Most of the Asian markets fell Wednesday as investor confidence was weighed down by the lack of stimulus measures from policymakers to support the global economy and regain the growth momentum.

Asian shares steadied Wednesday as strong U.S. retail sales and data showing Germany and France avoiding a contraction last quarter bolstered investors' risk appetite, with weak euro zone growth sustaining hopes for more stimulus.

Banco Santander S.A., Mellanox Technologies Ltd, Agrium Inc, Pizza Inn Inc, Newmont Mining Corp, Citigroup Inc, Caterpillar Inc and Groupon Inc are among the companies whose shares are moving in pre-market trading Tuesday.

U.S. stock index futures point to a higher open Tuesday amid hopes that central banks around the world will announce stimulus measures to boost the economy and regain the growth momentum.

Most of the European markets rose Tuesday as investors were hopeful that the ECB will soon announce stimulus measures as the GDP data from Germany and France indicate that the euro zone economy continues to falter.

Asian shares steadied Tuesday with investors staying sidelined ahead of more figures from Europe and the United States later in the day, after recent data showed the euro zone's debt woes were eroding business activity globally.

Focus Media Holding Limited, Research In Motion Limited, Google Inc, Knight Capital Group Inc, CenturyLink Inc, Logitech International SA, Facebook Inc and J.C. Penney Company Inc are among the companies whose shares are moving in pre-market trading Monday.

U.S. stock index futures point to a lower open Monday as investor confidence was dragged down by concerns about the weakening of the global economy following the fragile gross domestic product growth in Japan in the second quarter.

Most of the European markets fell Monday as investors were disappointed to note that the economic growth slowed down in the second quarter in Japan indicating that the global economy continues to falter.

Asian stock markets ended with gains last week as sentiment continued to improve on hopes that the European Central Bank would shortly take policy action to lower the peripheral bond yields of struggling nations such as Italy and Spain.

Asian markets gained this week on buoyed investor confidence with indications of an improving U.S. economy and the hopes of an announcement of stimulus measures by China to regain the economic growth momentum.

The top after-market NYSE gainers Friday were MasTec, Oasis Petroleum, Matador Resources, Janus Capital Group and Putnam Municipal Opportunities Trust. The top after-market NYSE losers were Imperva, Ocwen Financial Corp, Radioshack Corp, Game Stop Corp and Permian Basin Royalty Trust.

Manchester United Ltd. (NYSE:MANU), one of the world's most storied sports franchises, began publicly trading Friday, but early signs indicated investors were giving a less-than-enthusiastic welcome to the 134-year-old club.

Fusion-IO, Barclays Plc, Southwestern Energy, Hewlett-Packard, Facebook, Nokia Corp, Weatherford International, Seadrill and GNC Holdings Inc. are among the companies whose shares are moving in the pre-market trading Friday.

Asian stock markets declined for the first time in five days Friday as weaker-than-expected Chinese trade data stoked fears of a growth slowdown in the world's second largest economy.

U.S. stock index futures pointed to a lower open Friday as China's trade data for July fell short of expectations.

European markets fell Friday as investor confidence was weighed down following disappointing trade data from China giving further indication that the global economic condition is faltering.

The top after-market NYSE gainers Thursday were Fusion-IO, Bally Technologies, ExactTarget, Christopher & Banks and Turquoise Hill Resources Ltd. The top after-market NYSE losers were Roundy's Inc, Scotts Miracle-Gro, EXCO Resources, Lions Gate Entertainment Corp and Delek US Holdings Inc.

Most of the Asian markets fell Friday as investors were disappointed to note that China's trade balance for July was worse than expected, increasing concerns about the faltering economic condition.

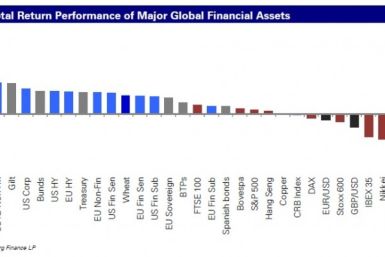

A report out Thursday morning by Jim Reid, head of Global Fundamental Credit Strategy, noted the global financial crisis is five years old today, tracing the beginning of the world's economic troubles to August 9, 2007.

Pluristem Therapeutics, Nokia Corp, Amarin Corp, Sprint Nextel, KB Home, Yelp Inc, Glu Mobile and Zynga Inc. are among the companies whose shares are moving in pre-market trading Thursday.

U.S. stock index futures point to a higher open Thursday ahead of the Labor Department's weekly jobless claims data and the Bureau of Economic Analysis' trade balance report.

Asian stock markets advanced for the fourth straight session Thursday after data showed that Chinese inflation continued to cool down in July, providing more room for further policy easing to boost growth.

European markets rose Thursday as investor confidence was lifted by hopes that China will announce stimulus measures to boost the economic condition and regain the growth momentum.

Crude oil futures advanced during the Asian trading hours Thursday after data showed Chinese inflation continued to cooled for a fourth straight month in July, rising hopes for monetary easing measures to support growth.

The top after-market NYSE gainers Wednesday were Millennial Media, FleetCor Technologies, NQ Mobile, Dillard's, Orbitz Worldwide and MBIA, Inc. The top after-market NYSE losers were Medicis Pharmaceutical, Teekay Tankers, McEwen Mining, China Nepstar Chain Drugstore and ING Groep NV.

Most of the Asian markets rose Thursday as hopes for monetary easing measures to be announced by China grew following reports that the country's inflation slowed down in July compared to the previous month.

MEMC Electronic Materials, Tower Semiconductor, Pebblebrook Hotel Trust, InterContinental Hotels Group, UBS AG, ARM Holdings, Hewlett-Packard and Credit Suisse Group AG are among the companies whose shares are moving in pre-market trading Wednesday.

Asian stock markets advanced for the third straight session on Wednesday as sentiment continued to improve on hopes that the major central banks around the world will soon announce new round of stimulus measures to spur economic growth.

U.S. stock index futures point to a lower open Wednesday as investor sentiment was weighed down by lack of stimulus measures from policy makers around the globe to rejuvenate the faltering economic growth momentum.