Ghana's parliament will begin debating on Monday a $3 billion loan facility awarded by China Development Bank to the west African nation to finance infrastructure projects including in the oil and gas sector, a government statement said.

South Africa's government bonds took a breather on Monday, with yields coming off record lows as some dealers cashed in their holdings after a strong rally last week.

Bachmann continues to pound away at Obama’s weak handling of the economy.

Car dealers in the United Arab Emirates are trying to get around strict new regulations created by the Gulf nation’s Central Bank that require car buyers to put 20 percent down on every purchase.

The stock market inched back up this morning as bargain hunters scoured the Big Board for victims of last week’s crash.

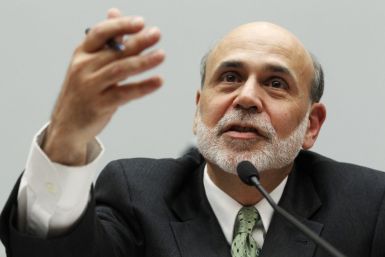

With the U.S. recovery having slowed considerably, and Europe debt woes persisting, investors will look to Fed Chairman Ben Bernanke's Jackson Hole, Wyo. speech later this week to provide clues regarding the central bank's evaluation of the economy, and at what point it thinks additional stimulus would be needed.

Sales of the Chevrolet Suburban in the Middle East and North Africa have increased by 34 percent in the first seven months of 2011 compared to the same period in 2010.

The Cadillac Converj Concept, a luxury coupe with extended-range electric vehicle technology, is moving forward as a production car that will be called the Cadillac ELR.

Hurricane Irene hits Puerto Rico and approaches Florida, rebels take over Libya's capital, charges may be dropped against Dominique Strauss-Kahn and more in Monday's daily scoop.

Now that her wedding is over, Kim Kardashian might do the nation a favor and advise Obama on how to get the country out of its economic slump.

Stock index futures pointed to a slightly higher open on Wall Street on Monday, with futures for the S&P 500 up 0.61 percent, Dow Jones futures up 0.55 percent and Nasdaq 100 futures up 0.73 percent at 3:44 a.m. EDT.

The Black Death of the debt crisis across the euro zone will hurt China's exports, although Beijing's relatively small holdings of euro assets will limit damage to foreign exchange reserves, the nation's top official newspaper said on Monday.

The top after-market NYSE gainers on Friday are: Frontline, Weatherford International, CBL & Associates Properties, iSoftStone Holdings and Strategic Hotels & Resorts. The top after-market NYSE losers are: Royal Bank Scotland Group, Accretive Health, Yanzhou Coal Mining Co, Clean Harbors and Liz Claiborne.

Brent crude dropped more than $3 on Monday to below $106 a barrel, while U.S. oil fell more than a dollar to below $82, on the potential for a resumption of exports from OPEC-member Libya as a six-month civil war there appeared close to an end.

European stocks extended four weeks of losses on Monday, tracking jittery Asian shares lower, while gold shot to new highs as investors worried about the sluggish U.S. economic outlook and Europe's festering debt crisis.

Brent crude dropped by more than $2 on Monday to around $106 a barrel on the potential for a resumption of exports from OPEC member Libya as a six-month civil war there appeared close to an end.

The rupee is expected to inch up in early trade on Monday, tracking firm Asian peers, with the performance of local shares seen providing further direction during the day.

Asian stocks turned positive on Monday, recovering a small portion of last week's steep losses, while gold shot to new highs as investors worried about the sluggish U.S. economic outlook and Europe's debt crisis.

In early summer, before layoffs began sweeping across Wall Street, billboard-sized photos of employees were plastered on the walls, pillars and elevator banks of Credit Suisse Group AG's offices in the United States and abroad.

To say it's been a discomforting summer for U.S. stock investors would be an understatement. The Dow has been on a wild ride, with large market drops followed by sudden reversals. Look for market choppiness to continue until investors determine whether the Fed's latest monetary policy decision will be enough to rev-up U.S. GDP growth.

Large banks in the U.S. and Europe are undergoing a massive and painful re-organization in order to confront the gloomy new realities of the global economic landscape.

It goes without saying that a civilization and society as complex as the United States would have its share of myths and misnomers, so let's take a moment to dispel a few.

Shares of business development companies have plummeted during the stock market crash and currently trade at 80 percent of their net asset value.

Cadillac on Friday unveiled the Ciel concept, an open-air grand-touring car inspired by the natural beauty of the California coast.

Leadership is what America desperately needs because investors are trading more on fear instead of on facts.

China's buying of West African crude oil is set to rise about 15 percent in September from August, trade sources said on Friday, but overall Asian imports from West Africa will fall due to slower Indian demand.

Inflation in Morocco jumped to 1.8 percent in July from a year earlier, exceeding the average forecast for 2011 for the first time this year, due mainly to a surge in food prices, the state High Planning Commission (HCP) said on Friday.

House prices are skyrocketing in the sun drenched Lebanese capital of Beirut, forcing working families to find affordable housing miles outside of town.

Investors started buying beaten-down stocks Friday, especially in the tech sector, to lift the Nasdaq composite index into positive territory and shortly thereafter boosting other major indexes.

Autonomy's founder and chief executive Mike Lynch, who owns an 8.2 percent stake in the company, could walk away with £582-million ($960-million).