Wealthy Crypto Owners Weather Crash While Low-Income Investors Sell Holdings: Survey

KEY POINTS

- The cryptocurrency industry experienced a bloody market over the past weeks

- Investors with high annual income are not likely to sell their crypto investments

- Some consumers still do not consider Bitcoin legitimate

During the recent cryptocurrency crash, almost half the investors cashed out their holdings, while the rest, or those with diamond hands, chose to muddle through the storm, a recent poll has revealed.

Consumer intelligence platform Civic Science disclosed in a report the recent market crash in cryptocurrency triggered some investors to sell off their holdings. The report revealed that 46% of these investors admitted to having sold their assets -- 20% sold a small portion of their crypto stash, while 26% claimed they cashed out a lot, if not all, of their investments.

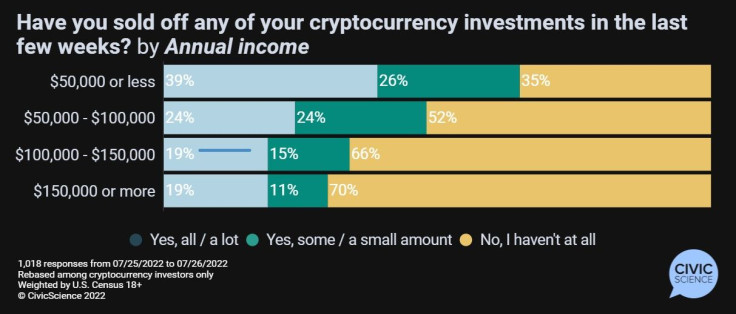

Based on the data, the poll noted that "the primary group of sellers turns out to be the lowest income crypto investors." Interestingly, the report shared those with "higher income are more willing to weather the storm with their assets."

Only 19% of financially stable investors or those with income above $150,000 annually sold a lot or all of their assets, while 11% sold some of their stashes.

The remaining 70% -- the diamond hands -- have not sold any chunk over the past few weeks.

A diamond hand is crypto speak for investors who continue to hold onto their holdings even in the worst market conditions. Among investors with an annual income of $100,000, but not more than $150,000, 66% were diamond hands, while 15% sold a small portion of their assets and 19% cashed in their crypto holdings during the market crash.

Meanwhile, 52% of crypto investors earning between $50,000 and $100,000 every year held on to their investments, 24% sold some or a small portion, while the rest 24% sold off their crypto investments. Unsurprisingly, only 35% of investors with an annual income of less than $50,000 held on to their crypto stash; 39% sold a lot or all of their holdings, while 26% sold a small portion or some of their crypto assets.

The report also revealed people did not stay away from cryptocurrency because of its price swing. Of the surveyed respondents, 30% believe that Bitcoin, the world's largest crypto by market capitalization, was not at all legitimate.

Others, or around 23%, suggested they do not like digital assets because of their volatility. A smaller number of the respondents or 10%, admitted they "do not have the financial ability" to get into the ecosystem, while 5% did not understand how to purchase cryptocurrency.

© Copyright IBTimes 2024. All rights reserved.