Ancient Bitcoin Whales Cash Out $1.2 Billion In 2 Weeks, ETF Flows Negative: Analyst

KEY POINTS

- CryptoQuant CEO Ki Young Ju said the sell-offs come amid $460M in spot BTC ETF outflows in the past 2 weeks

- On Tuesday alone, Bitcoin ETFs saw net outflows of $152.4 million

- Other whales appear to be unfazed by the price slump, buying a collective 20K BTC in one day last week

Long-term Bitcoin holders sold a staggering $1.2 billion worth of BTC in the past two weeks, on-chain data revealed, and the cash out trend comes at a time when spot BTC exchange-traded fund (ETF) net flows have been negative.

Ki Young Ju, the founder and CEO of cryptocurrency analytics service CryptoQuant, revealed the trend on X (formerly Twitter), saying the massive sales were likely facilitated with the help of brokers.

Ju warned that if the sell-side liquidity isn't purchased over the counter, "brokers may deposit $BTC to exchanges," and such deposits may have an effect on the market. He also pointed out that BTC ETF netflows "are negative with $460M outflows in the same period."

#Bitcoin long-term holder whales sold $1.2B in the past 2 weeks, likely through brokers.

— Ki Young Ju (@ki_young_ju) June 18, 2024

ETF netflows are negative with $460M outflows in the same period.

If this ~$1.6B in sell-side liquidity isn't bought OTC, brokers may deposit $BTC to exchanges, impacting the market. pic.twitter.com/oYeKsRqKeF

On Tuesday alone, spot Bitcoin ETFs saw net outflows of $152.4 million, as per data from investment management company Farside Investors. Fidelity's FBTC led the daily outflows count with $83.1 million out, followed by Grayscale's GBTC, which saw $62.3 million in outflows. Bitwise's BITB also had $7 million in outflows.

Good morning,

— WhalePanda (@WhalePanda) June 19, 2024

Yesterday's ETF flows were negative again for $152.4 million.

Fidelity had $83.1 million of outflows and GBTC $62.3 million.

Price kept grinding further down until $64.2k, now starting to rebound a bit at sitting at $65.5k.

SEC closed its investigation against… pic.twitter.com/IIR4hXKYzt

Bitcoin whales, investors who have held at least 1,000 BTC for several years, are known to have the capability to move markets depending on their on-chain activity. Their transactions can either trigger fear among small holders or encourage other owners to keep "hodling," a term used to describe the action of holding on to one's digital assets regardless of market sentiment.

Crypto outlet Decrypt noted that CryptoQuant's data on "ancient" whales doesn't "tell the whole story," since other BTC whales, not necessarily those who've been in the Bitcoin holding circle since the digital currency's early days, have displayed continuing accumulation activity.

Just last week, on-chain data showed that Bitcoin whales bought the dip, when crypto sleuth Abram, who is also a community manager at CryptoQuant, shared that on Tuesday, over 20,000 BTC were added into whale digital wallets. "It appears that the whales took advantage of yesterday's correction in Bitcoin and accumulated additional quantities," he said of the whale activity.

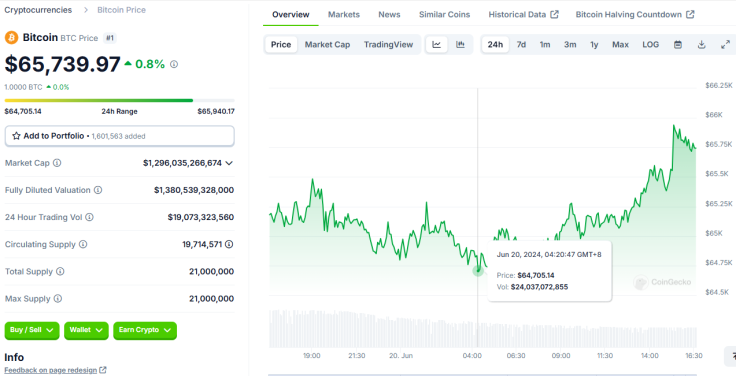

Bitcoin prices have been struggling to soar in recent weeks. At one point on Wednesday, the world's largest digital asset by market value slumped to $64,700. The coin has since added some $1,000 as of early Thursday, according to CoinGecko data. However, BTC has been on a 7.4% decline in the last 14 days.

Talks of price manipulation have also been rising on X this week. Some traders revealed there had been "spoofing" around the asset, and others argued that institutions were not taking serious note of the "blatant manipulation" going on in the market at this point.

On the other hand, other industry experts noted that Bitcoin's price downturn is "fairly typical" around the halving. Julien Bittel of Global Macro Investor (GMI) said BTC is just in the "boring zone" and will reach the "banana zone" in the long run.

© Copyright IBTimes 2024. All rights reserved.