Stockton, California, is expected to file for bankruptcy before the end of the week, becoming the largest U.S. city to seek protection from its creditors.

Stockton, Calif., will become the largest U.S. city to file for bankruptcy, which could happen as early as Wednesday, after talks with bondholders and labor unions failed.

Higher costs and a spike in taxes are squeezing the bottom line at China's state-owned companies, the Xinhua news agency reported on June 15, driving down profits and slowing down the rate of growth in operating income.

U.S. pending home sales rose 5.9 percent in May, matching a two-year high, the National Association of Realtors said Wednesday.

Orders for long-lasting U.S. manufactured goods posted the first gain in three months in May, but economists warn that the May data is not as good as it looks.

With the official start date of the London 2012 Olympics now just one month away, some Londoners are questioning whether the Games are worth all the trouble ? and they?ve good reason for concern.

It is just amazing how we never learn from other people's mistakes.

Amarin Corp, Facebook, Zynga, Saks, O'Reilly Automotive, Credit Suisse Group, Atlantic Power and Tata Motors are among the companies whose shares are moving in pre-market trading Tuesday.

Wrapping up his Latin American tour, Chinese Premier Wen Jiabao on Tuesday announced a proposal to set up a $10 billion credit program for the developing economies to offer support for infrastructure projects.

U.S. stock index futures point to slightly lower opening Wednesday as investor sentiment is weighed down by the concerns of debt crisis looming over the euro zone.

Asian stock markets mostly advanced Wednesday but gains were capped as investors are opting for caution ahead of the EU summit that begins on Thursday.

European markets rose Wednesday following global cues but investors remained watchful about the debt crisis lingering over the euro zone.

Crude oil futures slightly declined and hovered above $79 a barrel during Asian trading hours Wednesday as doubts over the ability of European leaders to address the debt crisis at a summit this week offset concerns over tightened North Sea supplies due to a strike in Norway.

The top after-market Nasdaq gainers Tuesday were AeroVironment Inc, Anthera Pharmaceuticals Inc, Zogenix Inc, United Therapeutics Corporation and Orexigen Therapeutics Inc.

The top after-market Nasdaq losers were: Omeros Corporation, O'Reilly Automotive Inc, Medivation Inc, IAC/InterActiveCorp and Alexza Pharmaceuticals Inc.

The top after-market NYSE gainers Tuesday were: BPZ Resources, MEMC Electronic Materials, Ultra Petroleum, Fusion-Io and Gol Linhas Aereas Inteligentes. The top after-market NYSE losers were: Campus Crest Communities, Harbinger Group, Yingli Green Energy Holding, HCA Holdings and AutoZone.

Most Asian markets rose Wednesday but investors remained watchful about the the debt crisis looming over the euro zone.

The Chinese government has spent billions to buy Japanese stocks as the euro zone crisis lingers, in an effort to diversify its investments, the AFP reported.

U.S. car sales are expected to have remained strong in June, maintaining a total seasonally adjusted annual rate (SAAR) of around 14 million vehicles, however sales are beginning to slow at the beginning of summer and a return to pre-recession sales levels is not foreseen anytime soon, according to early predictions by analysts at LMC Automotive and Kelley Blue Book.

Banca Monte dei Paschi di Siena SpA, a 540-year-old financial institution commonly called Europe's oldest bank, was the newest Continental house of finance to receive a government bailout, after the Italian Treasury granted the bank a ?3.9 billion ($4.87 billion) credit lifeline Tuesday. The rescue came even though Monte dei Paschi is seen as basically insolvent by the markets and is led by a banker currently under criminal indictment.

Although U.S. home prices inched up in April and new home sales rose to a two-year high in May, the national housing market remains uneven and weak, said a New York-based developer.

The price of crude oil fell Tuesday to less than $79 on the U.S. wholesale market, cutting the value of the commodity by about one-third since early March.

Even as the crisis in Air India continues with no signs of a solution in sight, another Indian carrier Kingfisher Airlines is in fresh trouble with 80 of its engineers quitting their jobs.

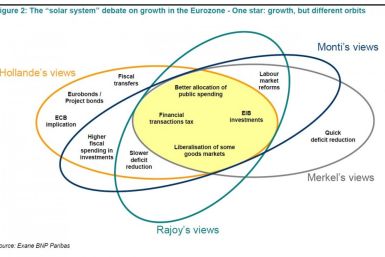

An eye-catching illustration included in a report by BNP Paribas Exane explains why the Continent's leader seem unable to solve the ever-worsening eurozone crisis: in spite of being ostensibly committed to the same goals, top policy-makers disagree on the more aggressive policies most experts believe are needed. It's almost like they're on different planets.

Single-family home prices picked up for the third month consecutive month in April, showing signs that the housing market recovery is gaining traction.

Spain's short-term borrowing costs almost tripled during Tuesday's debt auction, a day after Moody's downgraded the country's banking system.

Zynga, Syngenta, JPMorgan Chase, Banco Santander, James River Coal, Nokia Corp, Morgan Stanley and AIXTRON are among the companies whose shares are moving in pre-market trading Tuesday.

Spikes in unemployment might be a necessary evil to austerity reform measures meant to control the European financial crisis. But, when push comes to shove, those high levels of joblessness are actually making contagion of the crisis amongst countries worse.

Asian Stock markets mostly declined Tuesday as market participants continued to doubt the ability of European leaders in tackling the debt crisis at a European summit later this week.

U.S. stock index futures point to a slightly higher opening Tuesday after Monday's sell-off, but investors remain watchful as euro zone debt crisis concerns linger.

European markets rose Tuesday after sell off in the previous day, but investors remained watchful about the debt crisis lingering over the euro zone.