In the municipal market, the downgrade will likely affect credits directly supported by federal aid and credits that rely on federal support streams for part of total revenues.

The S&P 500 index has not endured such a roller-coaster since in almost three years.

Which is a better way to battle the capital market blues: the Swiss franc or Frank Sinatra?

South African stocks added more than 3 percent on Thursday, the biggest daily percentage increase in 15 months, boosted by sentiment generated by better-than-expected U.S. labour market data.

Mortgage rates have fallen to a nine-month low, sending refinancing applications on the rise.

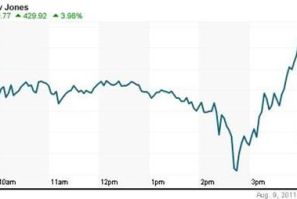

The schizophrenic Dow and other major U.S. markets indexes were having a good day Wednesday, up more than two percent across the board.

While the rest of the world spirals into a debt-filled economic abyss, ultra-wealthy Persian Gulf states like Qatar and Kuwait are propped up by the high prices of crude oil and natural gas.

Physical gold is the ultimate collateral because it has no credit risk, according to the Bank of America Merrill Lynch?s Global Commodity Research team.

The top pre-market NASDAQ Stock Market gainers are: Cisco Systems, Primo Water, AMC Networks, News Corp., and Sequenom. The top pre-market NASDAQ Stock Market losers are: Elbit Imaging, Open Text, SodaStream International, American Superconductor, and Lululemon Athletica.

The companies whose shares are moving in pre-market trade on Thursday are: Freeport Mcmoran Copper, News Corp, Ford Motor, PPL Corp, Regions Financial, Sara Lee, NYSE Euronext, American International Group, Alpha Natural Resources, Lincoln National Corp and Citigroup.

The Dow registered another volatile day Wednesday, plunging 520 points to 10,720 on chatter of additional banking sector concerns in Europe. Further, until investors can sort out which debt concerns are real, and which are not, look for choppy trading conditions to continue.

The top after-market NYSE gainers on Wednesday are: Demand Media, Active Network, Jaguar Mining, China Ming Yang Wind Power and Jones Group. The top after-market NYSE losers are: EnerSys, Alpha Natural Resources, Navistar International, Morgan Stanley and 7 Days Group Holdings.

The top after-market NASDAQ Stock Market gainers are: Gibraltar Industries, Nara Bancorp, Bon-Ton Stores, Medivation, and Altra Holdings. The top after-market NASDAQ Stock Market losers are: Open Text, Qlik Technologies, China Gerui Advanced Materials Group, Home Inns & Hotels Management, and Shanda Interactive Entertainment.

India's annual industrial output growth probably slipped further in June to 5.5 percent from a nine-month low of 5.6 percent in May, indicating taut monetary policy and soaring inflation were hindering growth momentum, the median forecast in a Reuters poll showed.

U.S. stock futures rose 1 percent on Thursday after a sharp drop on Wall Street overnight, limiting losses in Asian share markets, though the focus was shifting to how Europe reacts to a sovereign debt crisis that is now threatening its banking system.

New China Life, the third-largest life insurance company in China, has filed its listing application with the Hong Kong stock exchange, setting the stage for a planned IPO of up to $4 billion in Hong Kong and Shanghai, sources with direct knowledge of the plans told Reuters on Thursday.

August's dramatic financial shock, which is now both feeding off and risks fueling another economic downturn, may well introduce a third phase of the four-year-old global credit crisis -- the infection of the ultimate creditors.

U.S. stocks plunged again in another wild and erratic session on Wednesday.

Apple (NASDAQ:AAPL) just became the most valuable company in the world by declining less than Exxon Mobil (NYSE:XOM), the previous leader, in Wednesday?s brutal session that saw the S&P 500 plunge 4.42 percent.

HSBC plans to dispose of its 8 percent stake in Bank of Shanghai, a Chinese newspaper reported on Thursday, citing unidentified sources.

China Railway Group , the country's largest railroad builder, has dropped a plan to raise about 6.2 billion yuan ($966 million) via a share placement, the company said on Thursday.

Beijing should move rapidly to diversify its foreign exchange reserves, buying more euro and yen rather than dollar assets, after U.S. debt was downgraded by one rating agency, a paper run by China's central bank cited local banking sources as saying.

The euro fell to fresh five-month lows against the yen in Asia on Thursday and looked set to stay under pressure as worries about the euro zone sovereign debt crisis spread to the region's banking sector.

The Dow Jones industrial average dropped 520 points on Wednesday wiping out Tuesday's rebound as investors continue to worry about the European debt crisis and the health of the global banking system. The Dow's 4.62 percent drop has placed the blue-chip index back below the 11,000 level, closing at the lowest level since last September.

U.S. stocks tumbled more than 4 percent on Wednesday, almost wiping out gains from a relief rally the previous day, as rumors about the health of French banks sparked concern that the euro zone's debt crisis could claim new victims.

In what is turning out to a highly volatile week, U.S. stocks plunged on Wednesday on a vicious late-session sell-off.

Crude oil historically trades at about 8 times the price of natural gas. Currently, it's trading at about 20 times natural gas. Is oil overpriced, natural gas underpriced, or is it a combination?

These two iconic corporations are going in decidedly different directions.

The UK is seeing the worst civil unrest in 30 years just months before the 2012 Summer Olympics in London, but officials are optimistic that the riots will have no effect on the safety or planning of the games.

A reorientation of Russia to East from West could be a complete economic game-changer.