9-Month Old Bitcoin ETFs Pass $20B In Total Net Flows – Gold ETFs Took 5 Years

KEY POINTS

- Eric Balchunas noted that spot $BTC ETFs achieved in a much shorter time what gold ETFs reached in 5 years

- This week's rally was largely thanks to BlackRock's IBIT, which hauled in a little over $1B in four days

- Grayscale's GBTC remains the outflow king among all US-listed $BTC ETFs

Spot Bitcoin exchange-traded funds (ETFs) have, for the first time, passed the $20 billion-mark in total net flows, marking a new milestone in the funds' financial journey just nine months since their launch.

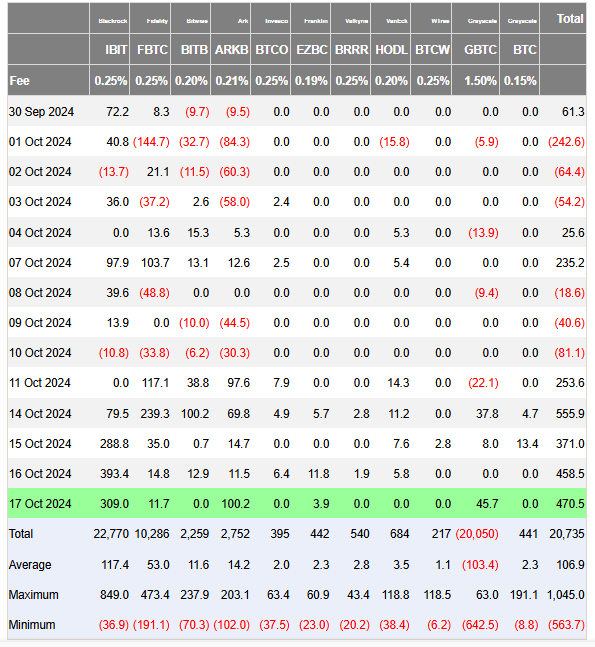

Data from Farside Investors shows that as of Thursday, the total net flows of Bitcoin ETFs has reached $20.7 billion, led by asset management titan BlackRock (IBIT), and followed by Fidelity Investments (FBTC).

Why This Milestone is Significant

Aside from $20 billion in net flows already being a staggering figure, Bloomberg senior ETF analyst Eric Balchunas noted that compared to gold ETFs, spot BTC ETFs have achieved much more in less time. "It took gold ETFs about 5yrs to reach [the] same number," he pointed out.

He also said total net flows are "the most important number" and the "most difficult metric to grow in [the] ETF world."

Bitcoin ETFs have crossed $20b in total net flows (the most imp number, most difficult metric to grow in ETF world) for first time after huge week of $1.5b. For context, it took gold ETFs about 5yrs to reach same number. Total assets now $65b, also a high water mark. pic.twitter.com/edldEimfqd

— Eric Balchunas (@EricBalchunas) October 17, 2024

Big Week for $BTC ETFs

The new milestone was hit in the backdrop of a massive week for the U.S.-listed ETFs, which logged an accumulative $1.8 billion so far in the last four days.

The four-day rally from Monday through Thursday was spearheaded by the King of Bitcoin ETFs, IBIT, which accounted for some $1 billion in the week's inflows so far.

Grayscale's Poor Performance

While the BlackRock and Fidelity's spot BTC ETFs have been doing great since their launch in January, one fund has been on the downtrend: Grayscale's GBTC.

The said ETF saw a staggering $20 billion in outflows, as opposed to IBIT's $22 billion in. It has also seen many days without inflows, even with some days where it also saw millions flowing in.

Some analysts previously said the ETF's downward spiral may be largely due to its considerably high fee compared to other funds within the bubble.

In the end, the GBTC's poor performance has become a stain in the glorious climb of other U.S.-listed ETFs, even those who have not seen massive hauls like IBIT but have consistently seen small inflows.

$BTC Largely Unmoved

Despite the big news from spot BTC ETFs, Bitcoin prices were largely unaffected. At one point late Thursday, the world's largest cryptocurrency by market value did shoot above $68,000, but within hours retreated to around $67,500. As of early Friday, the digital currency is trading above $67,700.

It remains to be seen how the Bitcoin ETFs will perform on the last day of the week, but regardless of how the flows turn up, it can be safe to say that BTC ETFs have become some of the fastest-growing funds the financial industry has ever seen.

© Copyright IBTimes 2024. All rights reserved.