El Salvador Continues Bitcoin Stacking As $BTC Struggles Below $85,000

KEY POINTS

- El Salvador's Bitcoin office revealed it purchases another $BTC Sunday, bringing its total stash to 6,118.18 $BTC

- Under the deal, El Salvador is supposed to not make any Bitcoin purchases throughout the IMF program's duration

- A $BTC expert argued that the Bukele administration was 'contracting' itself in its stance regarding the IMF package

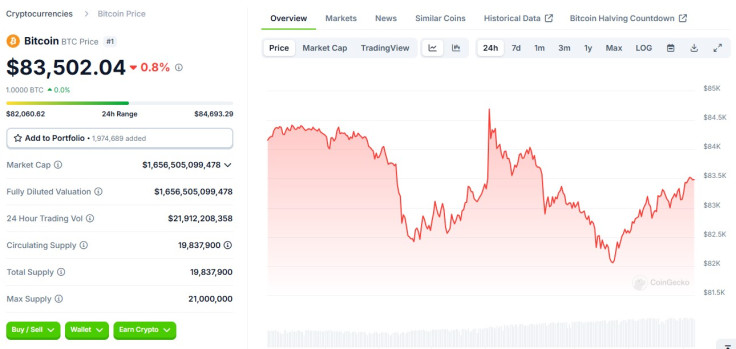

El Salvador continued its Bitcoin purchases as the world's most valuable cryptocurrency lingers below $85,000 amid a broader crypto market downturn and despite concerns around a funding package from the International Monetary Fund (IMF) that sets limits on the Salvadoran government's BTC activities.

On Sunday, President Nayib Bukele's Bitcoin Office said it has added another BTC to its national strategic Bitcoin reserve, bringing its total holdings to 6,118.18 Bitcoins worth over $512 million.

🇸🇻El Salvador keeps stacking!

— The Bitcoin Office (@bitcoinofficesv) March 16, 2025

One more bitcoin added to our strategic reserve:

➡️Total BTC added today: 1 BTC

➡️Total SBR Holdings: 6,118.18 BTC

This is the way 👇 pic.twitter.com/WqiKCpj8uE

El Salvador Buys the Dip

The central American country's latest BTC buy comes as Bitcoin prices struggle to break out of the $85,000 mark.

The world's largest crypto asset by market cap even dipped as low as $82,000 at one point Sunday before settling in above $83,000 late in the night.

Bitcoin has erased some $400 billion from its market cap since it joined the $2 trillion club with Google and Amazon in the ranks earlier in December when it topped $100,000 for the first time.

For some, the digital currency's price downturn is a huge loss, but for others, El Salvador included, it is an opportunity to stack up more while prices are low.

Can El Salvador Continue Buying Despite IMF Deal?

Earlier this month, the IMF revealed that it has agreed with El Salvador on a $1.4 billion funding package to help the government with its reform plans.

Under the deal, El Salvador should not be able to make Bitcoin purchases during the funding program's duration, and wind down its e-wallet Chivo among other concessions that the Bukele government had to make.

John Dennehy, the founder of El Salvador-based BTC education program My First Bitcoin (Mi Primer Bitcoin), was among the industry leaders who called out the Bukele administration for "directly contradicting itself" on its Bitcoin policy.

He noted how the IMF's publication on the matter earlier this month states how the Salvadoran government proposed it will "no longer accumulate new Bitcoins in our portfolio" so it can secure the loan.

Okay, the govt of El Salvador is directly contradicting itself regarding how Bitcoin policy will change as a result of a loan agreement with the IMF

— John Dennehy (@jdennehy_writes) March 5, 2025

Let me show you. I brought receipts

Yesterday the IMF released a detailed (111 page) document outlining the agreement and… pic.twitter.com/sMOfKfVRDu

"The El Salvador govt is disagreeing with itself—simultaneously saying they will stop accumulating Bitcoin and that it is 'not stopping.' It's impossible for both to be true," he argued.

Bukele's government has yet to address concerns on the legality of its Bitcoin purchases, considering its agreements with the IMF.

US Follows Suit

Despite issues around El Salvador's Bitcoin reserve, the United States is following in El Salvador's footsteps, albeit on a different path and with a more different approach.

U.S. President Donald Trump has signed an executive order establishing a Bitcoin reserve but at least on the onset, the reserve will only comprise of BTC seized by the U.S. government, currently at around 200,000 BTC.

Trump's Bitcoin reserve is not without opposition as some critics pointed to the innate volatility of crypto.

It remains to be seen whether El Salvador will be able to catch up to the U.S.'s reserve stash but at least based on its seeming defiance to the IMF, it may someday catch up or even surpass the American Bitcoin treasury.

© Copyright IBTimes 2024. All rights reserved.