The Canary Is Alive And Chirping A Year Into Fed's Rate Hiking Cycle

Utah homebuilder Ivory Homes still has a pipeline of several hundred houses under construction, but CEO Clark Ivory isn't pulling permits for any more at this point, and in a year of retrenchment for the single-family home industry, he has laid off just under 10% of his workers.

But don't look for that to be reflected in overall U.S. construction employment or spending data, a canary that is very much still breathing inside what would usually be the toxifying air of rising U.S. interest rates.

While housing starts are falling, "there is still a fair amount of completion happening," Ivory said, adding that contractors can move on to other jobs once finished with his company's projects. "There are other areas of construction - public works, industrial, roads and infrastructure. There is so much money out there," he said, from pandemic spending programs as well as recent federal government initiatives like the Inflation Reduction Act.

A year after the Federal Reserve began a historic drive to arrest inflation with rapid interest rate hikes, Fed officials meeting this week face a wildly confusing economy that by some measures continues operating beyond capacity - a recipe for rising prices - and by others seems to be approaching a serious fissure given how a banking crisis has rattled markets in the last two weeks.

Is the economy really standing firm against the Fed's aggressive rate moves? Rate increases have averaged more than half a percentage point at each of the eight Fed meetings since March of 2022, and pushed the benchmark overnight interest rate from the near-zero level to the current 4.50%-4.75% range.

Or are businesses and consumers just slow to respond, with the full impact perhaps developing now?

As the tightening orchestrated by Fed Chair Jerome Powell hits the one-year mark, the extent of the influence depends on where you look.

A MIXED INFLATION SCORECARD

The Fed's purpose throughout its aggressive tightening cycle has been to reduce inflation from the 40-year-high reached last summer down to the 2% annual rate the central bank regards as consistent with its generic goal of "price stability."

Inflation has slowed.

But recent progress has been less than hoped. As of March 8, in his last public comments before the Fed's March 21-22 meeting, Powell said recent data had "reversed the softening trends" the central bank had hoped were becoming established, and that meant higher interest rates might be needed to slow an economy that doesn't want to buckle.

GRAPHIC: Rates and inflation (

)

DOGS THAT DIDN'T BARK (YET)

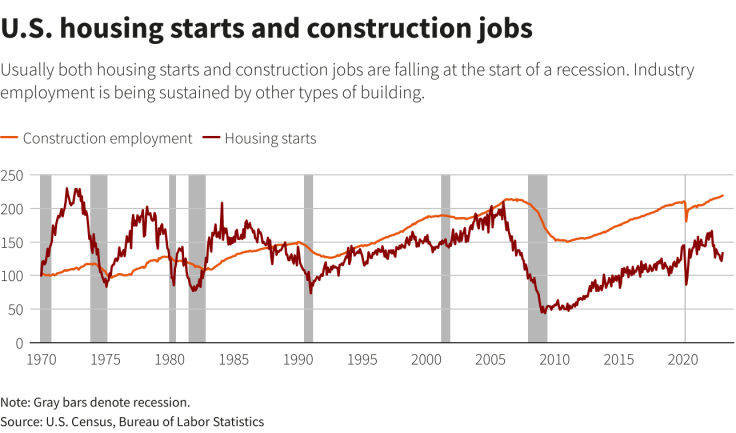

Construction: The status of the construction industry shows the Fed's pandemic-era dilemma.

Monetary policy works on the economy through many different channels, but housing is an important one. As interest rates rise, buying slows, spending that would have taken place on home building supplies and new home furnishings plummets, and existing homeowners shy away from financing major improvements.

Since the 1970s, declines in housing starts have been followed by drops in construction employment, and been associated with the onset of recession.

It is not happening the same way this time.

Graphic-U.S. housing starts and construction jobs (

)

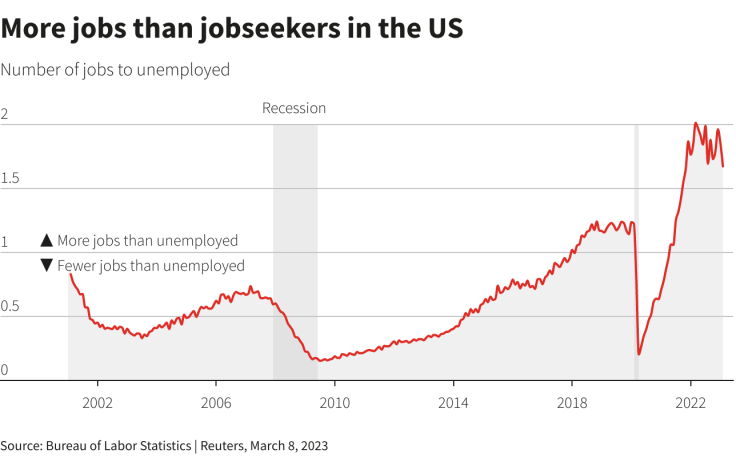

Employment: The job market overall in fact has shown only initial signs of slowing - and the Fed has put a lot of weight on tempered job and wage growth as a necessary condition for inflation to fall.

