EXCLUSIVE: Bitget CEO Talks Bitcoin ETFs' Impact On Australia's Crypto Literacy

KEY POINTS

- Younger investors in Australia are driving the rise in crypto interest in the country

- Bitcoin ETFs will make crypto simple for Australian investors: Gracy Chen, Bitget CEO

- She said the funds relieve investors from the burden of security, regulation, and technicality

Australia is one of a growing number of Asia-Pacific nations embracing spot Bitcoin exchange-traded funds (ETFs), and with the entry of American investment management firm VanEck's VBTC, Australia is in for a revolution in the local cryptocurrency landscape.

ETF interest in Australia on the rise

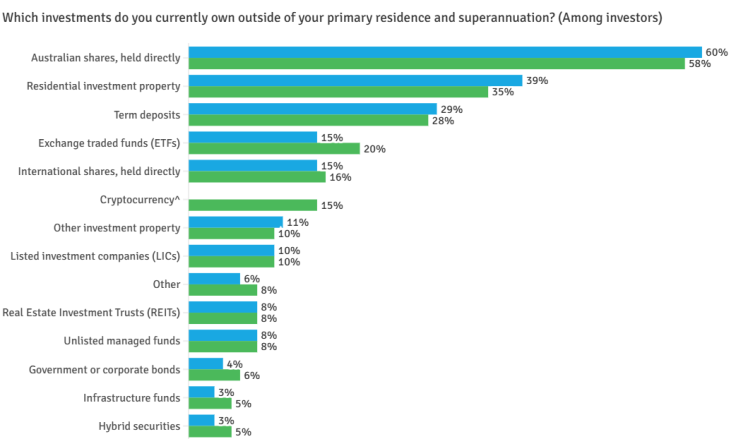

The country's Australian Securities Exchange (ASX) approved VBTC last month, providing Australian crypto investors with the first spot $BTC ETF on the exchange. The exchange revealed in its 2023 investor study that 15% of Australian investors own digital assets, and 20% have invested in ETFs, suggesting that crypto interest in the country is on the rise. Interestingly, the ASX study also revealed that 31% of next-gen (aged 18-24) investors in the country hold cryptocurrencies, and 33% of younger investors are into ETFs.

Gracy Chen, the CEO of the crypto firm and exchange Bitget, shared with International Business Times her thoughts on the development's impact on the Australian crypto sector.

For Chen, the VBTC's entry into the Australian investment ecosystem could spark a wave of interest among a large population in the country, considering the new level of exposure and access to digital assets that spot Bitcoin ETFs offer.

The benefits of Bitcoin ETFs in Australian investment

"Bitcoin ETFs will essentially make crypto simple for everyone as it takes away the complexity of managing wallets and understanding the decentralized finance ecosystem. This could result in an increase in retail and increasing institutional adoption while providing more market liquidity," she said.

Direct ownership of Bitcoin, the world's top digital asset by market value, may pose regulatory and technical challenges, especially for newbies in the $BTC investment market. With BTC ETFs, holding crypto is easier since investors "allocate their money into crypto through regulated investment products."

Crypto investments and security concerns

Security has become a major concern for some investors, especially those who witnessed the notorious collapse of FTX in 2022. Chen noted that Bitcoin ETFs completely "take the burden" of security issues off the investors' shoulders.

"For asset management firms, safe and profitable storage of investments is their business. ETFs typically distribute ownership across investors, mitigating centralization risks which are monitored by regulators. While ETFs can influence crypto market sentiments, Bitcoin's decentralized network and scarce supply will support its resilience against concentrated ownership risks from ETF accumulation."

Investment management firms like VanEck and others have established strict security audits and are closely monitored by regulators, bringing assurance to investors that their funds are in safe hands.

ETFs' implications on Australia's $BTC adoption

Chen sees Bitcoin ETFs driving mainstream awareness and adoption of crypto. Bitget is on a mission to help people navigate the complex crypto landscape, and with the emergence of crypto ETFs, Bitget has advanced a step closer to its goal.

For Chen, $BTC ETFs will help crypto become "a part of people's everyday lives." This vision is backed by numbers published on the Independent Reserve Cryptocurrency Index (IRCI) Australia 2024.

The index showed that 25% of Australians now view $BTC more favorably after the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETFs. Furthermore, Bitcoin is the most recognized digital asset in the country, and since 2019, Australians' awareness of the coin has jumped from 87% to 93%.

Though Australia has a long way to go before it completely opens up to crypto investments as much as other countries around the world have done so, the entry of crypto offerings such as Bitcoin ETFs signals the country's willingness to step up adoption.

© Copyright IBTimes 2024. All rights reserved.