World Bank Trims 2016 Global Growth Forecast, Warns Of ‘Perfect Storm’ In Emerging Economies

In its flagship report published Wednesday, the World Bank trimmed its global growth forecast for the third straight year, highlighting the risks posed by what it termed a “perfect storm.” Although global growth is projected to accelerate to 2.9 percent this year, from the previous year’s 2.4 percent, the forecast still represents a downgrade from the international lender’s June estimate of 3.3 percent.

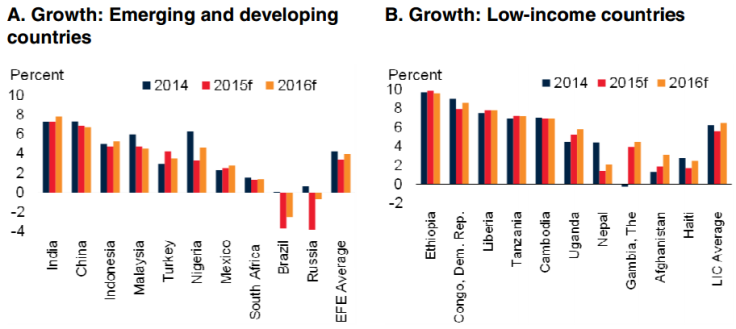

Continuing uncertainty in emerging markets, including the possibility that so-called Brics nations — Brazil, Russia, India, China and South Africa — could face deeper contractions than expected, led the international lender to downgrade the global growth forecast in its bi-annual Global Economic Prospects report.

“More than 40 percent of the world’s poor live in the developing countries where growth slowed in 2015,” World Bank Group President Jim Yong Kim said, in a statement accompanying the report. “Developing countries should focus on building resilience to a weaker economic environment and shielding the most vulnerable. The benefits from reforms to governance and business conditions are potentially large and could help offset the effects of slow growth in larger economies.”

The World Bank said U.S. gross domestic product (GDP) would expand 2.7 percent in 2016, slightly higher than last year’s 2.5 percent, but down 0.1 percent from its previous forecast. This is largely due to the strengthening dollar and weak overseas demand, which, cumulatively, are expected to dampen exports.

“Reflecting in part asynchronous monetary policy stances among major central banks, the dollar has appreciated more than 20 percent in nominal effective terms — and 18 percent in real effective terms — since mid-2014,” the bank said. “Empirical studies suggest that an appreciation around this size may reduce GDP growth by one percentage point after two years.”

Meanwhile, loose monetary policy in Japan and euro area countries should continue to sustain “fragile” recoveries in these economies, the bank said.

“This outlook is expected to be buttressed by recovery in major high-income economies, stabilizing commodity prices, and a continuation of low interest rates,” World Bank Group Vice President and Chief Economist Kaushik Basu said, in the report. “All this does not rule out the fact that there is a low-probability risk of disorderly slowdown in major emerging markets, as U.S. interest rates rise after a long break and the U.S. dollar strengthens, and as a result of geopolitical concerns.”

For instance, in China, where jittery investors are still unsure about the prospects of an economic recovery, GDP growth in 2016 is projected to be at 6.7 percent, the slowest since 1990. Of the other Brics nations, recession-hit Brazilian and Russian economies would continue to shrink, South Africa would witness a modest growth of 1.4 percent, while India would post a growth of 7.8 percent in 2016, the World Bank said.

“Stronger growth in advanced markets will only partially offset the risks of continued weakness in major emerging markets,” said World Bank Development Economic Prospects Group Director Ayhan Kose. “In addition, the risk of financial turmoil in a new era of higher borrowing costs remains.”

© Copyright IBTimes 2024. All rights reserved.