The Month in Housing: Is February's Recovery Real?

The U.S. housing market improved last month, but warmer weather could have been as much of a factor as any genuine strengthening of market fundamentals, industry experts say.

Although various indicators beat expectations throughout the month, results could be distorted, Mark Vitner, senior economist of Wells Fargo Securities LLC, wrote in a Wednesday research note entitled, How Much of the Seasonally Adjusted Recovery Is Real?

Undoubtedly, positive trends emerged: Home sales and new home construction increased, while access to mortgages improved slightly and some foreclosure inventory has been cleared.

But the winter months are typically a slow time for home sales, so a slight increase could be exaggerated in comparison to the previous season.

The extent of the improvement is not as great as first meets the eye, said Vitner in a phone interview.

He wrote that the seasonally adjusted data for new home sales rose 3.2 percent since October. Most reports, including one by the National Association of Realtors, seasonally adjust winter sales to account for the rhythm of the sales market, which typically peaks in the summer before cooling in the fall and winter.

But data that was not seasonally adjusted was down only 0.1 percent. Normally, home sales would have declined much more on a seasonally unadjusted basis, Vitner wrote, most likely as a result of colder weather discouraging homebuyers.

The relatively warm weather also encouraged more sales and more construction starts, said Vitner. The National Association of Home Builders and Wells Fargo Housing Market Index rose 12 points over the last four months with the most gains in the West and Midwest, where it was generally mild.

But looking closer, the type of construction doesn't indicate a surging marketplace. Builders are clearly busier than they have been at any other time outside of the tax-credit fueled buying binge immediately following the recession. The gains, however, are spotty, wrote Vitner.

Much of new construction was confined to partially complete developments and cheap parcels that can compete with foreclosed properties. Rental housing is also a popular choice for larger developers.

Meanwhile, a settlement between 49 states and five major lenders announced in February will likely lead to more foreclosures and declines in home prices, a negative but necessary move to clear the overhang of distressed properties. Relief for homeowners through expanded refinance opportunities and some direct payments will help individuals, but aren't expected to have a large impact on future recovery.

Tough mortgage approval standards, conservative home appraisals and declining home prices will continue to discourage both buyers and sellers from participating in the market, said Vitner.

Disparity between regions continues, but there have been signs of life in troubled areas. The Miami area has actually seen price gains in non-distressed properties, but the troubled housing stock continues to drag the overall market down. For-sale and rental development have picked up in Florida and Arizona.

Detroit was the only city in the S&P/Case Shiller Home Price Index to post a year-over-year price increase, although the gain should be taken with disclaimers. They're rebounding off an incredibly low base, said Vitner.

Wells Fargo slightly increased its real estate forecasts for 2012 on Wednesday. Sales of new single-family homes are projected to rise 12 percent and housing starts are expected to rise 9 percent, with single-family construction rising 8 percent and multifamily starts rising 12 percent.

The real test for the housing recovery will come this spring, wrote Vitner.

February by the numbers...

The National Association of Home Builders Confidence Index rose to 29 from 25, beating a forecast of 26, marking the fourth consecutive month of increases and the highest level in four years. However, it's still below the 50 threshold, which would indicate that the majority of builders view the market positively.

The S&P/Case-Shiller National Housing Index reported a decline of 3.8 percent in home prices in January data. Analysts polled by Reuters had expected a drop fo 5.5 percent, but prices were still down to the lowest level since the housing crisis began in 2006.

Housing starts rose to 699,000 in January from a revised 671,000 in the prior month, and beating a consensus forecast of 675,000.

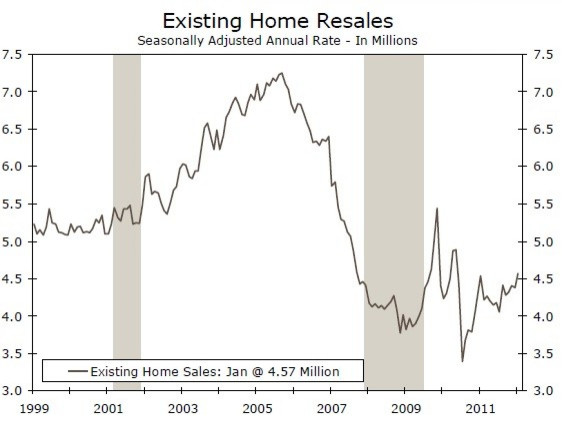

Existing home sales rose 4.3 percent to an annual rate of 4.57 million in January, up from a revised 4.38 million sales in December. They missed forecasts, which had expected 4.66 million home sales.

New home sales fell to 321,000 in January from a revised 324,000 in December, but beat forecasts of 315,000.

Pending home sales rose 2 percent in January, more than 1 percent forecast from analyts surveyed by Bloomberg.

The average 30-year fixed-rate mortgage rate dropped to a record low of 3.97 percent before rising slightly, ending the month at 3.90 percent according to Freddie Mac. Around 80 percent of mortgage activity was refinances throughout the month, according to the Mortgage Bankers Association.

© Copyright IBTimes 2024. All rights reserved.