Obagi Medical Products, Arm Holdings, Silver Wheaton, Banco Bilbao Vizcaya, Newmont Mining, Arena Pharmaceuticals, Goldcorp, CYS Investments and Research In Motion are among the companies whose shares are moving in pre-market trading Wednesday.

U.S. stock index futures point to higher opening Wednesday, but investors remain watchful amid concerns that the sluggish global economy and the euro zone debt burden will hurt the earnings of companies.

Asian stock markets mostly ended lower Wednesday, following declines on Wall Street Overnight, as concerns over corporate earnings outlook and euro zone crisis weighed on the sentiment.

Most European markets fell Wednesday as investor sentiment remained fragile following concerns of the worsening economic condition in the euro zone to hurt quarterly earnings of companies.

The top after-market Nasdaq gainers Tuesday were Obagi Medical Products Inc, Xyratex Ltd, OraSure Technologies Inc, MannKind Corporation and Smith & Wesson Holding Corporation.The top after-market Nasdaq losers were VOXX International Corporation, Prospect Capital Corporation, Golar LNG Partners LP, Arena Pharmaceuticals Inc and Jamba Inc.

The top after-market NYSE gainers Tuesday were Banco Santander Brasil, Actuant Corp, Allison Transmission, Mueller Water Products and Forest Oil Corp. The top after-market NYSE losers were hhgregg, Best Buy Co, Hovnanian Enterprises, Goldcorp and SandRidge Mississippian Trust.

Most Asian markets fell Wednesday amid investor concerns about the euro zone?s debt burden to worsen global economic downturn.

In another triumph of digital medial over legacy media, Buzzmedia said Tuesday that it would buy Spin Media LLC, the 27-year-old music magazine that chronicled the rise of alternative rock in the 1990s.

The U.S. is currently in a recessionary cycle and, no matter what they say, there's nothing policymakers can do to stop that. That's according to Lakshman Achuthan, co-founder of the Economic Cycle Research Institute.

British industrial data released Tuesday, while a slight improvement over the previous month's figures, can't hide the fact that the economy is still weak, experts say.

Italian Prime Minister Mario Monti told reporters Tuesday that Italy won't need a Greek-style bailout, but said the country may need to tap into the European Stability Mechanism (ESM), Europe's all-purpose bailout bucket, asking the fund to subsidize sovereign borrowing by buying Italian government bonds.

Unemployment in advanced economies will remain high until at least the end of 2013, with youth and the low-skilled hurt most by the weakest economic recovery in the past four decades, the Organization for Economic Co-operation and Development (OECD) said Tuesday.

Boeing Co. (NYSE: BA), the largest U.S. aerospace manufacturer, said Tuesday it had reached a deal with Kuwaiti airplane leasing company ALAFCO to sell 20 Boeing 737 aircraft valued at $1.9 billion, its second big deal at the Farnborough Airshow in England.

China's double-digit growth rate during the financial crisis has been the envy of the world and most people agree that we may have seen the last of the country's miraculous growth. So yes, China's growth is slowing. However, it's too early to get all pessimistic.

General Growth Properties (NYSE: GGP), the second-largest public U.S. mall landlord, is living up to its name once again. After exiting bankruptcy in 2010, the Chicago-based company's shares hit a new all-time high of $18.49 on Friday.

The Beatles and Rolling Stones were inadvertently stepping into a vacuum ? the biggest rock star in the world, Elvis Presley, was inducted into the army in 1962.

Asian stock markets ended lower Tuesday as a weak Chinese trade data stoked fears of a growth slowdown in the world?s second largest economy.

U.S. stock index futures point to a lower opening Tuesday, as weak global economic conditions and debt burden in the euro zone continued to drag down the investor sentiment.

Most European markets marginally rose Tuesday as investors remained in a watchful mode amid concerns that the economic condition in the euro zone is worsening.

Crude oil futures declined Tuesday as the offshore oil and gas workers strike in Norway ended overnight after the government's intervention.

The top after-market NYSE gainers Monday were Cellcom Israel, Clear Channel Outdoor Holdings, Yingli Green Energy Holding, Sunrise Senior Living and Zale Corp. The top after-market NYSE losers were Advanced Micro Devices, Beazer Homes USA, Douglas Emmett, Quantum Corp and Senior Housing Properties Trust.

Most Asian markets fell Tuesday amid investor concerns about the intensifying debt crisis looming over the euro zone and the worsening global economic downturn.

Asian shares crawled higher on Tuesday after sharp losses the day before but gains were limited as investors, worried about a global economic deceleration, waited for Chinese trade data due later in the day that could set the tone for risk appetite.

Many small businesses have been paying nearly twice the amount for half the health care benefits that they are entitled to provide their employees. However, under the new health care mandate, health insurance will be more affordable for small companies.

Alcoa (NYSE: AA) posted a second-quarter loss as a slump in aluminum prices to near two-year lows offset, growing demand in the aerospace and automobile markets.

The European Commission is expected to give Spain an additional year to reach deficit-reduction goals and also to ease its debt reduction targets.

Japan, which is still floundering from last year's earthquake-tsunami, is once again nearing a recession, economists say.

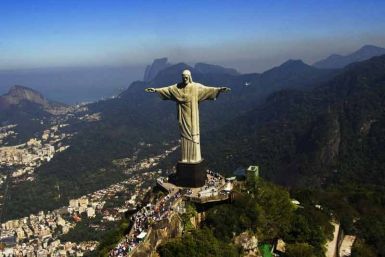

The world's major economies extended their slowdown in May, with conditions deteriorating significantly in India and Italy, according to a statistical indicator released by the Organisation for Economic Co-operation and Development on Monday. Even in Brazil, one of the few economies surveyed that is expanding, the pace of growth slowed.

This week?s focus will be the June Federal Open Market Committee minutes, U.S. trade deficit and China's Q2 GDP.

Health Insurer WellPoint Inc. (NYSE: WLP) agreed to buy the managed-care company Amerigroup Corporation (NYSE: AGP) in a roughly $4.9 billion cash deal to expand its presence in Medicaid space.