Aramco says ready for two-stage IPO, timing up to govt

Saudi energy giant Aramco is ready for a two-stage stock market debut including an international listing "very soon" but the timing is up to the government, its CEO said Tuesday.

Aramco has said it plans to float around five percent of the state-owned company in 2020 or 2021 in what could potentially be the world's biggest stock sale.

The mammoth initial public offering (IPO) forms the cornerstone of a reform programme envisaged by the kingdom's de facto ruler Crown Prince Mohammed bin Salman, a son of King Salman, to wean the Saudi economy off its reliance on oil.

It aims to raise up to $100 billion based on a $2 trillion valuation of the company, but investors have debated whether Aramco is worth that much and there have been repeated delays in the launch originally envisaged for 2018.

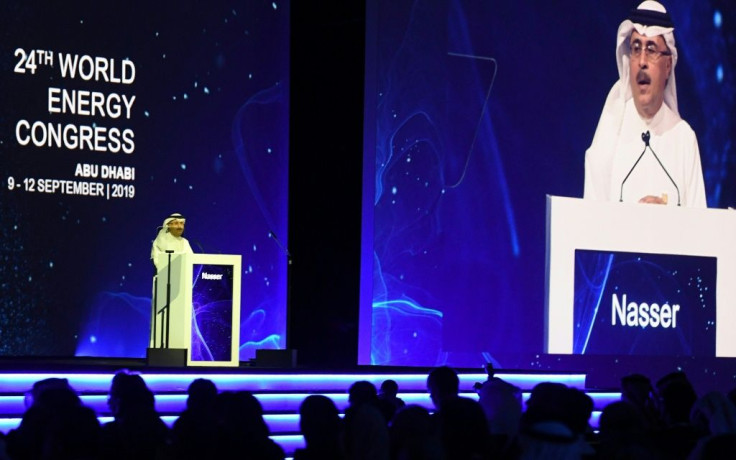

"We have always said that Aramco is ready for listing whenever the shareholders make a decision to list," CEO Amin Nasser told reporters on the sidelines of the World Energy Congress in Abu Dhabi.

"And as you heard from His Royal Highness Prince Abdulaziz yesterday, it is going to be very soon. So we are ready -- that is the bottom line," he said, referring to the newly appointed energy minister.

In New York, sources told AFP that US giant JPMorgan Chase had been tapped as the investment bank to lead Aramco's IPO.

The oil giant notified the US bank of its selection on Tuesday, the sources said.

Aramco has also chosen Goldman Sachs to work on the offering and other banks are expected to be added at a later date, sources said.

International listing

The Saudi government has not given any explanation for the delays in the listing, but apart from holding out for the big-ticket valuation, they are also said to be concerned the IPO could bring intense legal scrutiny of the secretive company's finances and inner workings.

Exchanges in New York and Hong Kong are heavily lobbying the Saudi group for the listing, the New York sources said, adding that Tokyo is not in the running.

"One of the primary listings is going to be local but we are also ready for listing outside," Nasser confirmed.

Prince Abdulaziz bin Salman, another son of the king, was promoted Sunday to the pivotal role of energy minister, replacing veteran official Khalid al-Falih, as the top crude exporter accelerates preparations for the much-anticipated IPO.

In his first comments since taking up the role, the minister on Monday endorsed oil supply cuts, saying in Abu Dhabi they would benefit all producing nations amid an oversupplied market and sagging prices.

Crude prices are currently moving around levels of $60 a barrel, compared with more than $75 a year ago, but were given a boost Monday by the comments.

Prices in decline

The OPEC petroleum exporters' cartel and key independent producers are deliberating how to halt a slide in prices that has persisted despite previous cuts and US sanctions that have squeezed supply from Iran and Venezuela.

Abu Dhabi is also hosting this week a meeting of the Joint Ministerial Monitoring Committee (JMMC) of the OPEC+ alliance for a supply cut deal reached last year.

The ministers will consider fresh reductions, even though analysts are doubtful such a move would succeed in bolstering crude prices, which have been badly dented by the US-China trade war.

The Aramco listing is key to Saudi Arabia's economic future. Its GDP grew by 2.4 percent last year but the International Monetary Fund said growth would fall to 1.9 percent in 2019 due to substantial oil output cuts.

The IMF said Monday that fiscal reforms, including a consumption tax and higher energy prices, have started to yield results but that more is needed to plug a chronic budget deficit.

The prospect of falling short of the $2 trillion valuation desired by Saudi rulers is widely considered the reason the IPO has been delayed.

Earlier this month, Aramco said its first half net income for 2019 slipped nearly 12 percent to $46.9 billion on lower crude prices.

It was the first time the company has published half-year financial results and comes after Aramco opened its accounts for the first time in April, revealing itself to be the world's most profitable company.

© Copyright AFP 2024. All rights reserved.