Why Cheaper Food Means Less Profit At Restaurants Like McDonald's (MCD) And Wendy's (WEN): UBS Opens Restaurant Coverage

Cheap meats and crops may bode badly for fast food restaurants, according to a UBS AG (VTX:UBSN) note from Wednesday.

“When commodities carry very low inflation or deflation, it disadvantages chain restaurants and favors groceries and independents,” UBS analysts wrote in the report, which re-opened their coverage of the U.S. restaurant industry.

The analysts argued through the lens of commodity inflation, saying that an ideal environment is one with 2 to 3 percent commodity inflation.

In that environment, food at home becomes more expensive relative to restaurants, thanks to slimmer supermarket profit margins, they say. That drives consumers to restaurants. Inflation also indicates that consumers are spending a healthy amount on food, so restaurants will benefit from higher demand.

Lower commodity costs can impact both pricing and demand in chain restaurants, they wrote.

Despite the views of other Wall Street analysts, the UBS researchers don’t find significant correlations between input costs and profit margins. Grains and meats are considered key costs for restaurants.

“Company restaurant margins aren’t correlated with commodity prices: demand and price increases also play crucial roles,” they wrote. “Interestingly, neither straight data nor lagged data showed any correlation of note.”

The basic thought runs that cheaper food costs lead to fatter profit margins. But the UBS analysts cite counterexamples. In 2009, profit margins narrowed, despite materially cheaper costs, while margins expanded in 2010 despite higher costs, as measured by inflation.

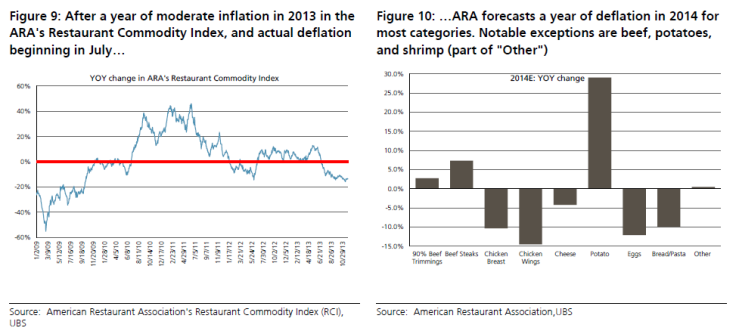

Over 2013, agricultural commodity prices fell sharply, thanks to big corn and soybean harvests which overwhelmed demand and boosted stockpiles. Feed supplies for livestock are the best they’ve been in seven years, according to the American Restaurant Association Group, which tracks food input costs.

The association said on Wednesday that feed prices could fall 30 percent by December 2014, if normal weather benefits U.S. crops over the year. But the ARA maintains that lower commodity prices should improve fast food margins.

The U.S. Department of Agriculture also expects chicken, milk and pork supplies to grow in 2014.

In their note, UBS analysts said fast food companies need to drive more traffic to their stores, given that they’re not opening many U.S. outlets. They should emphasize food over service, cheap or excellent food – rather than products straddling reluctantly between high-value and high-quality –, new products and international expansion.

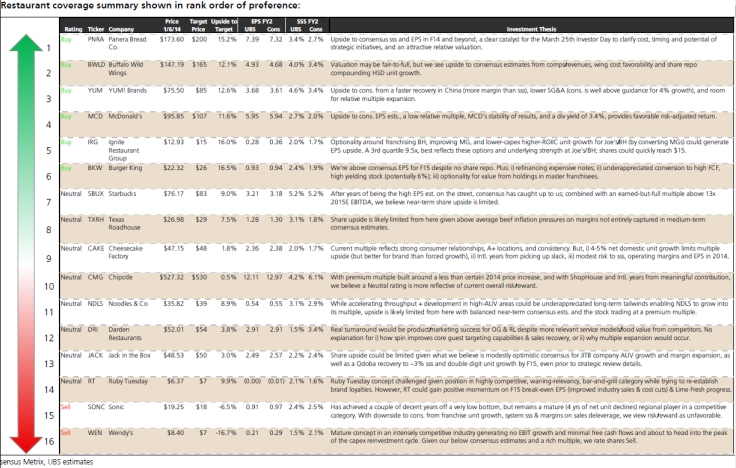

They picked Panera Bread Co (NASDAQ:PNRA), Yum! Brands, Inc. (NYSE:YUM), McDonald’s Corporation (NYSE:MCD) and Burger King Worldwide Inc (NYSE:BKW) as stocks to buy, but rated The Wendy’s Co (NASDAQ:WEN) and Sonic Corporation (NASDAQ:SONC) ‘Sells’. A slow global economy is a challenge to more spending on casual dining, they noted.

Panera and Buffalo Wild Wings (NASDAQ:BWLD) which recently struck a deal with PepsiCo, Inc. (NYSE:PEP), were UBS favorites.

© Copyright IBTimes 2024. All rights reserved.