The Gold Price fell to new multi-month lows against all major currencies on Tuesday morning, dropping to $1325 per ounce as capitulation and panic hit Asian investment traders, according to one Hong Kong dealer.

Gold fell to its lowest in ten weeks on Tuesday, putting the price on course for its worst monthly performance in 13 months as safe-haven demand evaporated and investors booked further profits on the 2010 rally.

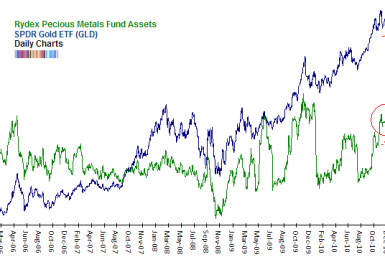

Lately, we've noted the improving sentiment picture for Gold. As a market weakens, sentiment will naturally become less bullish. In this case, sentiment has weakened considerably yet Gold is only 6% off its high. Most interesting in particular is the divergence between the COT data for Gold and Silver and the rest of the commodities.

Canadian gold miner Greystar Resources said on Monday its gold and silver Angostura project in Colombia poses no threat to the ecosystem amid growing opposition from local authorities.

Wesdome Gold Mines Ltd said fourth-quarter gold production rose 2 percent to 21,500 ounces and forecast higher output in 2011. The company sees overall production of more than 70,000 ounces in 2011, helped by initial production at its Mishi mine in Ontario.

Gold continues to form a long consolidation pattern which has lasted basically for the final quarter of 2010, says Phil Smith in his chart analysis for Reuters' clients. [On] the possible topping [head-and-shoulders] pattern I've been looking at...we have now broken the neckline. Watch for a decisive break below this line. The target for this topping pattern is $1230.

Gold rose on Monday as lower prices after the metal's third consecutive weekly loss attracted some buyers back to the market, but a more optimistic view of global growth still limited fresh investment.

By lunchtime in London – and compared with New Year 2011's record highs – the Gold Price in Dollars stood 6% lower, in Euros 7.5% down, and in British Pounds nearly 9% lower.

Gold rose for a third straight day on Wednesday on a weaker dollar and strong Asian physical demand, while platinum and palladium hit multi-year highs on an improving global economic outlook.

After a lengthy absence, [other] asset managers and central bankers are readmitting gold back into the group of prudent asset classes, writes Thomas Kaplan, chairman of New York's Tigris Financial advisory and asset-management group, in today's Financial Times.

In covering the gold sector, I have noticed something lately. The large-caps really suck! Ok, that is harsh but it is the truth. The chart below shows the large-cap indices. What do you see? The Dow Jones Precious Metals Index hasn't gone anywhere for five years, while Gold has more than doubled.

Mid-tier producer Iamgold Corp (IMG.TO) posted a 21 percent sequential rise in gold production in the fourth quarter and reaffirmed its 2011 production outlook. The Toronto-based company said on Monday it expects to produce 1.1-1.2 million ounces in 2011, at cash costs of $565-$595 an ounce.

African Barrick Gold (ABGL.L) said fourth-quarter output rose from the preceding quarter as its new Buzwagi mine overcame production difficulties by mid-November, but missed its overall output target for the year.

Gold priced in US dollars rose for a second day on Tuesday. Reflecting the improved consumer appetite for gold in Asia, premiums for gold bars rose on Monday to hit another two-year high as jewelers from China rushed to buy ahead of the Lunar New Year, while purchases from the electronics sector helped stir up physical trading in Japan, dealers said.

Investors remain preoccupied by the threat of further monetary tightening in China, writes Marc Ground at Standard Bank in London today. This is weighing on precious metal prices, encouraged further by a stronger Dollar off the back of lingering Eurozone debt concerns.

An upward sloping consolidation in Gold that began in October has, despite a lack of any real losses, been enough to improve various sentiment indicators.

Jim Rogers, the famous commodity bull, currently favors rice over gold as an investment.

Gold fell in Europe on Friday after China's central bank raised lenders' reserve requirements by 50 basis points, with softer haven demand for the metal after solid bond sales by Portugal and Spain also weighing on prices.

2011 is shaping up as a race to the bottom for currency values, writes Harvard professor Kenneth Rogoff in today's Financial Times. No wonder gold has been so attractive.

Talking to people in the Chinese market over the weekend, writes Jeff Toshima, Tokyo director of the World Gold Council, in today's Nikkei Money, I was amazed to discover the number of gold saving accounts at Industrial and Commercial Bank of China has grown above 1,000,000 within a year of ICBC launching the service.

Gold holdings rose because of purchase by the central bank of Estonia to cover its contribution to the ECB's foreign reserve assets, the ECB said.

Traders are talking about buying dips again, concurs a Hong Kong dealer, noting that Asia physical market remains very tight for Gold Bars. Reuters says the Hong Kong premium for wholesale Gold Bars over benchmark London prices today held at $3 per ounce, a near 30-month high.

The Gold Price in Euros whipped within 1.5% of last month's all-time record highs in London trade on Monday, as weaker-economy Eurozone bonds fell sharply on a raft of bail-out rumors and leaks.

The Gold Price in Dollars slid to a near 6-week low in early London trading on Friday, dropping below $1360 an ounce, but then bounced back to $1369 as New York trading began and Non-Farm Payrolls showed a rise of 103,000 - below analyst forecasts - and the labor-force participation rate slipped further below two-in-three.

In this piece, we will examine four of gold's most important rules; the irreversible trends affecting the gold price; and how the consequences of these trends will push gold higher in 2011 and beyond.

Silver and Gold Prices both unwound the last of late Dec.'s gains in early London trade on Wednesday, retreating to $29.20 and $1370 respectively per ounce on what several analysts called profit taking as world stock markets also fell.

Gold and Silver Prices both fell as London traders returned to work from the New Year shutdown on Tuesday, dropping over 3 percent from yesterday's highs as world stock markets caught up with Wall Street's strong gains.

The entire precious metals complex had a stellar run in 2010, led by palladium's 97 percent rise and Silver's 83 percent gain. Gold yielded investors a 29.7 percent profit in 2010, the tenth consecutive annual gain in a row.

It's going to be tougher to make money 2011. I expect the government to strike back. I don't think they're going to let commodity prices continue to soar. I'm very concerned about the repercussions of that on investors.

The Gold Price in Euros broke fresh all-time highs overnight in Asian trade, hitting more than €34,500 per kilo - some 38% higher in 2010.