Yahoo! Inc, National Bank of Greece, Nokia Corp, Zynga Inc, Compucredit Holdings, Halcon Resources, Harmony Gold Mining, Amazon.com and Banco Santander are among the companies whose shares are moving in pre-market trading Thursday.

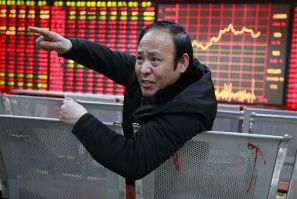

Asian stock markets were mixed Thursday as investors opted for caution ahead of the U.S. Federal Reserve's policy announcement later in the day.

The U.S. stock index futures point to a lower open Thursday as investors maintained a cautious mode ahead of the Federal Reserve meeting in which there is the likelihood of another round of quantitative easing measures to be announced to invigorate the economy.

Most of the European markets fell Thursday as investors remained watchful waiting for the U.S. Federal Reserve to announce stimulus measures to revive the economic growth.

The top after-market NYSE gainers Wednesday were K12 Inc, Pall Corp, HFF, Inc, National Bank of Greece and Dole Food Co. The top after-market NYSE losers were Spartech Corp, Halcon Resources Corp, Genesee & Wyoming, Chesapeake Lodging Trust and Nautilus, Inc.

Most of the Asian markets made gains Thursday as investors remained hopeful waiting for the policymakers in the U.S. to announce monetary easing measures to boost the global economy and rejuvenate the economic growth momentum.

Asian shares eased Thursday ahead of the U.S. Federal Reserve's decision later in the day, but investors remained optimistic of further stimulus action to bolster the world's largest economy.

Alcatel Lucent SA, Nokia Corp, Sohu.com, Facebook, Barclays, Banco Santander, Cognizant Technology Solutions Corp, Morgan Stanley and Apple Inc. are among the companies whose shares are moving in pre-market trading Wednesday.

The U.S. stock index futures point to a higher open Wednesday as investor confidence was underpinned by expectation that the Federal Reserve will announce stimulus measures this week to invigorate the economy and boost growth.

Most European markets rose Wednesday with investors awaiting Germany's Constitutional Court to approve the euro zone's new bailout fund to help reduce the debt stress faced by the countries in the region.

Asian stock market advanced Wednesday with investors expecting a positive decision in the German court ruling on ESM constitutionality while speculation of further stimulus measures from China also added to the sentiment.

The top after-market NYSE gainers Tuesday were AU Optronics, Genco Shipping & Trading, Beazer Homes USA, Air Lease Corp and EnergySolutions Inc. The top after-market NYSE losers were Teekay Offshore Partners, Vanguard Natural Resources, Pilgrim's Pride Corp, Swift Transportation and General Growth Properties.

Asian stock markets rose Wednesday as investors remained hopeful that policymakers in the U.S. and China would announce monetary easing measures to boost the global economy and rejuvenate economic growth momentum.

Asian shares edged higher Wednesday as investors remained cautiously optimistic that a German court would approve the legality of the euro zone's bailout fund later in the day and the U.S. Federal Reserve may deliver further stimulus measures this week.

Prana Biotechnology Ltd, Dryships Inc., Sanofi SA, Tata Motors, Amarin Corp, American International Group, ArcelorMittal and Delhaize Group are among the companies whose shares are moving in pre-market trading Tuesday.

The U.S. stock index futures pointed to a higher open Tuesday as investor sentiment turned positive amid hopes that the Federal Reserve would announce monetary easing measures this week to revive the economic growth momentum.

European markets fell Tuesday as investor confidence was weighed down by increasing concerns of the debt crisis affecting the euro zone.

The top after-market NYSE gainers Monday were Calix, Inc, Nam Tai Electronics, Freescale Semiconductor, Harbinger Group and Northern Tier Energy LP. The top after-market NYSE losers were Palo Alto Networks, El Paso Pipeline Partners LP, Sun Communities, EnergySolutions Inc and General Growth Properties, Inc.

Most of the Asian markets fell Tuesday as investors' concerns about the debt crisis affecting the euro zone were revived, undermining the optimism initially raised by the bond-buying plan announced last week by the European Central Bank.

Asian shares eased Tuesday ahead of a key German ruling on the euro zone's bailout funds and the U.S. Federal Reserve's policy decision.

Cell Therapeutics, Deutsche Bank, Transocean Ltd., Peregrine Pharmaceuticals, Kraft Foods Inc, American International Group, Seadrill Ltd and Anheuser-Busch InBev are among the companies whose shares are moving in pre-market trading Monday.

Asian stock markets mostly ended higher Monday on hopes that major economies including the U.S and China would soon announce a new round of stimulus measures to spur growth.

Most of the European markets marginally fell Monday as investor optimism over last week's bond buying plan announced by the European Central Bank began to fade and concerns about the debt crisis faced by the euro zone was revived.

Crude oil futures slightly declined Monday as weak economic reports from the U.S. and China weighed on the sentiment.

Most of the Asian markets rose Monday as investors remained hopeful that stimulus measures would soon be announced by China to boost its economy as its industrial production growth rate slowed down in August compared to previous month.

Asian stock markets ended with gains last week after the European Central Bank (ECB) announced plan to reduce borrowing costs of struggling euro zone countries’ and news that Chinese regulators had approved another batch of infrastructure projects, which should stabilize and restore growth in the world's second largest economy. Market participants’ are likely to focus on Federal Open Market Committee (FOMC) interest rate decision on September 13th.

Asian stock markets posted their first weekly gains in three weeks as the European Central Bank's (ECB) announcement about its widely anticipated bond-buying program, and Chinese stimulus measures, triggered a rally on Friday.

Deutsche Bank AG, ING Groep, Rio Tinto, Cliffs Natural Resources, Tata Motors, Bank of America Corp, Audience and Pandora Media are among the companies whose shares are moving in pre-market trading Friday.

While pundits and analysts dissected a myriad angles regarding the ECB's proposal, one lesser-considered issue has been how, following the announcement of the plan Thursday, it increasingly seemed Spain was being given the short end of the stick, while Italy was being favored, by the announcement.

The U.S. stock index futures point to a higher open Friday ahead of the Bureau of Labor Statistics' nonfarm payrolls and unemployment reports.