How to Spend Your PPP, EIDL, and MSLP Money

Government loans and grants always come with strings attached in the form of spending restrictions. The Paycheck Protection Program (PPP), Economic Injury Disaster Loan (EIDL), and Main Street Lending Program (MSLP) loans are no exception.

The coronavirus is not typical and the costs it imposes on SMBs are not typical either. For that reason, COVID-19 loan programs are not designed to offer regular small business loans: In general, they have more restrictions. These loans, by and large, are primarily set up to encourage you to maintain payroll and staff and "keep the lights on" during the coronavirus crisis. And that affects how you spend the money.

Which Loans Cover Which Expenses?

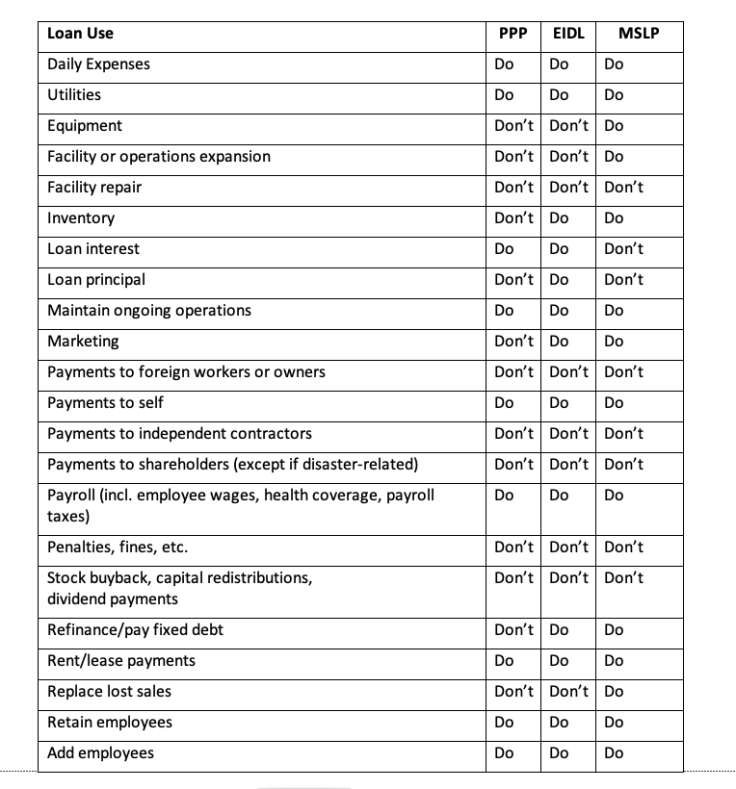

Here are some common business expenses, and which loans can be used for them.

- Inventory (EIDL, MSLP): PPP loans cannot be used to purchase supplies and products, but both EIDL and MSLP consider inventory replacement and supplies acceptable uses of those funds.

- Equipment (MSLP): You may not purchase equipment with PPP or EIDL funds. Equipment purchases are not prohibited with MSLP loan funds.

- Daily Expenses (PPP, EIDL, MSLP): All three loan programs permit the use of loan funds for daily operations -- things as payroll, utilities, rent/lease, and mortgage payments.

- Refinance/Pay Down Debt (EIDL, MSLP): You can't use PPP or EIDL funds to refinance or pay down long-term debt but your EIDL loan can be refinanced into a PPP loan. MSLP funds have restrictions against both refinance and debt retirement but the MSLP Priority Loan Facility does let eligible borrowers refinance existing debt under certain circumstances.

- Marketing (EIDL, MSLP): Efforts to advertise and promote your business is not an acceptable use of PPP funds but is allowed under specific circumstances with both an EIDL or MSLP loan.

When it comes to the things small and medium-size businesses prefer to spend loan proceeds on, the Main Street Lending Program (MSLP) is the clear winner, hitting all five areas. EIDL funds may be used in at least three categories and PPP loans, the most restrictive, may only be used for one (daily expenses). If you want to apply for PPP or even EIDL money, you may have to realign your expectations when it comes to how you use those funds.

Let's look at each program in more depth.

Paycheck Protection Program (PPP)

Paycheck Protection Program (PPP) loans are both the most restrictive and the most rewarding. These loans primarily concentrate on helping you maintain payroll and staff but are totally forgivable if you follow the rules. In other words, if your needs align with PPP restrictions, your "loan" can become a "grant."

