Why Almost Half Of Americans Pay No Federal Income Tax

Mitt Romney is, once again, under fire after video footage from a private fundraiser showed the Republican presidential nominee making incendiary remarks about the 47 percent of Americans who reportedly do not pay federal income taxes -- a group he seemed to claim was entirely comprised of Obama supporters.

"There are 47 percent of the people who will vote for the president no matter what," Romney said in the leaked video, which was filmed during a private fundraiser earlier this year. "There are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it, that that's an entitlement. And the government should give it to them. And they will vote for this president no matter what."

Romney's isn't completely wrong. Almost half Americans, in fact, do not pay a federal income tax. But they certainly are not solely comprised of individuals who support President Barack Obama.

The figure comes from the nonpartisan Tax Policy Center, which actually reported that 46 percent of Americans would not pay a federal income tax in 2011. But, as the center itself took pains to emphasize, that does not mean those individuals literally pay no taxes.

Almost half of the people who do not owe an income tax find themselves in that situation simply because they are too poor. For example, the Tax Policy Center reported a couple with two children bringing in an annual income below $26,400 would pay no federal income tax, because their standard $11,600 deduction and four exemptions of $3,700 each would reduce their taxable income to zero.

About 46.2 million people lived below the poverty line in 2011, according to the U.S. Census Bureau. Last year the official poverty line was an annual income of $23,021 for a family of four.

As for the rest of the untaxed households? In 2011, three-quarters of those remaining households did not pay a federal income tax because they were able to take advantage of tax credits and other provisions specifically designed to benefit lower-income households. Those provisions include the earned income tax credit, the childcare tax credit, and extra deductions for the elderly.

While households with incomes under $50,000 make up nearly 90 percent of those made nontaxable by tax expenditures, higher-income households can often pay no taxes because of other provisions, such as itemized deductions and reduced tax rates on capital gains and dividends.

Plus, while millions of families do not pay federal income taxes, virtually no one is exempted from paying payroll taxes, sales taxes, and state and local taxes.

According to a 2009 study from the Institution on Taxation and Economic Policy, the poor pay a higher percentage of their income in taxes than the wealthy in every state except for Vermont. In Alabama, families making less than $13,000 a year pay almost 11 percent of their income in state and local taxes, compared with less than 4 percent for those who make $229,000 or more, the report said.

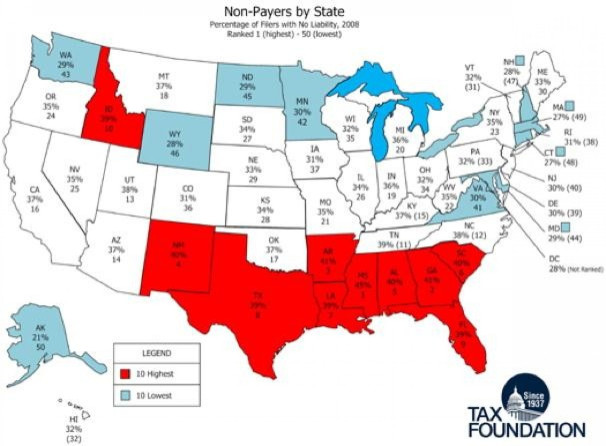

And while Romney apparently believes 47 percent of the nation's population consists of glorified moochers, he was wrong to call them Obama supporters. As Ezra Klein points out, a map from The Tax Foundation shows the states with the highest percentage of people who do not file income tax returns are, except for Florida and New Mexico, solid red states.

© Copyright IBTimes 2024. All rights reserved.