'Death Of Ethereum?': Ether Leads Staggering 1-Hour Crypto Liquidations Of $390 Million

KEY POINTS

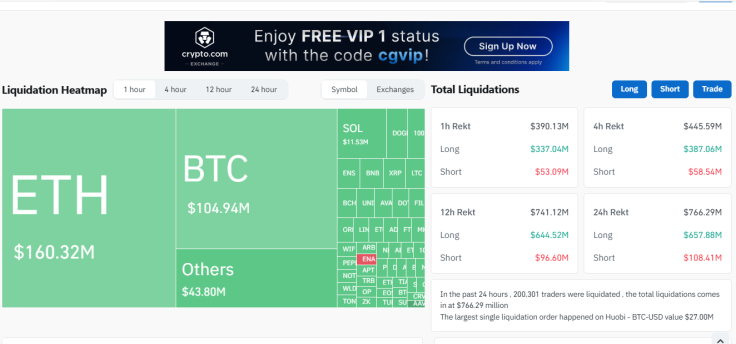

- Of $390 million liquidated within one hour, Ether accounted for $160 million

- Pessimism is rising within the crypto community, with some saying it could be $ETH's end

- Jump Crypto's unstaking activity has led some to believe it triggered the dump

Ether, the native cryptocurrency of the Ethereum blockchain, saw the largest one-hour liquidations in the crypto market Sunday night as the world's second largest digital asset by market value suffered a pricing free-fall.

Ethereum plunges

$ETH was trading at around $2,900 Saturday before it plunged to $2,200 within hours Sunday, marking a staggering 20% drop in the last 24 hours. The coin has already been struggling to get off the red line for weeks as it has been on a 34% decline over the past 14 days, as per data from CoinGecko.

Ether liquidations eclipse Bitcoin

Bitcoin, the world's largest cryptocurrency by market cap, has often led all other digital assets in terms of daily liquidations. However, Ether led the pack Sunday night, accounting for more than $160 million of $390.13 million liquidated over a one-hour period, data from CoinGlass showed.

Most of the liquidations were long positions. Already, the crypto market saw a whopping $766.29 million wiped out in the last 24 hours. $BTC liquidations were at $104 million, while other assets collectively saw some $43 million cashed out.

Crypto users in a frenzy

X users have had mixed reactions as they watched Ethereum's free-fall, but many were pessimistic over the crypto market's apparent steep downtrend Sunday.

One user said the digital space was "witnessing the death of Ethereum in real time," adding that it was a "turning point" for the emerging industry. Another user said it appears crypto was at a point where it "would never come back."

Even some industry experts are expecting both $ETH and $BTC holders to be "in for a rude wake up" call Monday morning over trading activity in the last day.

My god. Ethereum and Bitcoin ETF owners might be in for a rude wake up tomorrow morning regarding 24/7 trading. Ethereum in a free fall right now pic.twitter.com/09ekHBg74T

— James Seyffart (@JSeyff) August 5, 2024

Is Jump Crypto to blame?

News of $ETH's sharp drop came after Jump Crypto, the crypto arm of financial services company Jump Trading Group, unstaked some $315 million of Ether and transferred over half of the said amount to crypto exchanges.

Crypto firm @jump_ crypto has unstaked at least $315 million of $ETH and has sent more than half of that to crypto exchanges. pic.twitter.com/3i36Pk5epZ

— Cointelegraph (@Cointelegraph) August 5, 2024

Some X users are insinuating that Jump Crypto's activity "caused" the massive Ethereum liquidations that affected prices. Trader @WazzCrypto said Jump's latest movement was a "conscious decision to inflict the maximum amount of pain" [on prices].

$ETH liquidations spike

Meanwhile, Ethereum holders, particularly $ETH whales, are cashing out their stashes. Late on Sunday night, a long-position whale liquidated $21.5 million, including over 5,000 $WETH and some 108,000 $cETH as per PeckShield.

#PeckShieldAlert #Liquidation A whale (0x99e8...ddc3) who took a long position in Ethereum (ETH) has been liquidated ~$21.5M worth of cryptos, including 5,730.5 $WETH & 108.5K $cETH pic.twitter.com/KdDTVFDpo9

— PeckShieldAlert (@PeckShieldAlert) August 5, 2024

© Copyright IBTimes 2024. All rights reserved.