Yahoo: Latest Turn Could Let in Private Equity via PIPE

PIPE. It's something to enter into the Yahoo search engine. Do so and the first financial link that pops up is a private investment in public equity.

Reports Tuesday suggest that rather than auction itself to the likes of Microsoft or Walt Disney or to a private equity investor such as Silver Lake Partners or Providence Equity Partners, Yahoo may try a PIPE.

That could mean the Sunnyvale, Calif.-based search and media combine could sell a piece of itself, which must be under 50 percent, to one of the P/E companies, keeping control in friendly hands.

That might be a way to forestall a takeover bid by activist investors like Daniel Loeb, whose Third Point Capital already owns a 5.2 percent stake, or Carl Icahn, who dabbled before but sold after former CEO Carol Bartz came in 2009.

After Bartz was fired on Labor Day, Yahoo promoted CFO Tim Morse to Acting CEO, hired Goldman Sachs and Allen & Co. for strategic advice and then reported higher third-quarter earnings.

Since then, Yahoo shares have gained 24 percent, boosting its market capitalization to $19.8 billion and its enterprise value to $17.7 billion. That would be a tough nut for an acquirer to swallow, although Microsoft once offered as much as $40 billion for the company.

Also, Yahoo's partner, Alibaba Group, the Chinese online payments concern, has expressed interest in buying the whole company and has been talking with Singapore's state investment company, Temasek Holdings, about financing.

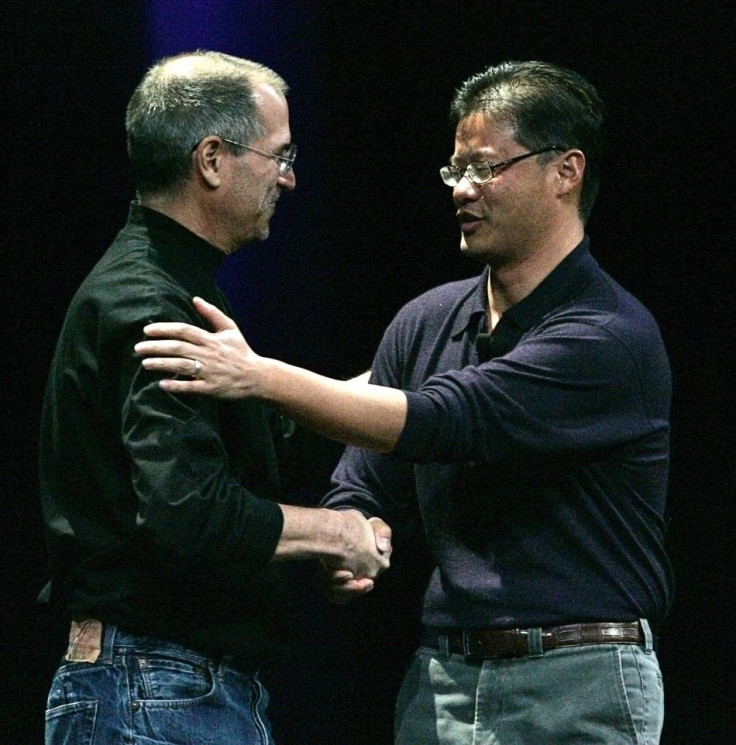

Yahoo owns about 40 percent of Alibaba already, so Morse and other Yahoo directors including co-founders Jerry Yang and David Filo might be interested in unloading that, as well as interests in Yahoo Japan not owned by Yahoo's former big investor, SoftBank.

In a PIPE, any deal usually keeps outsider interests below 50 percent so as to prevent lawsuits.

In a letter to Yahoo's board, Third Point's Loeb argued against a PIPE noting it makes no sense and its only purpose would be to put substantial equity stakes into friendly hands to entrench management and transfer effective control without payment of a premium, or even, it appears, a shareholder vote.

Sometimes PIPEs trigger lawsuits. Steven Davidoff, a law professor who contributes to The New York Times, recalled a 1984 case when Limited Brands launched a hostile bid for Carter Hawley Hale, another retailer whose stores included Neiman Marcus. Carter Hawley beat it by selling a 37 percent stake to General Cinema.

Another option Yahoo could try is to use some of the $2.8 billion it has in cash and securities to buy back shares. But that effort might not be big enough.

Yahoo shares Tuesday were essentially unchanged at $15.98.

© Copyright IBTimes 2024. All rights reserved.