At least two serious potential bidders have emerged so far for the London Metal Exchange (LME) from 15 suitors who expressed interest in the world's biggest metals marketplace, a source with knowledge of the matter said on Wednesday.

When a country builds a skyscraper, a financial collapse will soon follow, a new report from Barclay's Capital -- suggesting investors should take a hard look at India and China.

Billionaire investor Carl Icahn on Wednesday dropped his $1.73 billion hostile bid for Commercial Metals Co (CMC.N) after failing to pick up support among the metal company's other shareholders.

The International Business Times spoke with Bob Lutz on Tuesday about Via Motors' plans, the state of the U.S. auto industry and more.

U.S. mortgage applications increased 4.5 percent on a seasonally adjusted basis in the week ending Jan. 6, according to the Mortgage Bankers Association (MBA).

Indian lenders may have to downgrade their loans to loss-making state-run Air India after they deferred a long-pending debt restructuring proposal, seeking a revision and making it tougher for the carrier to raise funds, three sources said.

The top aftermarket NYSE gainers Tuesday were: China New Borun Corp, Synnex Corp, Hospitality Properites Trust, Choice Hotels International, Bank of Ireland, Yingli Green Energy Holding Co, Boise Inc, FelCor Lodging Trust and Starwood Hotels & Resorts Worldwide.

The top aftermarket NYSE losers on Tuesday were: HCA Holdings, Hill-Rom Holdings, PVH Corp, Medifast, Two Harbors Investments, Emergent Biosolutions, Jones Group, Marathon Petroleum Corp, Pioneer Natural Resources and Cal Dive International.

DETROIT -- Soon after the earthquake and tsunami pummeled Japan last March, Nissan sent executives to their suppliers in Japan. They reported what parts had not been affected in what quantities.

The head of global sovereign ratings for Fitch, one of the world's premier credit rating agencies, riled up the Italian government today by saying the country was the pivotal factor on which the European financial crisis hinges, and suggesting the country's credit rating could be further downgraded.

U.S. orange juice futures surged almost 11 percent to an all-time high on Tuesday, as reports that discovery of small doses of an unapproved fungicide in Brazil could crimp juice imports from that country added fuel to a rally sparked by a brief freeze last week in Florida.

Historically low interest rates and weak stock market gains led 100 of the largest U.S. corporate pension funds to a massive funded-status deficit of $464.4 billion in 2011, the largest deficit in the 11 years consulting firm Milliman Inc. has been tracking such pensions.

Canadian housing starts climbed more than expected in December, fueled by low mortgage rates and a boom in condo construction, even as analysts predicted the once-hot sector would cool further in 2012.

Canadian stocks touched their highest level in two months on Tuesday as mining and energy issues rose on healthy import data out of China, which boosted investor optimism for the global economy.

A deteriorating European with slower growth and the longer we go without economy and weak global growth will keep the Bank of Canada from raising rates for at least another year, though an interest rate cut looks highly unlikely, according to a Reuters survey.

The International Business Times spoke with head designer Alfonso Albaisi, who led the design team for the all-new 2013 Pathfinder and is the Vice President of Nissan Design America.

Shares of silver mining companies rose on Tuesday as the price of the metal jumped, outperforming the rest of the market.

The federal government will soon begin selling government-owned foreclosed properties in bulk to investors as rentals, in a new effort to dispose of its growing portfolio of distressed properties.

Bank of America Merril Lynch's (NYSE:BAC) move to fire one-fifth of the managing directors in its Asia operations, while significant, is only the latest sign foreign banks are jumping ship on investment banking opportunities within that market.

DETROIT -- John Mendel is looking for a big difference in his top-selling model. Due to a variety of factors and circumstances in 2011, Mendel -- Honda's executive vice president of North America -- saw sales of Honda Accord plunge while competitors grew in sales and market share.

DETROIT -- Toyota introduced a plug-in hybrid concept vehicle Tuesday here in Detroit at the 2012 North American Auto Show called the NS4, separating it from the Prius family of vehicles and showcasing a new design the company plans to carry into the near future.

The U.S. office market improved in 2011 to highest leasing level in four years, according to real estate brokerage Cushman & Wakefield.

Chinese imports posted an unexpectedly sharp drop in December, flashing a warning sign that the world's second-largest economy is expanding at a slower rate. Meanwhile, full-year figures pointed to a narrowing trend in the Chinese trade gap, which suggest that the country is relying more on its domestic demand.

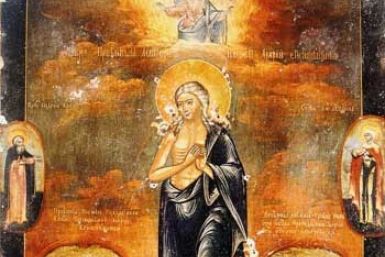

The Christian presence in Egypt stretches as far back to the earliest days of Christendom.

Bank of America-Merrill Lynch, the second-largest U.S. bank by assets, is cutting around a fifth of its managing directors across its Asia investment banking division, sources said on Monday, in a bid to cut costs as the outlook sours in a once-booming region.

The top pre-market NASDAQ Stock Market gainers are: Regeneron Pharmaceuticals, Lululemon Athletica, Cirrus Logic, Focus Media Holding, Achillion Pharmaceuticals, Research In Motion and Apple. The top pre-market NASDAQ Stock Market losers are: WebMD Health, Illumina, Affymax, Brocade Communications Systems and Teva Pharmaceutical Industries.

Oil rose to around $113 a barrel on Tuesday as tension over Iran's nuclear program and unrest in Nigeria outweighed persistent concerns about the strength of Europe's economy.

The top aftermarket NYSE gainers Monday were: Emulex Corp, MagnaChip Semiconductor Corp, Charles River Laboratories, Five Star Quality Care, Key Energy Services, Lions Gate Entertainment, Meritor, RealD, FXCM and First American Corp.

The top aftermarket NYSE losers Monday were: Liz Claiborne, Royal Bank Scotland Group, Terreno Realty Corp, Crestwood Midstream Partners, General Cable Corp, Cambrex Corp and Freescale Semiconductor Holdings.

Chinese exports and imports registered weaker growth in December than in November, signaling economic growth in the world's second largest economy is losing steam on account of sluggish demand and a thaw in the real estate market.

Data