Stock index futures were little changed on Tuesday as S&P 500 futures found support near their 50-day moving average following four days of losses on the benchmark index.

Japan's Sony Corp. said it expects a record a $6.4 billion net loss, more than double previous forecasts, in its just-ended fiscal year, with over half of that amount ($3.6 billion) coming from write-offs of tax credits in the U.S.

China returned to an export-led trade surplus of $5.35 billion in March, heralding the prospect that a rebound in the global economy is lifting overseas orders just in time to compensate for a slowdown in domestic demand.

Stock index futures edged up on Tuesday as S&P 500 futures found support near their 50-day moving average following four days of losses on the benchmark index.

Futures on major US stock indices point to a higher opening Tuesday as investors closely watch the start of US corporate earnings.

China reported Tuesday an unexpected $5.35 billion trade surplus in March, following a vast deficit in February and in the midst of a continued exports weakness caused by economic crises in overseas markets.

U.S. stock index futures pointed to a higher open on Wall Street on Tuesday that would halt a four-session losing streak, with futures for the S&P 500 up 0.32 percent, Dow Jones futures up 0.34 percent and Nasdaq 100 futures up 0.44 percent at 0845 GMT.

The former chief executive of online brokerage E*Trade Financial Corp has emerged as a favorite for the top job at Freddie Mac , the Wall Street Journal said, citing people familiar with the matter.

U.S. stock index futures pointed to a higher open on Wall Street on Tuesday that would halt a four-session losing streak, with futures for the S&P 500 up 0.32 percent, Dow Jones futures up 0.34 percent and Nasdaq 100 futures up 0.44 percent at 0845 GMT.

The earnings season, which starts with Alcoa Inc. reporting first quarter results Tuesday, is expected to be sluggish and could witness markets struggling to maintain gains made in the past several weeks.

The Bank of Japan kept monetary policy steady as expected on Tuesday, holding off on any further steps to help meet its new inflation target and boost activity ahead of a more thorough assessment of the economy later this month.

Chesapeake Energy Corp, the second largest natural gas producer in the US, said on Monday that it has finalized three deals to sell its assets, which will raise $2.6 billion, as it faces cash crunch and a rising debt.

Asian shares eased Tuesday as investors cautiously awaited Chinese trade data to gauge whether the world's second-largest economy could achieve a soft landing, after a sharp slowdown in U.S. jobs creation clouded prospects for global growth.

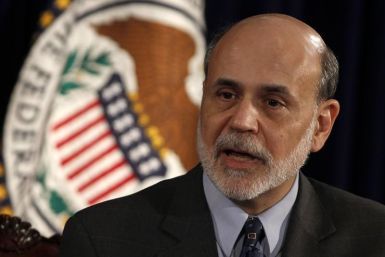

Federal Reserve Chairman Ben Bernanke said on Monday banks need to have more capital at hand in order to ensure the financial system is stable.

The U.S. economy has yet to fully recover from the effects of the financial crisis, and regulators must continue to find new ways to strengthen the banking system, Federal Reserve Chairman Ben Bernanke said on Monday.

The American League of Lobbyists Monday decided to ask the U.S. Congress to approve a set of changes to current registration rules.

Instagram users have revolted after the company first released an Android version of its software, then sold to Facebook for $1 billion.

Fans of the classic 1980s post-apocalyptic RPG “Wasteland” are making themselves heard. Thanks to the overwhelming number of contributors via Kickstarter, a sequel to the PC Western-themed game is in the works and players are finally beginning to see the culmination of their efforts.

China expressed consternation over the decision of the Australian government to ban telecommunications giant Huawei from competing in its new national broadband network over concerns for cybersecurity.

A U.S. Geological Survey team is preparing to publish a report that has drawn a link between hydraulic fracturing and an increase in earthquakes in the U.S.

The Dow and the S&P 500 extended losses to a fourth day on Monday, as investors took their cues from last week's disappointing jobs report, which raised fresh concerns about the U.S. economy's recovery.

Brazilian president Dilma Rousseff said she used an official visit to President Obama to press her concern that monetary policy pursued by the U.S. and Europe was inhibiting Brazil's economic growth.