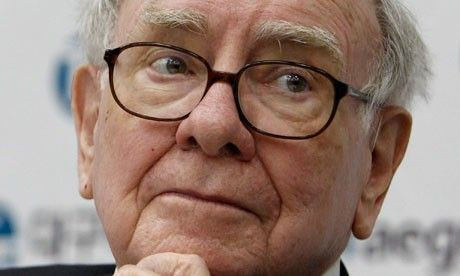

Warren Buffett: Congress Must Enact Minimum Tax Now On High Incomes

Warren Buffett, the world's third-richest man, again urged lawmakers to increase taxes on the wealthy and immediately endorse “a minimum tax” on high incomes, if it wants to get a handle on the so-called fiscal cliff.

Buffett, the CEO of Berkshire Hathaway Inc. (NYSE: BRK.B) and worth $44 billion according to the Forbes list of billionaires, also knocked the belief that higher taxes will prevent wealthy people from investing.

In a Sunday op-ed for The New York Times, Buffett wrote:

“Between 1951 and 1954, when the capital gains rate was 25 percent and marginal rates on dividends reached 91 percent in extreme cases, I sold securities and did pretty well. In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent — and the tax rate on capital gains inched up to 27.5 percent. I was managing funds for investors then. Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered.

Under those burdensome rates, moreover, both employment and the gross domestic product (a measure of the nation’s economic output) increased at a rapid clip. The middle class and the rich alike gained ground.”

Every American will see a tax increase in January if lawmakers cannot come to a fiscal cliff deal. President Barack Obama is now locked in negotiations with Congress on how to avert the approximately $600 billion in tax hikes and federal spending cuts that would kick in.

Almost all Republicans have signed on to Grover Norquist’s anti-tax-increase pledge. However, many are now changing course, admitting that they are willing to seek new revenues.

“So let’s forget about the rich and ultrarich going on strike and stuffing their ample funds under their mattresses if — gasp — capital gains rates and ordinary income rates are increased,” Buffett wrote. “The ultrarich, including me, will forever pursue investment opportunities.”

He said the wealthy “have plenty to invest" and argues that a “huge tail wind from tax cuts” has boosted the ultrarich, some of whom pay less than 15 percent in federal income while “a few actually paid nothing.”

“This outrage points to the necessity for more than a simple revision in upper-end tax rates, though that’s the place to start,” Buffett wrote, reiterating a support for eliminating the Bush tax cuts for high-income taxpayers.

Buffett did call for a cutoff point that is double the $250,000 limit proposed by Obama.

“We need Congress, right now, to enact a minimum tax on high incomes,” Buffett wrote. “I would suggest 30 percent of taxable income between $1 million and $10 million, and 35 percent on amounts above that. A plain and simple rule like that will block the efforts of lobbyists, lawyers and contribution-hungry legislators to keep the ultrarich paying rates well below those incurred by people with income just a tiny fraction of ours. Only a minimum tax on very high incomes will prevent the stated tax rate from being eviscerated by these warriors for the wealthy.”

© Copyright IBTimes 2024. All rights reserved.