European markets rose Thursday on hopes ahead of the European Central Bank meeting where the bank is expected to announce policy measures to boost the euro zone economy and revive growth momentum.

The top after-market NYSE gainers Wednesday were AAR Corp, Men's Wearhouse, Heckmann Corp, OM Group and Aeroflex Holding Corp. The top after-market NYSE losers were VeriFone Systems, First Bancorp, Sealed Air Corp, Cooper Tire & Rubber and Enbridge Energy Partners, L.P.

Most of the Asian markets rose Thursday as investors remained hopeful that the European Central Bank would announce stimulus measures soon to help boost the euro zone economic growth.

Google (Nasdaq: GOOG), the No. 1 search engine, which now owns the Motorola brand, refreshed its product line with three new members of the Razr brand line in a bid to recapture past success. They’re the first major new lines since Google completed the $12.5 billion acquisition of the former Motorola Mobility in May.

Pluristem Therapeutics, Facebook Inc, ARM Holdings Plc, Francesca's Holdings Corp, BP Plc, Nokia Corp, Alcatel Lucent SA, Capital One Financial Corp, Netflix and Lennar Corp. are among the companies whose shares are moving in pre-market trading Wednesday.

U.S. stock index futures pointed to a lower open Wednesday as investor confidence continued to be weighed down by high degree of uncertainty about policymakers announcing stimulus measures to revive economic growth momentum.

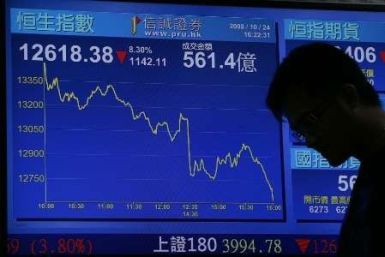

Asian stock market declined Wednesday as weak economic reports from U.S. and China weighed on the sentiment. Concerns over global economic downturn resurfaced after the Institute for Supply Management (ISM) said that U.S. factory activity contracted for the third straight month in August

Crude oil futures declined Wednesday as weak manufacturing reports from the U.S. and China raised concerns of a further global slowdown.

European markets remained in a tight range Wednesday as investors continued to be nervous ahead of the meeting in which the European Central Bank is expected to announce policy measures to boost the euro zone economy and revive growth momentum

The top after-market NYSE gainers Tuesday were Guidewire Software, Cenveo Inc, Six Flags Entertainment Corp, CONSOL Energy and Pep Boys-Manny, Moe & Jack. The top after-market NYSE losers were Greenhill & Co, Assured Guaranty Ltd, Kindred Healthcare, Nustar Energy L.P. and Giant Interactive Group Inc.

Asian markets fell Wednesday as investors' concerns about the weakening global economy was revived by the declining U.S. manufacturing activity and disappointing China's services activity.

Asian shares and the euro eased Wednesday, with investors waiting for a European Central Bank meeting on Thursday and U.S. payrolls on Friday for signs of more action to counter European debt woes and support growth.

StemCells Inc, Tower Semiconductor Ltd, Nokia Corp, Anheuser-Busch InBev, Telefonica, Valeant Pharmaceuticals, Banco Santander, Coca-Cola Co, Harmony Gold Mining Co and ARM Holdings plc are among the companies whose shares are moving in pre-market trading Tuesday.

Asian stock markets ended lower Tuesday as investors remained watchful ahead of the European Central Bank (ECB) meeting and U.S. non-farm payrolls data later this week.

The U.S. stock index futures point to a higher open Tuesday as market sentiment was underpinned by expectations that policymakers around the world will announce stimulus measures to rejuvenate the economic growth momentum.

Most of the European markets fell Tuesday as investors continued to remain cautious waiting for the policymakers to announce stimulus measures to boost the euro zone economy and revive the growth momentum.

Asian markets remained in a tight range Tuesday as investors were waiting for the outcome of meetings among the policymakers in the euro zone which is expected to announce measures to tackle the debt crisis affecting the region.

Asian stock markets mostly ended higher Monday on hopes that major central banks around the world would soon announce a new round of stimulus measures to tackle the deteriorating global economic conditions.

European markets were mixed Monday as investors continued to remain watchful waiting for policymakers to announce the stimulus measures to boost the euro zone and revive the growth momentum.

Crude oil prices declined in Asia Monday as sentiment was dampened after reports indicated a sharp slowdown in the Chinese manufacturing activity in August.

Most of the Asian markets rose Monday as investors remained hopeful that the world's central banks would announce stimulus measures soon to help boost the global economic growth.

Markets are expected to begin the week on a negative note after official data Saturday showed that Chinese manufacturing activity shrank for the first time in nine months, raising concerns over the growth slowdown in the world's second largest economy.

The top after-market NYSE gainers Friday were Dominion Resources Black Warrior Trust, Thompson Creek Metals Co, MPG Office Trust, Renren Inc and Overseas Shipholding Group. The top after-market NYSE losers were Alon USA Energy, HudBay Minerals, Heckmann Corp, Plantronics and RadioShack Corp.

Asian markets fell in the week as investor confidence was dragged down by the increasing concerns about the global growth slowdown amid the weak economic reports from Japan and South Korea.

SAIC, Nokia Corp, UBS AG, SAP AG, First Solar, Deutsche Bank, Carnival Plc and Zynga Inc are among the companies whose shares are moving in pre-market trading Friday.

Asian stock markets declined Friday as weak economic reports from Japan and South Korea revived concerns over the global economic growth while investors opted for caution ahead of the long-awaited speech by Federal Reserve Chairman Ben Bernanke at the Jackson Hole symposium later in the day.

U.S. stock index futures point to a higher open Friday ahead of Federal Reserve Chairman Ben Bernanke's speech at the Jackson Hole symposium where he is expected to announce another round of monetary easing.

European markets remained in the tight range Friday as investor confidence continued to be weighed down by fading hopes on the European Central Bank to announce policy measures to boost the euro zone economy and revive growth momentum.

India's economic growth rose in the first quarter of the fiscal year 2012-13 compared to the January-March quarter of the last fiscal, indicating that the country's economy is moderately improving though the soft global demand and the weak domestic policy measures have affected it.

The top after-market NYSE gainers Thursday were SAIC Inc, Domtar Corp, McEwen Mining, Freescale Semiconductor and Crane Co. The top after-market NYSE losers were Accretive Health, Gerdau SA, Quicksilver Resources, American Eagle Outfitters and CoreLogic, Inc.