Chinese Yuan May Become Fully Convertible Within 2-3 Years: HSBC

China’s top leaders have made their ambition very clear with a series of bold reforms: the redback is ready to dominate the spotlight on the world’s currency stage.

HSBC predicts that the Chinese yuan, which overtook the euro to become the second-most used currency in global trade finance after the U.S. dollar last December, will be fully convertible within two to three years.

The Chinese yuan’s global clout has already grown notably over the years. More than 10,000 financial institutions are doing business in yuan, up from 900 in June 2011.

Although the growth in the use of the yuan to settle trade between China and the rest of the world has been rapid, HSBC economists think there is still plenty of potential for the trend to continue.

From just 3 percent in 2010, the yuan is now used to settle around 18 percent of China’s total trade. But this is still low compared with around 50 percent to 60 percent for the euro area’s external trade settled in euro, and 30 percent to 40 percent in yen for Japanese trade. HSBC thinks the yuan is on track to account for 30 percent of total China trade by the end of 2015.

Moreover, with China's economy on the path of surpassing that of the U.S. in less than two decades, China has also been trying to promote the yuan as an alternative to the U.S. dollar, which has been the dominant global reserve currency since the 1944 Bretton Woods conference.

Currently, the yuan is already held as a reserve currency by some central banks despite existing restrictions on foreign investments.

“This points to high potential interest and underlying demand for reserve asset diversification,” said Paul Mackel, head of Asian currency research at HSBC. “Further development and opening up of the onshore market will help fulfil this potential demand.”

Sovereign interest in yuan assets has come from a wide range of regions. Aside from Asia, regions in Europe and Africa are also showing notable interest.

Some central banks have set official targets for yuan in their reserves pool. For example, in January, the Central Bank of Nigeria announced it would increase the yuan holding in the nation’s foreign exchange reserves from 2 percent to 7 percent.

One of Beijing’s top priorities right now is to speed up yuan capital account convertibility.

A report released after the Third Plenum, the important policy meeting last November at which the leadership released a detailed blueprint for reform, stated that Beijing would “push for opening the capital market both ways, increase convertibility of cross-border capital and financial transactions in an orderly way, set up and fine-tune a system to manage foreign debt and capital flows under the framework of macro-prudential management, and accelerate convertibility under the capital account.”

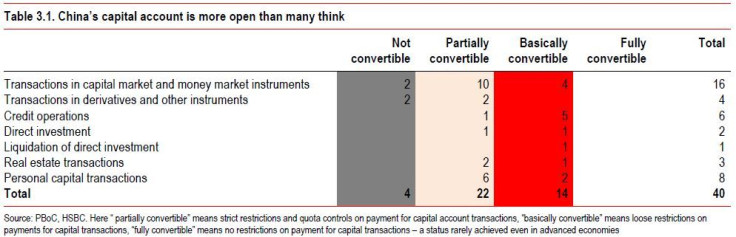

It’s important to note that the yuan is already more convertible than people think, according to HSBC's chief China economist Qu Hongbin.

Around 85 percent of China’s capital account is already convertible, while the current account achieved full convertibility in 1996.

In addition, “a deep and liquid domestic financial market is a precondition for the yuan to becoming a global currency,” Qu said. “China’s markets are still small compared to those in the developed countries, but as reforms gather pace we expect the expansion of the capital markets to accelerate rapidly.”

© Copyright IBTimes 2024. All rights reserved.