Why Are Stocks Dropping? Here's What US Equity Market Gyrations Are Telling Us

Global fears about China’s economic slowdown have rocked equity markets around the world the past few weeks, and while many stocks, and even entire sectors, have remained in a slump since the country’s so-called Black Monday, some securities have snapped back impressively. However, the list of winners in recent weeks has been pretty short. And experts indicate this is telling for where the U.S. economy and its markets are heading.

The major sell-off in U.S. equities recently has been broad-based across almost every sector in the Standard & Poor’s 500 index, and market professionals suggest investors should wait for the dust to settle in the short term. With money flowing out of the stock market, investors should hold bigger cash positions in their portfolios, said Karl Snyder, chief market strategist at Garden State Securities.

“There’s not a lot of safe sectors to be in right now,” Snyder said. “As an investor, you’re better off waiting on the sidelines to see how this plays out.”

Phil Davis, founder of PSW Investments LLC, agreed. “I really didn’t like the way things were looking this week and decided to cash out our positions,” Davis said.

Buying Opportunity?

Investors pulled a record $29.5 billion from equity funds in the week ending Aug. 26, according to Bank of America Merrill Lynch. This was the largest outflow since 2002, even exceeding any weekly movement seen amid the collapse of Lehman Brothers Holdings Inc. in 2008. Then investors cautiously came back into the stock market, adding $10.7 billion in global equity funds in the week ending Sept. 2, marking the biggest inflow in eight weeks, Bank of America Merrill Lynch said.

With more than 80 percent of the stocks listed on the New York Stock Exchange trading below their 200-day moving averages, the bargains could create buying opportunities for investors, as shares could get even cheaper.

“The biggest mistake investors made in 2008 was they started buying when the market first fell 10-20 percent, but then they missed out on better buying opportunities when the market fell another 50 percent from there,” Davis said.

Bullish Stocks

Ryanair

Wall Street is bullish on Ireland-based discount airline Ryanair Holdings PLC (NASDAQ:RYAAY) for two reasons.

First, airline companies are direct beneficiaries of comparatively low energy prices. Fuel is one of their largest fixed costs, so paying less for fuel helps their bottom lines.

Second, airline stocks are performing well right now largely because those companies cater to consumers, who benefit from comparatively low gasoline prices. Gas prices act as an indirect tax on businesses and consumers, so when energy prices are low, that increases discretionary spending, or the amount of money consumers have to spend. People then have more money to buy plane tickets, thus boosting the airline companies’ revenue.

“Even if there’s a slowdown in the economy, airliners’ profits are going to still benefit by people traveling more. They have more money put back into their pockets due to fuel prices coming down at such a rapid rate,” said Adam Sarhan, founder and CEO of Sarhan Capital.

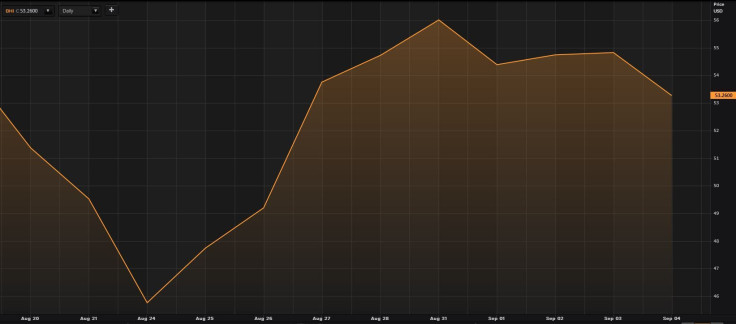

Ryanair’s share price shed nearly 7 percent in the market’s downturn Aug. 20-24. Since then, however, its stock has rallied a bit more than 9 percent, hitting an all-time closing high of $76.31 Friday.

Baker Hughes, Transocean

Oil prices have dropped by more than one-half over the past year, which has heavily weighed on energy companies. However, experts are bullish on service firms such as Baker Hughes Inc. (NYSE:BHI) and Transocean Ltd. (NYSE:RIG) because low oil prices don’t affect them quite as much as other outfits in the energy sector and their share prices have already taken a pounding.

“They’re so ridiculously low that you may as well buy them at this point because they’re trading at such low valuation,” PSW Investments’ Davis said.

Shares of Baker Hughes lost more than 10 percent after the S&P 500 broke through a key support level Aug. 20. However, the shares have soared 16 percent since Aug. 25. Meanwhile, shares of Transocean lost 10 percent of their value Aug. 20-24, but have since rallied almost 10 percent.

Bearish Stocks

Alibaba, JD.Com

However, experts warn to stay away from stocks that have large exposures to China, such as the online-commerce retailers Alibaba Group Holding Ltd. (NYSE:BABA) and JD.Com Inc. (NASDAQ:JD). “I would avoid highly speculative stocks with poor fundamentals that are losing money,” Sarhan said.

