Same-store sales rose 0.5 percent from the previous week and 4.5 percent year on year, the International Council of Shopping Centers and Goldman Sachs reported. Redbook Research said same-store sales were up 0.8 percent from March and 4.1 percent from April 2011.

China posted a surprising trade surplus in March, reversing a hefty deficit in February, but the underlying data indicated that its domestic economy seems to be losing steam, while exports were still weak as the European economy falters.

The think tank's composite leading indicators for February showed strong signs of regained momentum in the U.S. and Japanese economies, while Brazil, India, Russia and China showed positive signals compared with the previous month's assessment.

Retaining his top position for the second consecutive year, Saudi prince Alwaleed Bin Talal Alsaud became the richest Arab in the world, followed by the Ethiopian-Saudi Investor Mohammad Al Amoudi, according to the Forbes list of billionaires.

The top after-market NASDAQ gainers Tuesday were: Adept Technology, Washington Federal, Affymax, Federal-Mogul Corp, Arena Pharmaceuticals, GRAVITY Co, Orexigen Therapeutics, Tractor Supply and Century Aluminum Co.

Futures on major US stock indices point to a higher opening Tuesday as investors closely watch the start of US corporate earnings.

Most Asian stocks ended lower Tuesday, following a slump in the Wall Street overnight as disappointing March employment report raised concerns about the strength of recovery in the world’s biggest economy.

The top aftermarket NYSE gainers Monday were: C&J Energy Services, Visteon Corp, Centene Corp, Brookdale Senior Living, Hovnanian Enterprises and Alere Inc. The top aftermarket NYSE losers were: FX Alliance, Carnival Corp, Standard Pacific Corp, Vantiv, McClatchy and PPL Corp.

The top after-market NASDAQ losers Monday were: VIVUS, Harmonic, Shutterfly, Finish Line, Ocean Rig UDW, Power-One, Associated Banc, Schnitzer Steel Industries, Vertex Pharmaceuticals and China Real Estate Information Corp.

The earnings season, which starts with Alcoa Inc. reporting first quarter results Tuesday, is expected to be sluggish and could witness markets struggling to maintain gains made in the past several weeks.

Chesapeake Energy Corp, the second largest natural gas producer in the US, said on Monday that it has finalized three deals to sell its assets, which will raise $2.6 billion, as it faces cash crunch and a rising debt.

Asian shares eased Tuesday as investors cautiously awaited Chinese trade data to gauge whether the world's second-largest economy could achieve a soft landing, after a sharp slowdown in U.S. jobs creation clouded prospects for global growth.

Avon Products Inc. (NYSE:AVP)'s appointment Monday of Sherilyn McCoy to replace Andrea Jung as CEO brings some stability to the beleaguered direct-sales beauty company, but analysts say one person is unlikely to cure Avon's huge legal and organizational problems, which threaten its stock price and sales growth.

The risk-on sentiment ginned up by the kindness of western central banks plus the first quarter's good weather, which pulled forward consumer spending and construction activity, is fading.

Oone of the largest natural gas distributors in the U.S. announced it is planning to invest up to $1.8 billion in the construction of a pipeline connecting the Bakken oil fields in North Dakota with the nation's oil hub in Oklahoma. But the new pipeline won't solve the problem of getting to refineries all the oil being produced in the U.S.

King concedes that quitting the euro zone and reintroducing its drachma currency would likely lead to financial and economic turmoil, but the move would ultimately benefit the Mediterranean country.

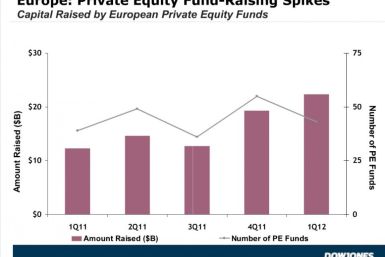

European private equity funds raised 82 percent more capital in the first quarter of 2012 compared to the same period last year, according to Dow Jones LP Source, a research service for the industry.

Fears of a partial breakup of the euro zone are already causing deposit flight from banks in Portugal, Italy, Ireland, Greece and Spain said Jens Nordvig, head of fixed-income research at Nomura Holdings.

Just last year, Andrea Jung was among the most powerful women in the world. On Monday, Avon announced her replacement as chief executive -- Sherilyn McCoy, a 30-year veteran of Johnson & Johnson.

U.S. stocks fell hard Monday after a surprisingly weak jobs report on Friday left investors hunting for safety rather than big returns.

The world's demand for alternative energy sources is powering growth in German industry, or so a look at the list of fastest-growing public companies in that country would suggest. Already the world leader in solar panel manufacturing, Germany is also home to an array of booming companies whose business is on the more peripheral side of clean energy creation and conservation.

More than 40,000 employees at AT&T Inc will keep working under the terms of an expired labor contract while their union continues negotiations with the telephone company, averting a potentially costly strike for now.

Qatar's sovereign wealth fund has raised its stake in Xstrata Plc to a little over 5 percent, which is valued around $2.7 billion, in advance of the Anglo-Swiss miner's intended merger with Glencore International Plc.

Futures on major US indices point to a lower opening Monday after US non-farm payrolls data showed that the world's biggest economy added fewer-than-expected jobs in March.

Asian stock markets declined for the fourth day on Monday as weaker-than-expected US employment report raised concerns about the strength of recovery in the world’s biggest economy.

Consumer electronics and entertainment giant Sony is letting go 10,000 employees, a sixth of its total workforce, in an effort to concentrate resources on core business and bring the company back to black.

Iraq is facing a serious crisis, Kurdistan's leader Massoud Barzani said during a recent visit in Washington -- and his semiautonomous region's ambitions in the oil-and-gas business aren't going to help defuse potentially explosive ethnic tensions.

Tullow Oil PLC recently announced an oil discovery in Kenya. Here is an economic analysis of what the discovery could mean for the future of the country.

China's love affair with American education is stronger than ever. Chinese families -- including those in the burgeoning middle class -- want to send their sons and daughters to be educated in another country, with most coming to U.S. institutions.

The economic calendar this week – April 9 to 13 -- is all about inflation. The market will be monitoring import prices, producer prices and Friday’s key consumer prices index. On the policy front, the Atlanta Fed will host 2012 Financial Markets Conference: “The Devil’s in the Details,” between April 9 and 11. We will be hearing from a bevy of Federal Reserve officials, including Chairman Ben Bernanke.