Worldwide PC Shipments Showed Signs Of Improvement Despite 1.7% Annual Decline In Q1 2014

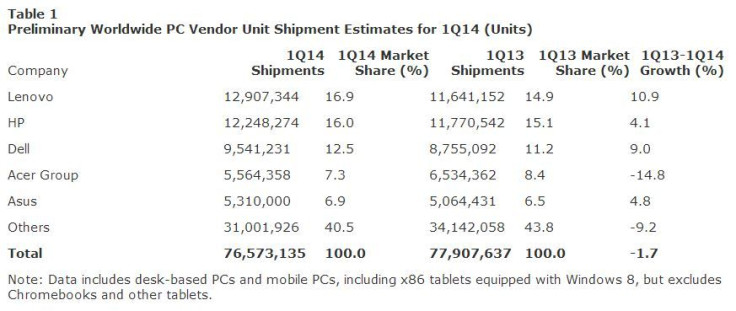

Worldwide shipments of personal computers, or PCs, reached 76.6 million units in the first quarter of 2014, accounting for a 1.7 percent decline from the same period last year, a new report by Gartner said, adding that the severity of the decline in demand for the machines eased compared to the previous seven quarters.

According to Gartner, a long-awaited decision by Microsoft Corporation (NASDAQ:MSFT) to end support for the older Windows XP operating system, which took effect earlier in April, triggered higher demand for newer PCs and played a role in easing the decline of shipments. For instance, Japan registered a 35 percent annual increase in PC shipments while other markets in Europe, Middle East and Africa, or EMEA, saw positive growth for the first time in eight quarters.

“While the PC market remains weak, it is showing signs of improvement compared to last year,” Mikako Kitagawa, principal analyst at Gartner, said in a statement. “The PC professional market generally improved in regions such as EMEA. The U.S. saw the gradual recovery of PC spending as the impact of tablets faded.”

While the high-volume, low-profit PC market has forced some vendors such as Sony Corp. (NYSE:SNE) out of the market, all of the top five vendors -- except Acer Incorporated (TPE:2353) -- registered year-on-year shipment growth.

Lenovo Group Limited (HKG:0992) experienced the strongest growth among the top five vendors and extended its position as the worldwide leader, while the share difference between Dell Inc. (NASDAQ:DELL) and Hewlett-Packard Company (NYSE:HPQ) once again narrowed compared to last quarter.

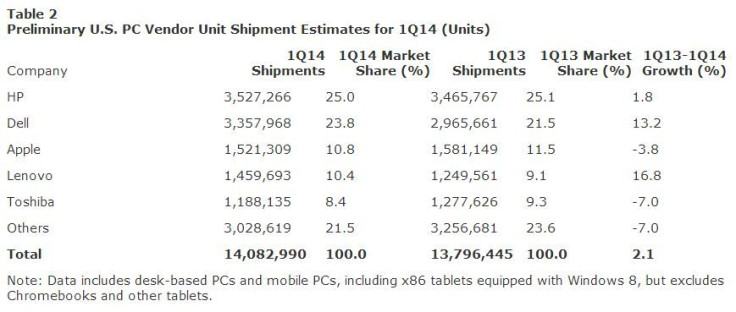

In the U.S., PC shipments totaled 14.1 million units in the first quarter of 2014, a 2.1 percent increase from the same period last year. While HP maintained the top position, Dell and Lenovo experienced the strongest growth among the top five vendors.

“In terms of the major structural shift of the PC market, the U.S. market is ahead of other regions,” Kitagawa said. “The U.S. PC market has been highly saturated with devices: 99 percent of households own at least one or more desktops or laptops, and more than half of them own both. While tablet penetration is expected to reach 50 percent in 2014, some consumer spending could return to PCs.”

While PC shipments in the Asia-Pacific region fell by 10.8 percent over the previous year to 24.9 million units in the first quarter of 2014, the EMEA PC market saw positive growth in the first quarter of this year after eight quarters of decline. Shipments totaled 22.9 million units during the period, a 0.3 percent increase from the same period last year.

While demand for newer versions of PCs was good for the industry, a general increase in professional spending also helped improve sales numbers in the last quarter, according to Gartner.

“The end of XP support by Microsoft on April 8 has played a role in the easing decline of PC shipments,” Kitagawa said, adding that the impact of users migrating from XP to newer systems is expected to "continue throughout 2014.”

© Copyright IBTimes 2024. All rights reserved.