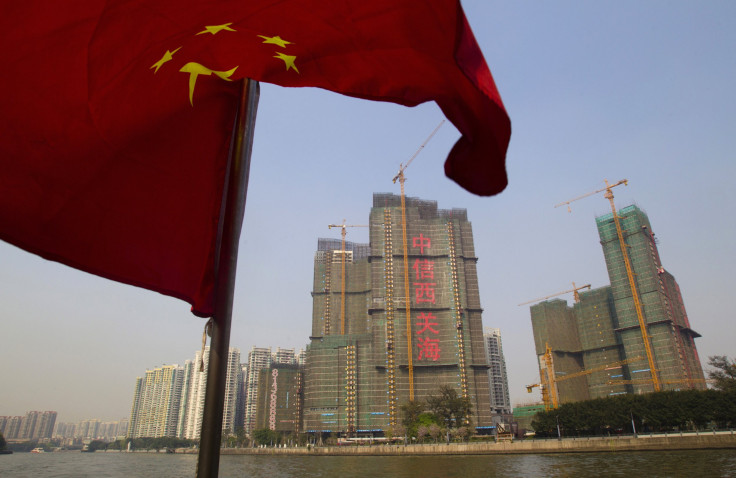

Chinese Property Developers Stake Out Shares In Commercial Banks, Intensifying Systemic Risks

Major Chinese property developers have in recent months been buying increasingly large stakes in regional banks, posing risk that an unravelling in the real estate market could leave both lenders and builders confronting losses big enough to pose a threat to the economy, experts warn.

Those fears are expected to be amplified next week as China is set to release a report on its weakest economic growth since 2009.

The prospect of a continued economic slowdown has spurred a flurry of tie-ups between Chinese property developers and commercial banks, raising questions about the motivation for these deals and the heightened systemic risk.

“The association of real estate companies and banks intertwines the destinies of the two industries and can be an explosive and dangerous mix,” said Jim Butler, chairman of the Chinese Investment Group with Jeffer Mangels Butler & Mitchell.

Dozens of Chinese developers have bought stakes in local banks, including Vanke -- the largest mainland developer. Vanke became the biggest single investor in Huishang Bank when it took an 8 percent stake in its IPO last October. Earlier this year, another major Chinese developer, Evergrande, acquired its 5 percent stake in Huaxia Bank via the secondary market, making Evergrande the bank’s fifth-biggest investor.

Analysts noted that the property developers that are buying into commercial banks are still very high profile developers, and they are only purchasing relatively small stakes in smaller banks. Therefore, this has not caused a significant rise in systemic risk yet. However, it will be a completely different story if smaller yet heavily-leveraged developers jump on the bandwagon.

Property companies are hoping to use their links to the banks to obtain preferential financing, which is crucial for real estate companies during times of tightening liquidity.

“The real estate business is essentially a financial business. [It has] very high capital intensity,” said Tracy Chen, senior research analyst at Brandywine Global.

But banks that are lending to property developers who own stakes in these banks are attracting close scrutiny from Chinese regulators. “Even when a property developer owns a partial share in a bank, it’s still hard for the bank to lend to the property developer,” Chen added.

The International Business Times has put together a list of some of the more widely reported deals in the Chinese press. The list below, while not exhaustive, provides a glimpse into a phenomenon that has the potential to become an industry-wide practice.

The race to buy into banks also highlights the fact that the one-way housing boom is over. “Developers don’t need to go into other businesses if they think their main business is so profitable,” Chen explained.

The cooling down of the housing market is squeezing into developers’ profit margins. Average new-home prices grew 10.04 percent in March from a year earlier, decelerating for the third straight month after February's 10.79 percent rise and January's 11.1 percent gain, data provider China Real Estate Index System showed.

Meanwhile, banking business is still the most profitable business. China’s banks are a different breed of financial institution. They enjoy lucrative interest margins during good times, and when things head south, the state is there to clean things up.

In fact, the former chief economist and spokesman of China’s National Bureau of Statistics went so far as likening the nation’s banking system to an automated system that even a dog could successfully run.

“Banking in China has become like a highway toll system,” Jingyuan Yao said in December at a summit on China’s economy held at Nanjing University. “Banks charge every time money goes through them.”

“With this kind of operational model, banks will continue making money even if all the bank presidents go home to sleep and you replaced them by putting a small dog in their seats,” Yao said.

The purchase of stakes into commercial banks by the high-profile property developers is a phenomenon that was triggered by China’s recent move to open up the country’s state-controlled banking sector to private capital.

“This [buying into banks] is a way for Chinese property developers to diversify their revenue stream and gain access to the high- profit-margin banking business,” Chen said.

While Chinese regulators are encouraging private capital to flow into the banking sector, there is a limit to how much competition state-owned banks can handle and the regulators can tolerate.

“If the flow of deals keeps on happening at this pace, the Chinese regulatory authorities will become uneasy with the situation in the very near future,” Chen said. “Actually, they already made an announcement recently that asked the banks to disclose their lending to associated companies, which means their stakeholders.”

© Copyright IBTimes 2024. All rights reserved.