Wall Street Tumbles; Alphabet And Microsoft Drop Ahead Of Reports

Wall Street tumbled on Tuesday, led lower by the Nasdaq as investors worried about slowing global growth and a more aggressive Federal Reserve, and with quarterly reports from Alphabet and Microsoft on tap after the bell.

Previously-prized growth stocks have been hammered this year as investors fret about the impact of higher interest rates on their future earnings, while China's COVID-19 led lockdown and an aggressive pivot by major central banks to fight inflation have overshadowed what has been a better-than-expected quarterly earnings season so far.

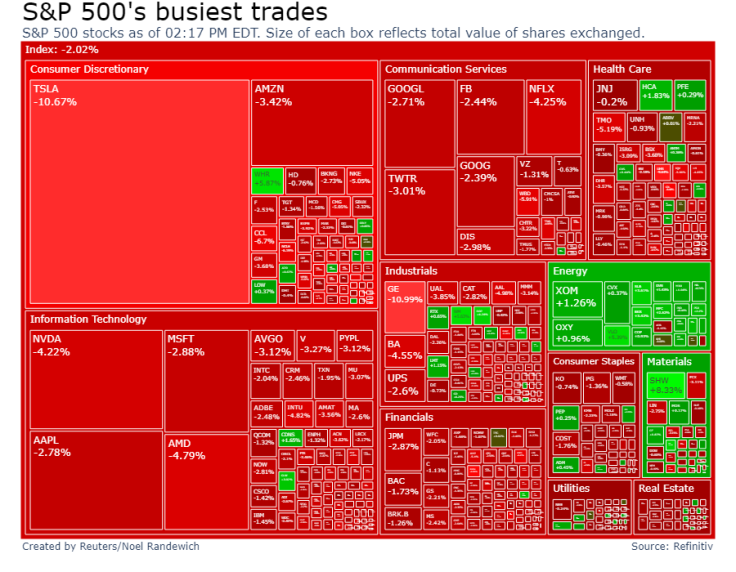

The consumer discretionary index dropped about 4%, pulled lower by a 3.8% loss in Amazon.

Tesla, another consumer discretionary stock, slumped almost 11%, with investors worried that chief executive Elon Musk might sell some of his stake in the electric car maker to help pay for his $44 billion deal to buy Twitter, announced on Monday.

Tesla contributed more than any other stock to the S&P 500's steep decline.

Alphabet Inc and Microsoft Corp each dropped 2.8% ahead of their results after the closing bell. About a third of the S&P 500 companies are set to report results this week.

Apple, Wall Street's most valuable company, fell 2.5% ahead of its report on Thursday.

"Earnings broadly have been pretty good. But it hasn't really mattered very much to the overall stock story. It's mainly about the Fed and other central banks, and now China and COVID," said Ross Mayfield, an investment strategist at Baird in Louisville, Kentucky.

"I think with where the market is right now, in this indiscriminate selling and fear phase, I think you've got more potential for downside risk than you have for an upside surprise," Mayfield said.

The United States and allies pledged new packages of ever heavier weapons for Ukraine during a meeting on Tuesday, brushing off a threat from Moscow that their support for Kyiv could lead to nuclear war.

The S&P 500 energy sector rose 1.4% as oil prices rebounded following reports that Russian gas supplies to Poland were halted.

In afternoon trading, the Dow Jones Industrial Average was down 1.84% at 33,423.69 points, while the S&P 500 lost 2.11% to 4,205.57.

The Nasdaq Composite dropped 3.09% to 12,602.74.

GRAPHIC: S&P 500's busiest trades

Of the 134 companies in the S&P 500 that reported earnings so far, 80.6% topped analysts' profit expectations, according to Refinitiv data. In a typical quarter, 66% beat estimates.

General Electric Co fell about 11% after forecasting full-year earnings at the low end of its previous estimate.

United Parcel Service Inc slipped about 3% despite reporting a rise in quarterly adjusted profit, while U.S. hospital operator Universal Health Services Inc slumped 10% after its earnings missed estimates.

Meanwhile, data showed U.S. consumer confidence edged lower in April, though households planned to buy automobiles and many appliances, which should help underpin consumer spending in the second quarter.

Declining issues outnumbered advancing ones on the NYSE by a 3.60-to-1 ratio; on Nasdaq, a 4.43-to-1 ratio favored decliners.

The S&P 500 posted no new 52-week highs and 40 new lows; the Nasdaq Composite recorded 21 new highs and 541 new lows.

© Copyright Thomson Reuters 2024. All rights reserved.