Stock index futures pointed to a higher open on Wall Street Monday, with futures for the S&P 500 up 0.43 percent, Dow Jones futures up 0.26 percent and Nasdaq 100 futures up 0.38 percent at 0945 GMT.

Recently, non-farm employment in New Jersey has been shaky, with employment falling in two of the last three months. Much of the job loss has been in the leisure and hospitality and information sectors, said an economist at Wells Fargo Securities.

The top aftermarket NYSE gainers on Friday were: C&J Energy Services, Flotek Industries, Standard Pacific, Monster Worldwide, Transcananda Pipelines, Quanex Building Products, Williams Partners, Stillwater Mining, Crawford & Co and Imax Corp.

The top aftermarket NYSE losers on Friday were: Gol Linhas Aereas Inteligentes, Genpact, Advantage Oil & Gas, Skilled Healthcare Group, Lender Processing Services, CoreSite Realty, Williams Companies, Western Asset Bond and Luby's.

For the week ending Dec. 16, more than $6.3 billion was spent on online shopping, according to digital analytics firm comScore. This figure is 15 percent higher than last year.

Americans are making progress in working down their heavy debt burden, but they are struggling to break out of another funk holding back the economy: their deep pessimism.

The Hindi film industry struck gold in 2011, revving a lackluster box-office with some help from its leading men, wooing audiences after a dismal run last year.

China's November housing inflation eased to its lowest level in the year, a victory for Beijing's campaign to ward off property bubbles as it steadily loosens monetary policy to ensure a soft landing in the world's second-largest economy.

CME Group Inc., which has given $22 million to Chicago-area schools and charities during the past five years, has stopped making grants through its main foundation, citing the collapse of MF Global Holdings Inc.

Hundreds of anti-Wall Street protesters took to New York City's streets on Saturday in an attempt to establish a new encampment, with scores arrested as they tried to move onto church-owned land.

The World Trade Organization closed its biennial ministerial conference on Saturday with its chairman citing an improved atmosphere in the 153-member club but no concrete moves forward on the Doha round of world trade talks.

With India's economic growth buckling and the rupee at an all-time low, other companies, too, are expected to struggle to meet debt obligations in the coming months.

A key House vote on controversial anti-piracy legislation has been delayed.

The Sahara group will give a loan of more than 2.5 billion rupees to cash-strapped Kingfisher Airlines, to help the carrier continue operations.

The top after-market NASDAQ losers are: Cray, Amylin Pharmaceuticals, ZAGG, HMS Holdings, Clearwire, Riverbed Technology, Aruba Networks, Carrizo Oil & Gas, Glu Mobile and Zynga Inc.

The top after-market NASDAQ gainers are: SuperMedia, AsiaInfo-Linkage, Imperial Sugar, Electronic Arts, Endocyte, Twin Disc, Spectrum Pharmaceuticals, Complete Genomics, Central European Distribution and PMC - Sierra.

With less than two weeks left before the end of the year, all kinds of market participants, from economists at multinational banks to stock bloggers in their bedrooms, have begun to give their predictions for 2012. Here is a lucky set of seven predictions that could benefit investors next year.

A rally in stocks fizzled, leaving major indexes with modest gains on Friday, as Wall Street was torn between hope that U.S. economic data signals better times ahead and fear Europe's debt crisis will engulf world economies.

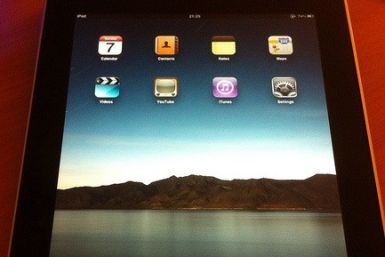

Apple has reportedly been receiving its A5 chips from a Samsung factory based in Texas. If the relationship holds, there's a great chance Apple's future chips will also be Texas-made.

The threat of Europe's financial crisis drifting overseas, slowing the U.S. recovery, remains. The Federal Reserve noted this week that Europe's debt crisis remains a threat to the U.S. economy, which it said is expanding moderately. Concerns linger over the health of the European banking sector and possible ratings downgrades in debt-ridden European countries.

Stock index futures pointed to a higher open for equities on Wall Street on Friday, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 rising 0.3 to 0.6 percent.

World stocks rose on Friday after upbeat U.S. data and corporate results, while concerns over the European banking sector and nervousness about potential ratings downgrades in European sovereign debt underpinned German government bonds.

The top aftermarket NYSE gainers on Thursday were: Bonanza Creek Energy, CTS Corp, Quiksilver, Transcananda Pipelines, Exterran Holdings, Jaguar Mining, Solarwinds, HyperDynamics, First Commonwealth Financial and Parker Drilling.

The top aftermarket NYSE losers on Thursday were: Harmony Gold Mining, MEMC Electronic Materials, Harry Winston Diamond, Accenture, Skilled Healthcare Group, Michael Kors Holdings, Diamond Offshore Drilling, Alpha Natural Resource, Aflac and MetLife.

Asian shares rose and the euro edged higher Friday, as signs of strength in the U.S. economy temporarily broke through gloom over the European debt crisis that had driven a selloff in riskier assets over the past three days.

Canadian industries are operating at a production capacity that is approaching pre-recession levels and the housing market remains strong, according to data on Thursday that offered the prospect of steady, if slower, economic growth.

After years of economic turmoil, U.S. homebuilders should see modest gains and a stable outlook in 2012, according to a report from Fitch Ratings.

Canadian commercial lending growth accelerated in the third quarter, showing smaller businesses expanded even as Europe's deepening debt crisis rattled investors worldwide, according to a PayNet Inc report.

Hong Kong was named the best city in the world for financial market development, beating out perennial front runners New York and London.

Despite unprecedented quantitative easing by the Fed, and $1 trillion-level U.S. budget deficits, the dollar continues to hold its own against a basket of the world's other, major currencies.