You must spend the funds during the "covered period" defined as the 8- or 24-week period beginning when you receive your loan funds. If you were assigned a PPP loan number on or before June 5, 2020, you have a choice of 8 or 24 weeks. If your assigned number came after June 5, you have 24 weeks or until Dec. 31, 2020, whichever comes first. If you have a choice, there are advantages and disadvantages to both options.

Acceptable Uses of PPP Funds

- Payroll (including wages, health coverage, payroll taxes)

- Mortgage interest

- Rent/lease payments

- Utilities

In general, these expenses/obligations (or agreements for them) must have been in effect before Feb. 15, 2020. Funds can also be used to pay interest on debt incurred before the coverage period and to refinance an EIDL loan made between Jan. 31 and Apr. 3, 2020.

Unacceptable Uses of PPP Funds

- Payroll compensation for any employee in excess of $15,385/8 wk period; $46,154/24 wk period

- Payments to contractors

- Payments to the borrower unless self-employed

- Inventory/supplies

- Equipment

- Refinance/pay down existing debt

- Marketing

Spending any PPP money on an ineligible expense, i.e., using your PPP funds to pay mortgage principal, may result in criminal prosecution and result in a requirement to immediately repay the ineligible amount

Loan Forgiveness

Technically you can spend the PPP money on any eligible expense and in any amount. However, doing so does not result in loan forgiveness. It results in a loan of two to five years at 1% interest. Forgiveness requires you to spend the money on eligible expenses using a specific 60/40 ratio: 60% on payroll/40% on eligible non-payroll expenses.

Suppose, for example, you had a $200,000 PPP loan. If you had $120,000 (60% of $200,000) or more in payroll expenses and up to $80,000 (40% of $200,000) in eligible non-payroll expenses, your entire loan could be forgiven.

If you want all or part of your PPP loan forgiven, you must apply for it after you have spent the funds. Further, those expenses must be incurred and paid during the covered period (8 or 24 weeks).

Your payroll expenses control the amount forgiven. If your payroll expenses in this scenario were only $90,000, the total amount forgivable would only be $150,000 ($90,000 equals 60% of $150,000). Your non-payroll expenses, which can't be more than 40% of the amount forgiven, would be limited to $60,000. In this case, $150,000 would take the form of a grant and you would have a loan of $50,000 to pay off.

Forgiveness rules also require that you rehire or retain staff, maintaining at least 75% of total salary costs.

Economic Injury Disaster Loan (EIDL)

Since the EIDL Loan and companion EIDL Advance are both considered working capital loans, the use of their funds is more flexible.

Acceptable Uses of EIDL Funds

- Fixed debt

- Payroll

- Accounts payable

- Other bills that could not be paid due to COVID-19

- Supplies

- Personal protective equipment (PPE)

- Lab expenses

- Marketing

- Loan principal payments

Unacceptable Uses of EIDL Funds

- Replacing lost sales

- Provide profit

- Expansion of facilities

- Facility repair

- Acquisition of fixed assets

- Dividends/Bonuses

- Repayment of stockholder loans (except disaster-related)

- Non-performance related distributions

- Refinancing of existing debt

- Penalties for noncompliance

- Any expense covered by your PPP loan

The EIDL loan is not forgivable but a companion EIDL Loan Advance is. You apply for the advance as part of your EIDL application but unlike with the PPP, you do not have to apply for forgiveness of the advance. If you receive an advance and are subsequently offered a loan, you may take the advance and reject the loan if you wish. The advance (up to $10,000, at $1,000 per employee) is yours to keep and does not have to be paid back. You can spend the advance on anything you can spend the loan on.

If you don't have employees and are a sole proprietor, freelancer or independent contractor, you still can apply and get a $1,000 grant for yourself.

Main Street Lending Program (MSLP)

Though the least restrictive of all, the MSLP loan still has a few conditions when it comes to spending the money. Borrowers must commit to making reasonable efforts to retain workers and maintain payroll. There are additional restrictions related to compensation, stock repurchases, and dividends that also apply to direct loan programs under the CARES Act. By and large, however, the MSLP acts more like a regular business loan than either the EIDL or PPP.

Acceptable Uses of MSLP Funds

- Maintain ongoing operations

- Expand operations

- Retain or add employees

- Refinance existing debt owed to a different lender (Main Street Priority Loan Facility only)

Unacceptable Uses of MSLP Funds

- Refinancing existing debt (except for MSPLF)

- Payments to a foreign owner or subsidiary of the U.S. borrower

- Cancellation of lines of credit

- Compensation, stock repurchase, or capital distribution prohibited under the CARES Act

© Copyright IBTimes 2024. All rights reserved.