Ethereum Leads $290M Single-Day Liquidations; Experts Discourage Bitcoin ETFs Launch Comparison

KEY POINTS

- Ethereum liquidations were at $102 million, while $BTC saw $81 million liquidated

- Bitcoin fell below $65,000 overnight, while Ether plunged to $3,100 after trading at $3,400 ahead of the ETFs' launch

- Some experts said Ethereum might be the 'weakest link' in the crypto market

The cryptocurrency market saw massive liquidations in the last 24 hours as Bitcoin and Ether, the world's top digital assets by market capitalization, plummeted. Ether ($ETH), the native token of the Ethereum blockchain, led the liquidations just a day after spot Ethereum exchange-traded funds (ETFs) went live.

Ethereum leads the pack

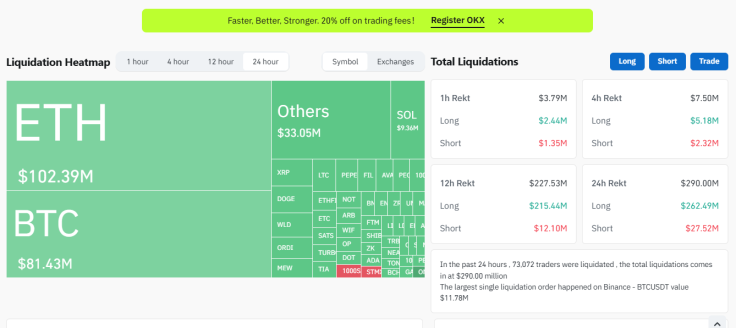

Data from CoinGlass shows that Ether saw liquidations surpassing $102 million in the last day, while $BTC liquidations exceeded $81 million. Solana ($SOL) saw over $9 million liquidated, while $XRP saw $3.89 million out.

Some of the most popular memecoins also saw millions liquidated, including $DOGE ($3.82 million), $PEPE ($2.54 million), and $MEW ($2.71).

$BTC, $ETH prices plunge

The market-wide liquidations came as Bitcoin fell below $65,000, and Ether slumped to $3,100, according to CoinGecko data. $BTC has been down by nearly 3% in the past 24 hours, while $ETH has saw a significant 8% drop.

Ether unmoved by ETFs

Ether's plunge came a day after the token didn't react to positive news about Ethereum ETFs, which saw trading volume exceeding $1 billion on the first day of trading. Ahead of the funds' launch, the world's second-largest cryptocurrency by market value was trading at around $3,400.

Is Ether a weak link in crypto?

Crypto research firm 10x Research published a report Thursday that looked into the "crashing" trend in Ethereum prices. It first noted that the launch of $ETH ETFs coincided with the first distributions of repayments from defunct crypto exchange titan MtGox.

The report also noted that if the downtrend in the broader financial market continues, "crypto will need more help" to get back to rallying mode. "Ethereum might be the weakest link, where fundamentals (new users, revenues, etc.) have been stagnant or lower," the report stated.

Ether's price action has yet to be seen as the ETFs continue trading and hype around the much-awaited Bitcoin 2024 conference spikes.

Give time to the ETFs?

Senior Bloomberg ETF analyst James Seyffart has said he thinks the Ethereum ETFs' launch was a "smashing success" if compared to standard launches of other ETF offerings. "The problem is we are comparing it to the biggest ETF launch of all time in the Bitcoin ETFs," he argued.

Compared to Bitcoin's market value, Ethereum's is quiet down there. However, it is still among the top two largest cryptocurrency and various other digital assets are even farther from $BTC than $ETH currently is.

Senior investment strategist at Bitwise, Juan Leon, agreed that Day 1 trading numbers for $ETH ETFs are a "great setup for the road ahead," since the funds did surpass expectations.

© Copyright IBTimes 2024. All rights reserved.