Manhattan's 2 World Financial Center was evacuated Thursday morning after workers who discovered what they believed to be a hand grenade contacted authorities -- it turned out to be a toy, police said.

International Business Machines Corp. said it would partner with the U.S. unit of Honda Motor Co. and PG&E Corp. to use the cloud for optimium charging of electric cars.

Dudley said strong first-quarter data might have been the result of unseasonably warm weather in much of the United States that pulled forward some economic activity and hiring.

U.S. 15-year fixed-rate mortgages dropped to a new record low of 3.11 percent in the week ending April 12, mortgage financier Freddie Mac said Thursday.

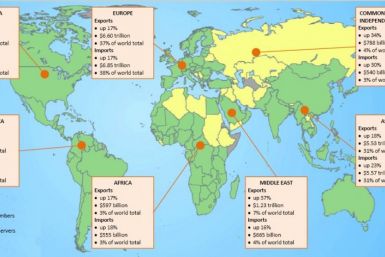

Trade growth is expected to slow for a second year in 2012 amid severe downside risks that could push it even further below the 20-year average of 5.4 percent, the Geneva-based body forecast Thursday.

U.S. trade deficit narrowed in February as exports rose slightly to a record while imports fell.

Mortgage rates fell this week over disappointing March job growth numbers, uncertainty about the ongoing debt crisis in Europe, and slower projected growth in corporate earnings, Bankrate.com reported Thursday in its weekly national survey.

The producer price index remained unchanged in March, as an unexpected drop in fuel prices offset increases in food and core prices, according to a report released Thursday by the U.S. Bureau of Labor Statistics.

The U.S. trade deficit narrowed unexpectedly in February as exports hit a record high, imports from China and other key suppliers declined and oil import volume fell to the lowest in 15 years, a government report showed on Thursday.

The disappointing performance of the U.S. labor market in March shows it is too early to conclude the economy is out of the woods, despite months of encouraging economic data, New York Federal Reserve Bank president William Dudley said on Thursday.

Claims for jobless benefits rose to 380,000 last week, giving economists another piece of data to worry about after a gloomy job market showing in March. Meanwhile, a Federal Reserve report published Wednesday painted a picture of a recovery that continues to press ahead, however, modestly, amid concerns of higher fuel prices.

The US reclaimed the top position as the biggest investor in clean energy last year, with clean energy finance and investment witnessing a growth $48 billion, a 42 percent increase over 2010, according to a global rank list published in a report by the Pew Charitable Trusts.

Futures on major US indices point to a higher opening Thursday ahead of key weekly jobless claims and February trade balance reports from the government.

The top after-market NASDAQ gainers Wednesday were: MannKind Corp, Seanergy Maritime Holdings, Savient Pharmaceuticals, Star Scientific, AVEO Pharmaceuticals and NewLead Holdings. The top after-market NASDAQ losers were: Avid Technology, Apogee Enterprises, Zix Corp, Approach Resources, Bruker Corp and Pacira Pharmaceuticals.

The top aftermarket NYSE gainers Wednesday were: McKesson Corp, YPF SA, Jaguar Mining, EXCO Resources and 3D Systems Corp. The top aftermarket NYSE losers were: Barnes & Noble, Muller Water Products, Cloud Peak Energy, Manning & Napier and Lexington Realty Trust.

Asian stock markets gained Thursday, following a rebound on Wall Street overnight on easing eurozone worries and hopes for a better-than-expected US earnings season after solid start from Alcoa.

Equity investors are advised to remember that dividends and capital gains or losses matter; one can't embrace the fact some stocks pay high dividends while ignoring their risk to capital.

Stocks popped Wednesday on both sides of the Atlantic, one day after their worst loss of the year, on easing euro zone worries and hopes for a better-than-expected earnings season.

Chinese real estate is facing such deep woes largely because government policies have encouraged market domination by speculators -- pushing prices out of reach for everyone except the rich.

U.S. mortgage applications dropped 2.4 percent on a seasonally adjusted basis in the week ended April 6, compared to the prior week, the Mortgage Bankers Association said Wednesday.

Billionaire casino mogul Sheldon Adelson announced on Wednesday plans to open a casino strip in Spain, pushing for a $35 billion casino complex in either Barcelona or Madrid.

U.S. Attorney General Eric Holder said Apple and publishers worked to eliminate competition. Three publishers settled the case.

Prices of goods imported into the U.S. rose more than forecast in March, driven by higher prices in fuel and non-fuel sectors, a government report showed Wednesday.

The top after-market NASDAQ losers Tuesday were: X-Rite, OPNET Technologies, Premier Exhibitions, Applied Micro Circuits Corp, Shuffle Master, Central European Distribution, JDA Software Group, Amylin Pharmaceuticals, Zix Corp and Gencor Industries Inc.

The top aftermarket NYSE gainers Tuesday were: Owens-Illinois, Och-Ziff Capital Management, Guidewire Software, Alcoa, Koninklijke Philips Electronics and Generac Holdings Inc. The top aftermarket NYSE losers were: Perini Corp, Computer Sciences Corp, Leapfrog Enterprises, QR Energy, Hospitality Properites Trust and Newcastle Investment Corp.

Asian stock markets declined Wednesday, following an overnight slump in Wall Street as surge in Spain’s borrowing costs reignited concern over the eurozone debt crisis.

The top after-market NASDAQ gainers Tuesday were: Mattress Firm Holding Corp, Standard Microsystems Corp, Century Aluminum, Spectrum Pharmaceuticals, NXP Semiconductors, Smith & Wesson Holding Corp, L&L Energy, James River Coal Co, Activision Blizzard and NutriSystem Inc.

The U.S. Justice Department sued Apple Inc. and Hachette, owner of Macmillan on Wednesday for allegedly fixing the price of e-books.

Certain issues were brought to the board's attention regarding Mr. Dunn's personal conduct, unrelated to the company's operations or financial controls, and an audit committee investigation was initiated, the company said.

Stocks extended their longest and deepest slump of the year on rekindled worries about the euro zone crisis along with nervousness about first-quarter corporate earnings.