Wall Street Ends Sharply Lower As Consumer Pessimism Stokes Recession Fears

Wall Street tumbled in a broad sell-off on Tuesday as dire consumer confidence data dampened investor optimism and fueled worries that the Federal Reserve's aggressive battle against inflation could tip the economy into recession.

All three major U.S. stock indexes closed sharply lower, with the tech-laden Nasdaq declining the most. Apple Inc, Microsoft Corp and Amazon.com were the heaviest drags.

With the end of the month and the second quarter two days away, the benchmark S&P 500 is on track for its biggest first-half percentage drop since 1970.

All three indexes are on course to notch two straight quarterly declines for the first time since 2015.

"At some point this aggressive selling is going to dissipate but it doesn't seem like it's going to be anytime soon," said Tim Ghriskey, senior portfolio strategist Ingalls & Snyder in New York.

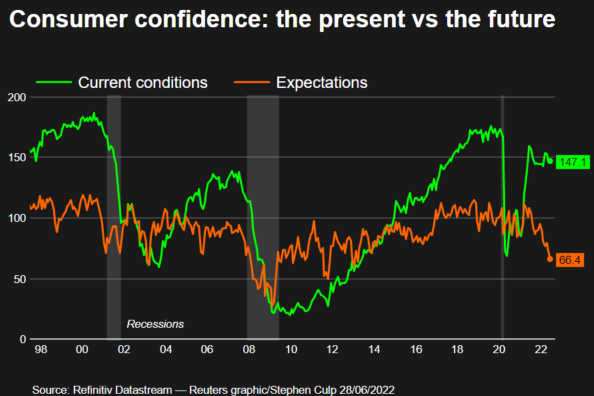

Data released on Tuesday morning showed the Conference Board's consumer confidence index dropping to the lowest it has been since February 2021, with near-term expectations reaching its most pessimistic level in nearly a decade.

"(Investors are) sitting there wondering whether declining consumer confidence will translate into recession and we haven't resolved that question," said Tom Hainlin, national investment strategist at U.S. Bank Wealth Management in Minneapolis, Minnesota. "We haven't seen second quarter earnings reports, so we don't know if companies are seeing a slowdown."

The growing gap between the Conference Board's "current situation" and "expectations" components have widened to levels that often precede recession:

Graphic: Consumer confidence -

According to preliminary data, the S&P 500 lost 78.02 points, or 2.00%, to end at 3,822.09 points, while the Nasdaq Composite lost 343.06 points, or 2.98%, to 11,181.50. The Dow Jones Industrial Average fell 490.78 points, or 1.56%, to 30,947.48.

With few market catalysts and market participants gearing up for the July Fourth holiday weekend, Hainlin does not blame the day's sell-off entirely on the Consumer Confidence report.

"It's hard to attribute (market volatility) to one economic data point with so much noise around portfolio rebalancing at quarter-end," Hainlin said.

"There's not a lot of new information out there and yet you see this volatile stock environment," he said, adding that there will not be much new information until companies start earnings.

With several weeks to go until second-quarter reporting commences, 130 S&P 500 companies have pre-announced. Of those, 45 have been positive and 77 have been negative, resulting in a negative/positive ratio of 1.7 stronger than the first quarter but weaker than a year ago, according to Refinitiv data.

Nike Inc slid following its lower than expected revenue forecast.

Shares of Occidental Petroleum Corp advanced after Warren Buffett's Berkshire Hathaway Inc raised its stake in the company.

© Copyright Thomson Reuters 2024. All rights reserved.