IP In The Metaverse: Greater Potential For Automation And Tracking

It is anyone’s guess if the Metaverse is going to truly take off as defined by virtual reality immersion shown in the Read Player One movie. After all, this depends on how many people are willing to wear headsets for long periods of time without getting motion sickness.

For that reason alone, we may end up with the Metaverse as a collection of more mundane platforms, but that carry over user’s digital assets and ID. What is more certain, however, is the degree to which metaverse content is treated.

With ID comes IP responsibility

Hundreds of millions of people have already tied their identities to crypto assets. Cryptocurrency exchanges that avoid KYC (know-your-customer) and AML (anti-money-laundering) protocols are now an exceptional rarity. Moreover, even exchanges themselves are venturing out into metaverse territory.

Both Coinbase and FTX have announced their own NFT marketplace/gaming divisions. Likewise, Binance Smart Chain hosts a number of metaverse DApps, such as SecondLive. The stage is then set for the following pipeline:

Verifiable identity → digital assets → metaverse content

This means that the upcoming online worlds will be more governable than simply posting content on the Internet. In turn, this comes with legal responsibility derived from Intellectual Property (IP) laws. The question is, what kind of IP governance in the metaverse realm can we expect?

Metaverse activities subjected to legal scrutiny

Meta’s (former Facebook) Horizon Worlds metaverse platform already gave us a good idea of what we can expect to see and experience. Metaverse activities involve business meetings, social events, monetized gaming, commerce, remote tourism, shopping, education, real estate browsing, socializing, and advertising.

It’s time. 10,000 worlds have already been created. Drop in and play, build or just hang out. The possibilities are endless. pic.twitter.com/VWc83PkuDV

— Horizon Worlds (@HorizonWorlds) February 16, 2022

In other words, a digital mirror of the physical world, which includes virtual merchandise as well. Typically, this entails branded clothing to adorn virtual avatars. Case in point, major brands like Nike, Adidas, and Bape have launched their branded merch as tokenized assets — NFTs — to be used on metaverse avatars.

Of course, when it comes to digital assets, everyone knows they are infinitely reproducible. This even applies to NFTs, but without the provenance part. So, what happens if one were to replicate such virtual content.

Trademarking Metaverse

Trademarking revolves around a simple legal concept. If a prospective consumer is confused about the origin of goods, i.e., conflating a false originator with the real one, then this falls under unauthorized third-party use.

The original content creator could then file a complaint and have the misleading content removed. Likewise, companies can use trademark law to protect their brands from losing value. In legal terms, this is called goodwill dilution. Case in point, before he became U.S. president, Trump built his wealth on his Trump brand across hotels and various associated products.

During and after his presidency, the Trump brand became toxic. If someone else had made it happen by misusing his brand, Trump would have had a solid case against them under trademark law.

For the time being, in lieu of specific legislation updated for virtual goods, companies use Nice Classification (NCL), established in 1957, under the classes of goods section. They include descriptions such as virtual goods, downloadable content, digital collectibles, artwork, and digital assets. As more companies copy those terms, we are likely to see them standardized in the future.

What does trademark transgression look like

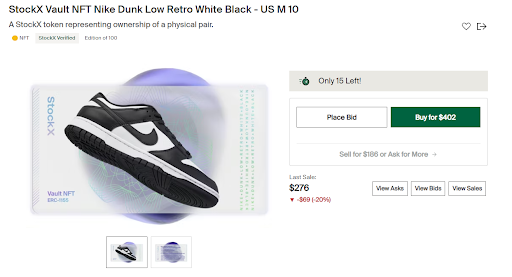

This February, Nike, the iconic brand for footwear and sports clothing, decided to sue StockX. The latter is a commerce mediator, reselling streetwear in addition to tying up physical goods with NFTs.

The problem arose when StockX started to sell Nike NFTs using its own Vault tokens as store monetization. Therefore, when a shopper visits the StockX page, they see their tokens associated with Nike products, for which StockX guarantees authenticity.

Predictably, Nike saw this as a breach of value dilution and false origination under trademark law. Specifically, because counterfeit products could sneak into the StockX marketplace.

The issue is yet unresolved, but it seems that Nike is trying to push the envelope of what is applicable. After all, StockX, valued at $3.8 billion, has a refund policy in rare instances if a product gets by their authentication process. Therefore, Nike would have a hard time proving its intent to mislead customers.

Patenting Metaverse merch

Closely related to trademark law, patenting relates to tools used in the creation of virtual assets. These encompass both software and hardware tech. However, given the abundance of open-source tools, patenting will largely revolve around hardware.

Specifically, VR headsets and accessories — touch registry, eye tracking, motion tracking, and other interactive elements. We may even see NFTs as design patents, so as to protect from digital counterfeiting. After all, the primary strength of blockchain technology is the proof-of-existence, one that is time-stamped and transparent for verification.

If such a system becomes standardized, it will be much easier to track protected virtual properties.

Copyrighting Metaverse

Copyrighting relates to original works of ownership, regardless of whether the media is digital or physical. Anyone who has been on TikTok or YouTube knows how easy it is to strike an account with a copyright claim.

In more recent years, the entire process has been automated by algorithms. From this, we can conclude that metaverse platforms will integrate with these established databases and automated systems. The only problem may arise from tracking copyright infringements across platforms.

For example, if a user runs the same copyrighted work across multiple platforms, it will be difficult to ascertain damages or royalty proceeds. This is yet uncharted territory, so we are likely to see a legal precedent set to which new platform guidelines and tech are established.

New legal waters to tread

The Nike-StockX lawsuit is just one of many to come. Over time, they will clarify the rules of metaverse engagement and determine the boundaries. Moreover, as the potential one trillion metaverse ecosystem grows, new legislation is almost certainly to come.

And even without one, agencies will be appointed to enforce ownership rights, so they mirror as close as possible existing standards.

This would be in line with the SEC’s fine of BlockFi at $100 million for trafficking in unregistered securities. Although securities definition is rather loose in the crypto world, in the absence of explicit legislation, the SEC took it upon itself to make a de-facto rule.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2024. All rights reserved.