The top after-market Nasdaq gainers Friday were Human Genome Sciences Inc, Netlist Inc, Synacor Inc, Nanosphere Inc and Jamba.The top after-market Nasdaq losers were: Gevo, Glu Mobile Inc , ZAGG Inc, Xyratex Ltd and Splunk Inc.

China's announcement of the unexpected interest rate cut this week has given an indication to market players that policymakers are increasingly rattled by the state of the economy.

Most Asian markets rose this week as investor confidence was boosted by expectations of stimulus measures from central banks globally to regain the economic growth momentum.

IBTimes reviews winners and losers in the world of business and economics for the week of July 1.

Greek Prime Minister Antonis Samaras requested on Friday that European Union (EU) and International Monetary Fund (IMF) creditors extend a ?237 billion bailout package for a grace period of two years to help the country survive its fifth year of recession.

As the gap between America's middle class and the wealthiest 1 percent has widened, luxury retailers and discounters continue to grow, while midprice brands are finding it difficult to compete.

Three of the world's biggest financial institutions in the U.S. are closing their European money market funds to new investments after the European Central Bank (ECB) reduced its benchmark rate to a record low of 0.75 percent and slashed deposit rates to zero on Thursday, undermining global investor confidence.

Hopes that emerging markets will lead the world out of the global economic slowdown are beginning to dim.Christine Lagarde, managing director of the International Monetary Fund (IMF), voiced her concerns over the strength of the global economy, emphasizing that emerging markets, which currently account for two-thirds of global growth, were showing signs of weakening.

Many high school graduates want to forego university altogether.

The pace of bankruptcy filings in the U.S. is slowing down to pre-recession levels, but don?t cheer just yet ?because hundreds of thousands of Americans might have been too broke to file for bankruptcy.

All major automakers posted big gains in pickup truck sales in June, usually a slow month for pickup truck sales, as contractors replaced old trucks because of a rebound in construction and new home starts.

Non-farm payrolls rose by a paltry 80,000 in June, while the unemployment rate remained stuck at 8.2 percent as the labor participation rate was unchanged at 63.8, the Labor Department said Friday. Economists polled by Thomson Reuters had called for a total gain of 90,000 jobs.

The owner of the New York Stock Exchange, whose share of trading in companies it lists has fallen in the last nine years to below 25 percent from 82 percent, received approval from U.S. regulators to offer similar services to rivals who are taking its customers.

Italy's technocratic government approved ?4.5 billion ($5.58 billion) in spending cuts for this year aimed at slashing the size of Italy's bloated public sector and delaying a new tax increase until after the first half of 2013.

Golar LNG, Xyratex Ltd, Silvercorp Metals, Silver Wheaton, Seagate Technology, Western Digital Corp, Banco Santander SA and eBay Inc. are among the companies whose shares are moving in pre-market trading Friday.

During the second quarter, average rents increased to record levels in 74 of the 82 U.S. markets tracked by real estate data firm Reis Inc. (NYSE: REIS), according to a report released Thursday. A number of factors are driving the trend.

Since its May 17 pricing at $38 a share, the stunning collapse in the value of Facebook (Nasdaq: FB) the No. 1 social networking site has made history ? for its sheer size and magnitude.The IPO market remains weak.

U.S. stock index futures point to a slightly lower open Friday as the interest rate cuts announced by central banks in Europe and China on Thursday failed to convince investors that the measures will be sufficient to rejuvenate the struggling global economy.

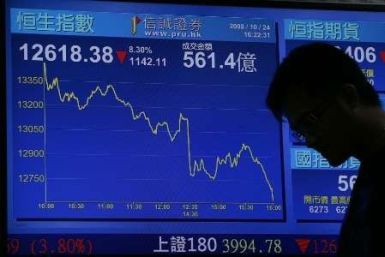

Asian stock markets declined Friday as investors remained cautious ahead of U.S. employment data due later in the day while major central bank?s actions to stimulate the global economy failed to calm market jitters.

European markets fell Friday as investors were not encouraged by the rate cuts announced by central banks.

The top after-market NYSE gainers Thursday were: Vanceinfo Technologies, Denbury Resources, Patriot Coal, McMoRan Exploration and First Tennessee National Corp. The top after-market NYSE losers were: iSoftStone Holdings, Teradata Corp, Leapfrog Enterprises, Hexcel Corp and Kronos Worldwide Inc.

The top after-market Nasdaq gainers Thursday were Xyratex Ltd, Celldex Therapeutics Inc, Sequenom Inc, Fifth Street Finance Corp and Applied Micro Circuits Corporation.The top after-market Nasdaq losers were: Informatica Corporation, Alexza Pharmaceuticals Inc, ValueVision Media Inc, Amtech Systems Inc and Alaska Communications Systems Group Inc.

Asian markets fell Friday as central bank measures in Europe and China could not allay investor concerns about the intensifying debt crisis looming over the euro zone and the worsening global economic downturn.

The European summit may have increased investor confidence, but weak consumer spending across Europe, along with the rise of the dollar against the euro, is slowing down the global economy, pushing many companies to trim their earnings forecasts.

Consumers, spooked by months of sluggish hiring and a global slowdown, pulled back on spending in June, which took a toll on top U.S. retailers' sales.

U.S. 30-year fixed-rate mortgages fell to a record low of 3.62 percent, its 10th such weekly record low in the last 11 weeks, following weak economic data, mortgage financier Freddie Mac said Thursday.

The Institute for Supply Management said its services sector index, which covers about 90 percent of the economy, dropped to 52.1 in June from the prior month's 53.7, to mark the worst reading since January 2010.

Planned layoffs fell to a 13-month low in June as U.S. employers announced 37,551 job cuts, a 39 percent reduction from May, according to a report from consultants Challenger, Gray & Christmas Inc.

U.S. private employment rose by 176,000 from May to June, on a seasonally adjusted basis, according to an ADP report issued Thursday.

A consortium of lenders of the cash-strapped Kingfisher Airlines Thursday asked the Indian private carrier to sell its properties in Goa and Mumbai and to come up with concrete steps to improve its operations.