Worldwide IT Outsourcing Market Grew 7.8% In 2011

With 7.8 percent revenue growth and 10.9 percent of the market share, IBM continued its lead.

The Worldwide IT outsourcing (ITO) market grew 7.8 percent from 2010, with the revenue totaled at $246.6 billion in 2011. It was the India-based IT services providers and providers rooted in cloud-based services who delivered the highest growth rates in 2011, according to a latest report by technology research firm Gartner.

According to Bryan Britz, research director at Gartner, it's the revenue cannibalization caused by client adoption of industrialized and often cloud-based services that risk muting the growth opportunities for the ITO providers, which are heavily weighted in infrastructure outsourcing.

Strategies will vary as clients are likely to pursue hybrid cloud strategies requiring providers to deliver some asset-light and some asset-heavy offerings - which will result in varying growth trajectories among competitors over the next several years, Britz said.

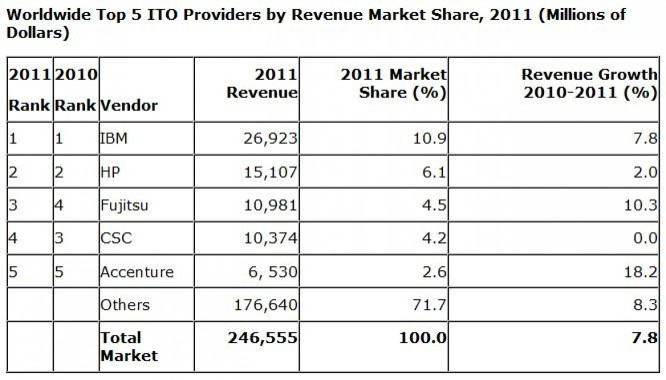

As per the Gartner report, with 7.8 percent revenue growth and 10.9 percent of the market share, IBM continued its lead. HP stood second in the last. However, it grew below the market growth rate with 6.1 percent market share. The third spot was acquired by Fujitsu with 10.3 growth rate and 4.4 percent of the market share, overtaking CSC.

According to Gartner, it's the currency gains that helped Fujitsu outdo CSC for the No. 3 worldwide market share position in 2011.

Have a look at the top 5 ITO providers by revenue and market share in 2011:

As many as 43 ITO providers booked 2011 revenues of $1 billion or more with a collective growth rate of 9.5 percent during 2011. If the India-based IT services providers, cloud-centric providers, and providers that made sizable acquisitions during the year are excluded, the remaining group of large ITO providers grew by only 6.5 percent during 2011.

For many leading providers in the ITO market, 2011 revenue results demonstrate how challenging simply maintaining a market share position has become, much less gaining share - and this challenge is likely to worsen over the next few years for providers that do not address these forces, Britz said.

Because acquisitions have been a challenge in the IT services market, all these challenges are likely to spur consolidation to augment growth, posing risk to the consolidators, according to Britz.

© Copyright IBTimes 2024. All rights reserved.