The Chinese online-commerce giant Alibaba posted quarterly sales that missed Wall Street forecasts. Although the company’s revenue rose 28 percent, it represented its slowest growth in more than three years. More than 80 percent of its revenue comes from its home market, and as China and other Asian economies slow, the firm’s growth is decelerating.

Shares of Alibaba lost 10 percent Aug. 20-24, and they have lost another 3 percent since then. Meanwhile, shares of JD.Com lost 10.6 percent during the same initial period, and they have extended losses by nearly 5 percent from then.

Red Flags Arise In ‘Safe Haven’ Stocks

More troubling, a number of the traditional so-called go-to sectors are no longer doing well. For example, investors historically have flocked to the defensive stocks in the utilities sector that are considered safe havens during corrective phases because those stocks typically perform comparatively well, as people still need gas and electricity. However, most stocks in the utilities sector haven’t been doing well this year because the sector is not in a growth phase. The large-capitalization segment of the sector has lost about 14 percent since January.

Also taking a hit are names in the health care sector, which had gained 10 percent from January to Aug. 20. Since then, the sector has erased nearly all of its gains for the year.

“It’s indiscriminate selling across the board, which is signaling the trend is changing,” Garden State Securities’ Snyder said.

End Of The Bull Market?

Six-and-one-half years into the bull market following the Great Recession, the S&P 500 broke below a key six-month support level Aug. 20, a little more than a week after global markets became extremely volatile in the wake of China’s devaluation of the yuan. Market leadership has narrowed considerably during the past six to eight months as fewer and fewer stocks are holding the market up, and fewer and fewer stocks are hitting new highs.

“That tells you that the structure of the market is changing,” Sarhan warned.

What came after Aug. 20 was unprecedented, not in percentage terms but in point terms. The Dow plummeted 1,000 points within the first few minutes of trading Aug. 24 -- the largest point loss ever during a trading day, surpassing the Flash Crash of 2010. The blue-chip index then closed down 588 points for the trading session, recording its worst day since August 2011.

The volatile swings Aug. 24 were driven by a reaction to China’s so-called Black Monday, which saw its benchmark Shanghai Stock Exchange composite index lose nearly 9 percent, erasing gains for the year. The recent volatility came after the Dow and S&P 500 hit all-time closing highs in May and the Nasdaq composite index hit a new record level in July.

U.S. stocks extended losses Aug. 24, with the major indexes all below their 200-day simple moving averages. A move through a major moving average is frequently used as a signal by traders that the trend is reversing.

“We could be in the beginning stages of a bear market,” said Jim Samson, publisher of Wall Street Informer.

According to Garden State Securities’ Snyder, the current downturn is more reminiscent of the short bear market in 2011 than the long bear markets that began in 2007 in association with the global financial crisis, or the bursting of the dot-com bubble in 2000. The 2011 event happened around the time the Standard & Poor’s rating agency slashed the U.S. government’s credit rating below AAA for the first time.

Coming Soon: Chinese Data, Fed Meeting

Next week could bring more volatility in the global markets. Investors will sort through a series of economic data releases coming out of China data that will receive a high level of scrutiny. They encompass figures on the country’s trade balance, inflation and retail sales.

The following week will be highlighted by the Federal Reserve’s widely anticipated meeting Sept. 16-17, which will include a news conference by Fed Chair Janet Yellen. Most economists previously anticipated the central bank would announce raising interest rates this month for the first time in almost a decade, but some experts indicate its decision could come down to the wire because of the recent stock-market gyrations.

“If the market doesn’t calm over the next two weeks, then the Fed probably won’t announce a rate hike at this next meeting,” said Jeffrey Cleveland, chief economist at Payden & Rygel.

And if the CBOE Volatility Index (INDEXCBOE:VIX), considered by some to be the best gauge of fear in the U.S. stock market, spikes above 30 in the next two weeks, then that could be a good indicator to use to determine whether the Fed will announce that it will not hike rates at its meeting in mid-September, Cleveland said.

The VIX leaped as much as 90 percent to 53 as the Dow dropped 1,000 points after the opening bell on Aug.24. The last time the volatility index jumped above 50 before that day was in March 2009.

As the Fed moves closer to tightening monetary policy, it will likely shift the equity market into a more volatile environment.

“It’s a very fragile house of cards that central banks have built here, and it doesn’t take much to knock it over,” PSW Investments’ Davis said. “China is a big wrecking ball coming to hit everything. It’s not worth the risk to stay invested in the stock market. It’s easier to cash out.”

© Copyright IBTimes 2024. All rights reserved.