Weissman said. He believes that by the end of the year, the industry may export as much as 1 million barrels a day of condensate.

Gheit said he talked to 15 oil companies this week, and “not one said they were interested in exporting condensate.”

“What [condensate] they have, they have already found a home for,” he said, adding that many refineries are opting not to invest in equipment to process the ultralight oil because they think the shale boom won’t last. Some refineries have, however, been investing in what are called condensate splitters to help them process the ultralight crude, and they will lose the benefit of cheaper U.S. crude as more is shipped overseas.

Whether or not oil and gas companies choose to export condensate will have "some major repercussions for natural gas prices," Weissman said.

Already, drillers tend to opt for liquids over gas because producing oil is often more profitable with relatively low natural gas prices, and the ability to export condensate could encourage companies to choose oil over gas until natural gas prices rise.

© Copyright IBTimes 2024. All rights reserved.