Bitcoin Crash – Did Powell's Comments On US $BTC Strategic Reserve 'Nuke' The Market?

KEY POINTS

- Powell was asked regarding the 'value' of a national strategic Bitcoin reserve, but he didn't answer directly

- The Federal Reserve Chair instead said the Fed is barred from owning $BTC

- Many crypto users reiterated that it's the Treasury that can hold Bitcoin reserves

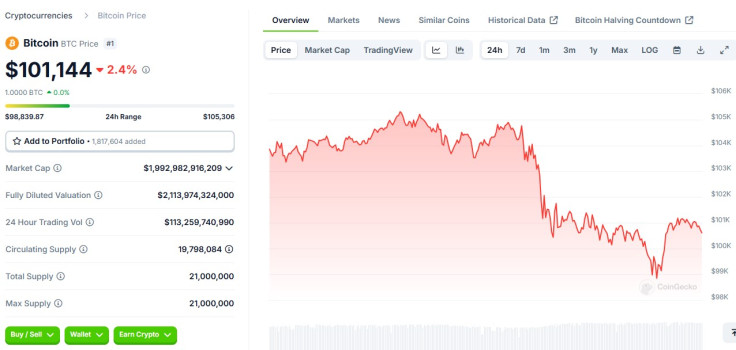

Bitcoin made a nosedive below $100,000 Wednesday night after Federal Reserve Chair Jerome Powell made comments about talks around a U.S. national Bitcoin strategic reserve, making the world's first decentralized cryptocurrency lose its $2 trillion market cap status.

The digital currency plunged from the $104,000 highs earlier in the day to around $99,800 at one point late Wednesday night before slightly recovering above $101,000 early Thursday. The coin bled 2.4% overnight as cryptocurrency users discussed Powell's statements.

What Did Powell Say to Hurt Bitcoin So Much?

During a Wednesday media briefing after the U.S. central bank's two-day policy meeting, Powell was asked about the possible value in the Donald Trump government's bid to build a strategic Bitcoin reserve.

Powell paused for a few seconds before saying, "We're not allowed to own Bitcoin," he said. He went on to explain that regarding legal issues on holding BTC, "that's the kind of thing for Congress to consider, but we are not looking for a law change at the Fed."

JUST IN: 🇺🇸 Fed Chair Jerome Powell says "we're not allowed to own #Bitcoin" pic.twitter.com/SQnNfqnTni

— Bitcoin Magazine (@BitcoinMagazine) December 18, 2024

His comments seemed to hit BTC prices hard, just about a day after the world's largest digital currency by market value erased all its previous all-time highs to spike above $108,000.

But crypto users have come out to insist that the Fed shouldn't have anything to do with a national Bitcoin reserve, an initiative being pushed by Trump ally Sen. Cynthia Lummis and several other prominent names in the industry.

Should $BTC Holders Panic?

For well-followed crypto enthusiast @CryptoSimmi, there should be no panic at this time since the incoming president never proposed that the central bank hold the country's BTC funds.

Simmi said Trump "suggested the Treasury could play a role," adding that while the Fed is not allowed to own any cryptocurrencies, "the Treasury can handle it under certain circumstances."

One crypto user had similar explanations, saying "it was never in the plan for the Fed BTC on balance sheet," pointing out that Powell is right regarding the need for Congress authority to flip the script to allow the Fed to own Bitcoin.

Another user said it appears Powell "knew what he was doing" when he "nuked the market with this statement," implying that the Fed chief understood many new retail investors in BTC would be frustrated by his comments and trigger pessimism in the market.

Some users are taking the hit on Bitcoin with open arms, saying Powell did a good job in making BTC prices plunge, just in time for a Christmas "buy the dip" spree.

For some crypto users, Powell intentionally made such statements to allow institutional investors to buy Bitcoin in the lows.

Meanwhile, most other digital coins in the top ranks have also retreated, including Ethereum (4.5% dip) and XRP (6.2% dip). All other coins in the Top 10 on CoinGecko are also in the red.

© Copyright IBTimes 2024. All rights reserved.