Between ongoing demand and the difficulty of hiring, many businesses seem to be holding on to existing workers and adding headcount when they can to try to stay fully staffed. The number of job openings for each available worker has barely budged from the record levels set during the COVID-19 pandemic, and monthly job growth remains in the hundreds of thousands.

Graphic-Mo GRAPHIC:

re jobs Job gains

than remain

jobseekers strong

in the US

(

)

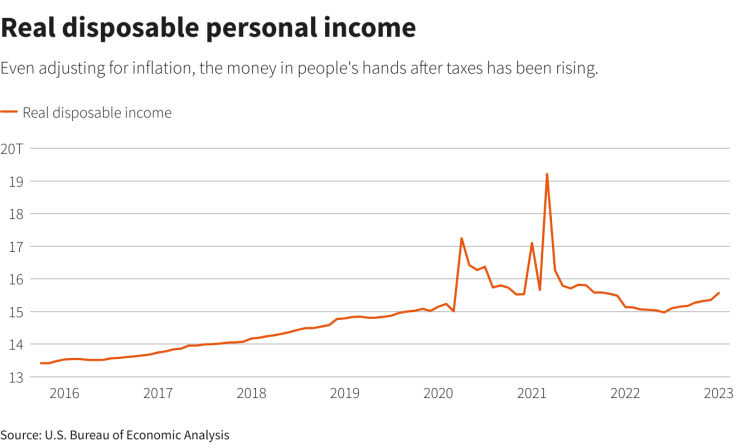

Income: For households, that means the pump is still primed. Even after adjusting for inflation, after-tax income - the amount of money left to spend or save - has been rising.

GRAPHIC: Graphic-Real disposable personal income

SIGNS OF STRESS?

The Fed's rate increases have had an impact.

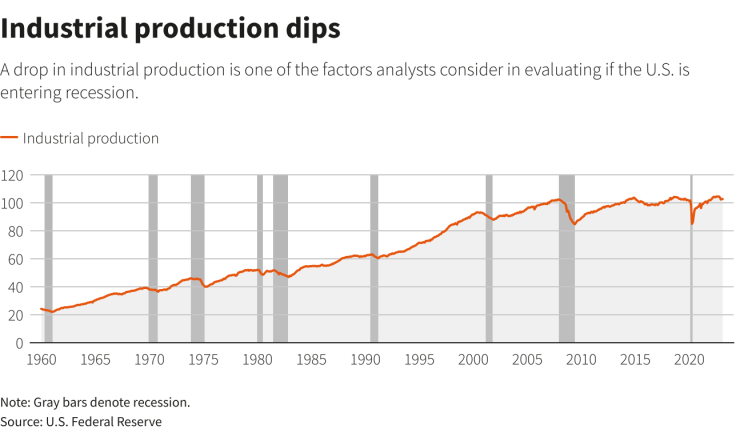

Manufacturing: A broad index of industrial output published by the Fed is among the top-line data that economists watch for signs the U.S. is entering recession. It is currently declining.

GRAPHIC: Industrial production dips

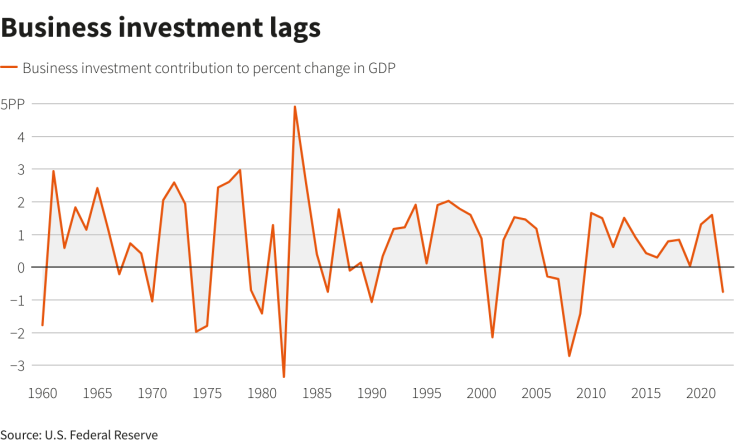

Capital expenditures: Business investment is also weak, and detracted from overall economic output last year - also a common precursor to recession and a sort of proxy vote by firms about the outlook and a sign they are delaying spending.

GRAPHIC: Business investment lags

Credit: Tighter monetary policy is starting to show up in measures of credit as well, and recent stress among midsized banks may add to that if financial firms become more cautious in their lending.

As long as it remains orderly, a credit crunch could be positive for the Fed. If businesses and households are less free to borrow, they are likely less free to spend - and demand for goods and services will fall, as should the pressure to raise prices.

GRAPHIC: Tighter business credit conditions

© Copyright Thomson Reuters 2024. All rights reserved.