Bitcoin Plunges To $65K, Other Coins Affected As BTC Starts Week Down

KEY POINTS

- Most altcoins, or other coins besides Bitcoin, were also down early Monday, including ETH

- Most memecoins on CoinGecko's top 10 were also on the decline in the last 24 hours

- There is growing anxiousness among BTC holders, but some long-time owners remain positive

Bitcoin is starting the week on the low end of prices, and the price downturn appears to have dragged down other cryptocurrencies as well, including most of the other coins that are usually in the top 10 of the ranks.

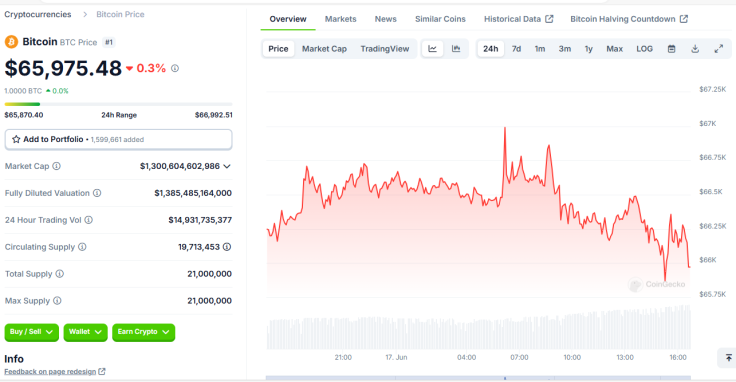

BTC plunged below $66,000 early Monday morning, settling at around $65,900 before gradually bouncing back above $66,000, according to CoinGecko data. At one point late Sunday, the digital currency dropped to $66,800. However, Bitcoin isn't the only digital asset that's starting the week on a weak note.

Ethereum's Ether (ETH), the world's second-largest digital asset by market value after BTC, was down 0.1% in the last 24 hours. Binance Coin (BNB) was down 0.4%, Lido Staked Ether ($TETH) declined 0.2%, and Dogecoin (DOGE), the top memecoin in the market, was dropped by 2.0% in the last day.

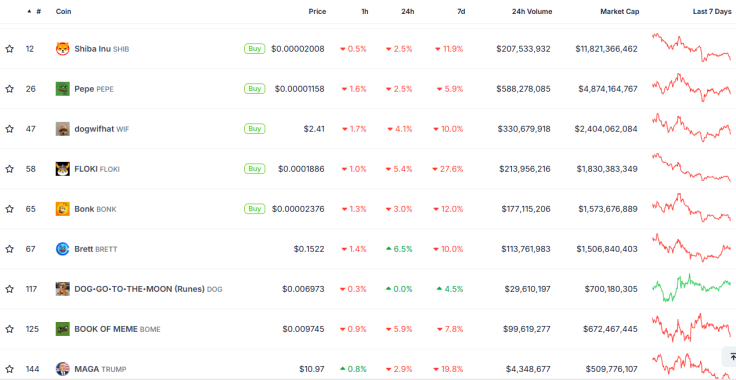

In the memecoin ranks, only two tokens survived the 24-hour beating. All other coins in the top 10 of CoinGecko's memecoin rankings declined in the past day, including popular Shiba Inu (SHIB) that fell 2.5%, FLOKI, which saw a 5.4% decline, and Donald Trump-themed MAGA, which was down by 2.9%.

Bitcoin has been on a downtrend in recent days, and it appears some Bitcoiners on X (formerly Twitter) are growing anxious over the price's struggle to hit $70,000 and stay there.

One user said the coin's price is "going sideways for far too long." Another user theorized that the reason Bitcoin hasn't been going up as many maximalists have predicted is because the price is "being held back by the bears."

Despite Bitcoin's continuing difficulties in climbing nearly two months after the April 20 halving that split mining rewards in half, some industry experts believe the world's first decentralized cryptocurrency is only on an upward motion.

Global investment firm AllianceBernstein said late last week that it sees Bitcoin reaching $200,000 next year. It is worth noting that Bernstein analysts previously projected a $150,000 price target for the digital asset by the end of 2025.

They said the increased price target is based on "unprecedented Bitcoin demand" from spot exchange-traded funds (ETFs), as well as supply being constrained after the halving.

There are also maximalists like MicroStrategy co-founder and executive chairman Michael Saylor, who are unfazed by the price slump. Instead, he wrote on X Sunday that people should "learn to think in Bitcoin." Prominent Bitcoiner Kyle Chassé agreed, saying pricing things "in Bitcoin" will make such items "get cheaper" as time goes by.

© Copyright IBTimes 2024. All rights reserved.