So far this week, U.S. industrial giants have announced nearly $3 billion will be invested in new operations and research in Brazil, China and India three cornerstone members of the BRICS countries.

Global stocks ended mixed Thursday as solid jobs data and better-than-expected results from retailers failed to offset revived concerns about the euro zone’s fiscal stability.

The U.S. economy is expected to expand at a disappointing pace in 2012, similar to the tepid 1.7 percent growth rate achieved in 2011, despite recent job gains, according to economists at HSBC, who said wages have failed to keep up.

Consumer loan delinquency rates dropped in all 11 categories tracked by the American Bankers Association, ABA, in fourth quarter 2011, a sign that deleveraging has worked and Americans' personal financial situations have become more stable.

U.S. 30-year fixed-rate mortgages declined slightly to 3.98 percent in the week ending April 5 as recent economic indicators were mixed, mortgage finance giant Freddie Mac said Thursday.

GM sales in China rose sharply in March, a somewhat unexpected increase, as competitors in the country are seeing only modest gains. Sales were driven into high gear by the six-speed Buick Excelle, a luxury sedan manufactured locally that -- at over $20,000 -- is an icon of achievement for the burgeoning upper middle-class in China.

Spanish borrowing costs Thursday hit their highest levels since before the European Central Bank launched two massive liquidity injections to keep the euro zone's financial system from freezing up.

China has further opened up its domestic share markets for foreign participation, in a bid to ease the tight controls for investments by qualified foreign institutional investors (QFIIs).

A pair of unexpectedly downbeat economic reports from Germany and the UK on Thursday added to fears of a recession in the euro zone and fueled doubts that manufacturing could power the region's economic recovery.

The U.S. titan will provide technology services to Eike Batista's EBX Group and acquire a 20 percent stake in EBX subsidiary SIX Automacao.

The Bank of England held back from giving Britain's fragile recovery an extra boost on Thursday, as the economy appears to have avoided falling into recession despite a shock drop in manufacturing output in the first months of 2012.

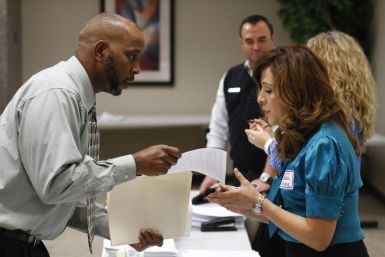

Claims for jobless benefits fell to 357,000 last week, building up toward a solid March nonfarm payroll report that is scheduled to come out on Friday. Some economists though still fear that the improvement in the U.S. economy seen so far this year could be just another false start.

U.S. employers planned 27 percent fewer job cuts in March compared with February and the lowest number of planned cuts since May 2011, global outplacement firm Challenger, Gray & Christmas Inc. said Thursday.

Futures on major U.S. indices point to a lower opening Thursday ahead of key weekly jobless claims from the government.

A senior research scientist has expressed concern over a possible global economic collapse that may occur in 2030 if humans fail to check expansion and preserve the world's already diminishing resources.

The top after-market NASDAQ gainers Wednesday were: Premier Exhibitions, Bed Bath & Beyond, Glu Mobile, Magal Security Systems, Vical Inc and Clearwire Corp. The top after-market NASDAQ losers were: A. Schulman, Carmike Cinemas, Complete Genomics, Cepheid, Microvision and Builders FirstSource.

The top aftermarket NYSE gainers Wednesday were: Cinemark Holdings, Constellation Brands, E-Commerce China Dangdang, National Bank of Greece, Sprint Nextel Corp and Aviva plc. The top aftermarket NYSE losers were: Ruby Tuesday, McClatchy, CTS Corp, Standard Pacific Corp, InvenSense and MGIC Investment.

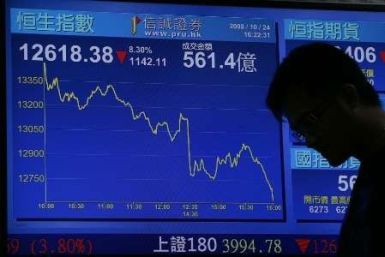

Most of the Asian stock markets ended lower Thursday, tracking overnight declines from Wall Street after a disappointing Spanish bond auction.

Asian shares fell Thursday after a weak Spanish bond sale heightened concerns about funding difficulties by lower-rated euro zone countries, further undermining sentiment hurt by fading expectations for more stimulus from the U.S. Federal Reserve.

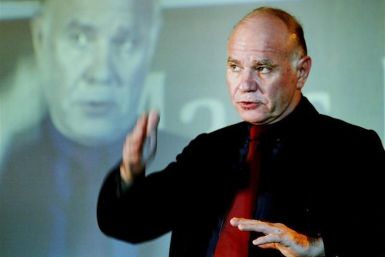

The financial expert and Gloom, Boom & Doom Report publisher predicts a massive loss of wealth sometime down the line, citing unresolved financial excess.

Two of the most iconic American brands suffered setbacks to their credit ratings on Wednesday, evidence that some of the nation's most visible economic engines could face higher borrowing costs.

Last year we woke up to headlines involving the home of the Acropolis and one of the worst debt situations in recent history – Greece.

China’s Premier Wen Jiabao called the country’s state-owned banks a “monopoly” that has to be broken to allow freer flow of capital to loan-hungry smaller businesses, as the world’s second largest economy appears to have skidded to its slowest growth in three years.

Stocks and commodities plunged Wednesday after the head of the European Central Bank -- a lynchpin in the euro zone's effort to contain the effects of its sovereign debt crisis -- suggested that some Greek banks will be left to collapse.

The U.S. services sector continued to expand in March, although the pace of growth has slowed.

Fresh figures on business activity and retail sales in the 17-member currency area reinforce earlier signs of recession, even as the European Central Bank left its main interest rate unchanged at an all-time low of 1 percent.

BTG Pactual, the largest independent investment bank in Latin America, said it is planning to raise up to $2.24 billion in a public offering that could signal the revival of Brazil's IPO market.

Spain's borrowing costs jumped Wednesday and demand for its debt tumbled at the country's first debt sale since the government unveiled its latest austerity budget last week, which apparently failed to convince investors that Madrid can be counted on to service its debt.

German authorities said on Wednesday the highly poisonous chemical dioxin had been discovered above permitted levels in eggs from a German farm but they see no danger to the public.

UK economy seems to be on the track to buck the trend in many other European countries where economic recovery continues to struggle.