US Q2 GDP 2013: Weak Economic Growth Unlikely To Derail QE Tapering

The U.S. economy probably expanded at a slower pace in the second quarter of 2013 than the first, as weak inventory, net exports and consumer spending weighed on growth. Despite the expected poor growth performance, most economists expect that the Federal Reserve will begin to taper its quantitative easing program in September.

Paul Ashworth, of Capital Economics, said: “Although the recent incoming data have suggested that second-quarter GDP growth could be particularly disappointing, with a sub-1-percent reading possible, we still expect the Fed to begin tapering its monthly asset purchases in September. Gains in employment have remained more robust and, rightly or wrongly, Fed officials have been very vocal in blaming much of the lingering weakness in economic growth on fiscal consolidation.”

The first estimate of second-quarter GDP data will be released on Wednesday at 8:30 a.m. EDT by the Bureau of Economic Analysis.

The gross domestic product, the value of all goods and services the nation produced, rose at a 1.0 percent annual rate after a 1.8 percent gain in the previous quarter, according to the median forecast of 60 economists surveyed by Thomson Reuters. That’s still short of the 2.5-3 percent pace economists say is needed to bring down unemployment. Some forecasts, such as that by Dean Maki of Barclays Capital, are as low as 0.5 percent.

Nearly every forecaster, however, thinks the dip is temporary and expects a bounce in the second half of the year. Barclays continues to look for real GDP growth of 2.0 percent in both the third and fourth quarters. “We do not believe that the downside surprise to growth in the second quarter means that growth through the rest of the year will be similarly weak,” Maki said. “We think the January tax increases will weigh on growth less in the second half of 2013 than in the first half.”

Also, monthly data on manufacturing production and light vehicles sales point to the maximum weakness in the March-April period, with strengthening in May and June. This momentum points to stronger growth in the third quarter, Maki noted.

That's also the message from the manufacturing survey data; while the timing differs slightly, both the ISM manufacturing index and the Markit manufacturing PMI suggest that manufacturing growth has troughed and is now turning higher. “While growth seems likely to improve, we expect the drag from sequestration to keep it in a moderate, rather than robust, range in the second half,” Maki said.

Perhaps more importantly, in addition to the second-quarter results, the Commerce Department will also release a comprehensive revision of the historical series since its beginning in 1929. This is an event that only occurs once every five years, on average. The three previous comprehensive revisions were in 2009, 2003 and 1999.

In a comprehensive revision, the Bureau of Economic Analysis usually makes significant methodological adjustments to the way that GDP is calculated, resulting in revisions that extend back many years. These can also occur in a “regular” annual revision to GDP, but the scope of changes in a comprehensive revision tends to be more extensive, HSBC economist Ryan Wang said in New York.

“These changes are expected to boost the level of real GDP by more than $400 billion,” IHS Global Insight economists Paul Edelstein and David Deull said. “The revisions could change our view about the depth and duration of the 2007-2009 downturn as well as the strength of the recovery.”

As currently reported, nominal GDP totaled $15.7 trillion in 2012, split between consumer spending, investment, government expenditures and net exports.

The change is aimed at more accurately reflecting the modern economy. In particular, new forms of investment are to be recognized as “final expenditure,” including research and development, as well as the creation of entertainment originals such as movies, books and long-running television programs.

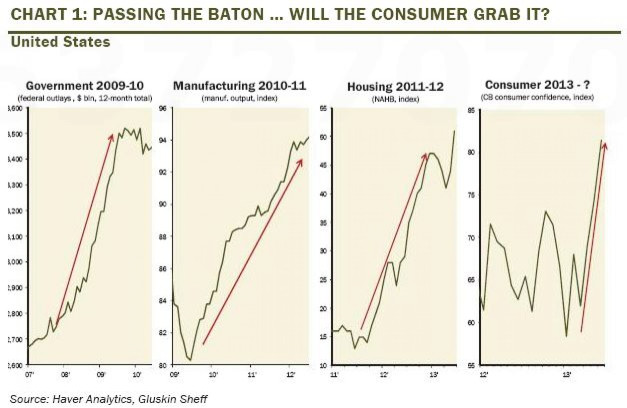

Gluskin Sheff's David Rosenberg has an interesting illustration of the various stages of the current economic recovery.

According to Rosenberg: Stage 1 was the government stimulus, and it’s over. Stage 2 was the manufacturing-led revival. Stage 3 was the housing revival, which is continuing for now, although the recent rolling-over of the homebuilding stocks suggests a dose of caution is warranted.

“Stage 4 will have to be the consumer grabbing the torch or else the economy will stagnate or perhaps even contract in the coming year – this is the spoke the wheel,” Rosenberg said in a note to clients. “The good news is that we are settling into payroll numbers of around +200,000 monthly, wages are beginning to show a pulse and consumer confidence has hit a cycle high.”

© Copyright IBTimes 2024. All rights reserved.