Bitcoin Price Plunge: Can $BTC Re-write Its Negative September History?

KEY POINTS

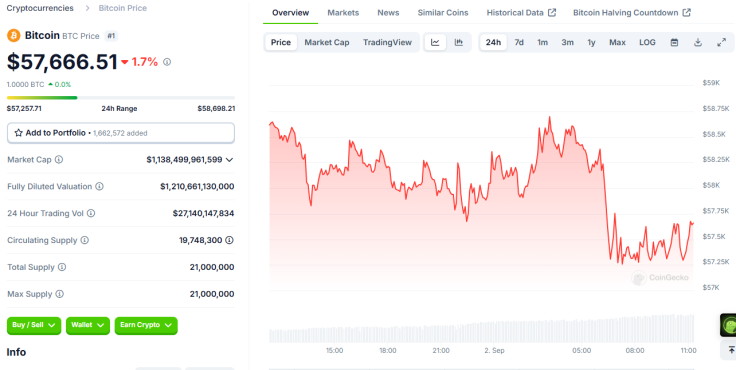

- Bitcoin started September in the red, down to $57,000 late Sunday from a $61,000 high Friday

- One of Bitcoin's worst Septembers was in 2021, when it started at $47,000 then plunged to $43,000

- Interest rate cuts could help Bitcoin re-write its negative history during September: Paybis Founder Innokenty Isers

Bitcoin ended August on a weak note, with the world's top digital asset by market value shedding some $3,000 over the weekend. It is entering a new month still in the red, and history has it that September isn't exactly a good month for the digital currency. Can the high and mighty $BTC re-write history this time?

Data from CoinGecko shows that Bitcoin hit $61,000 on Friday before sliding throughout the weekend to ultimately settle at around $57,000 late on Sunday. The coin has been down by over 10% in the last seven days and has been on a downtrend by more than 6% in the past month.

Bitcoin's Shaky September History

September hasn't always been the best month for Bitcoin. For instance, data from Yahoo Finance shows that in 2022, the digital currency started the month at $20,000 and ended at around $19,000. In 2020, $BTC prices kicked off September at around $11,000 then ended the month at $10,000. It was worse in 2021, when the coin started at a stellar $47,000 (with a $49,000 high) before gradually plunging throughout the month to around $43,000 (with a $41,000 low).

Last year was a little better for the world's first decentralized cryptocurrency as it started September at around $25,000 before ending the month near $27,000.

Innokenty Isers, the founder of crypto exchange platform and Bitcoin custodial wallet provider Paybis, told International Business Times that $BTC, indeed, has had a rocky past during September.

"September is a historically negative month for Bitcoin, as data shows it has an average value depletion rate of 6.56%. Thus far in August, the investor sentiment around Bitcoin has been negative too, with the coin trading between $49,000 and $66,000," he said.

Despite Bitcoin's negative history with September, it can find a breakthrough as things could be different this year, Isers pointed out.

Rate Cuts Could Play a Role

Last weekend, Bitcoin $BTC prices were at a much better place, targeting $65,000 amid a backdrop of positive news both within the crypto space and the broader financial world.

A key driving factor for the rally was Federal Reserve chief Jerome Powell's statement that the central bank may cut interest rates as early as September. For Isers, this could be the driver for a game-changing shift in Bitcoin prices this month.

"Should the Feds cut the interest rate in September, it might help Bitcoin re-write its negative history. This is because rate cuts generally lead to excessive U.S. dollar flow in the economy. This reduces the dollar's purchasing power, further strengthening the outlook of Bitcoin as a store of value," he said.

Institutional Titan Hinting Something Too?

As Bitcoin seemingly prepped for a historical repeat in September prices, several institutional investors such as Fidelity, Bitwise, and VanEck sold $BTC. However, data from leading blockchain analytics firm Arkham Intelligence showed that investment giant BlackRock snapped up $200 million in the last week of August.

Fidelity sold

— Arkham (@ArkhamIntel) August 31, 2024

Bitwise sold

Ark sold

Invesco sold

VanEck sold

But BlackRock bought $200M BTC this week pic.twitter.com/Xt2VB5W1YA

"Some institutional investors are already proving a point regarding views on $BTC as a store of value with massive Bitcoin accumulations. If the Fed's policies weaken the dollar, switching to risk assets with higher growth potential might be inevitable," Isers said.

© Copyright IBTimes 2024. All rights reserved.