California and New York, two key holdout states for a multi-state mortgage settlement, are expected to join the deal, smoothing the way for an announcement expected on Thursday, according to a person familiar with the matter.

A multi-state mortgage settlement in the works for more than a year will likely be pushed back again as dissident U.S. states continue to press specific concerns and ignore a Monday deadline to decide whether they will sign it.

Donald Trump officially endorsed Mitt Romney for president on Thursday, praising the Republican front-runner for his business sense and stance on foreign policy.

A proposed settlement to resolve mortgage abuses by top U.S. banks will give states broad authority to punish firms that mistreat borrowers in the future, according to documents seen by Reuters on Wednesday.

President Barack Obama called on Wednesday for an expanded homeowner refinance program that would lift restrictions for more borrowers, representing another government effort to aid the ailing housing market.

A proposed settlement to resolve mortgage abuses by top U.S. banks will give states broad authority to punish firms that mistreat borrowers in the future, according to documents seen by Reuters on Wednesday.

Mitt Romney cemented his front-runner status with his Florida 2012 primary win Tuesday night, coming ahead of Newt Gingrich with almost half of the vote.

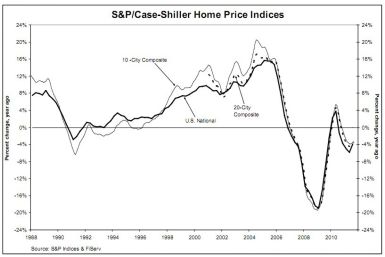

U.S. home prices are expected to continue to fall in S&P/Case-Shiller Housing Index data through November 2011, to be released on Tuesday, Jan. 31.

U.S. taxpayers are still owed $132.9 billion by companies that benefited from the financial bailout and haven't fully repaid. Some of that money will never be recovered, a government watchdog said. Christy Romero, the acting special inspector general for the $700 billion bailout, has said the bailout that began in September of 2008, could actually last for several more years.

New York Attorney General Eric Schneiderman has been a leading critic of a deal with the nation's largest mortgage servicers over improper foreclosure practices.

As state and federal officials near a deal with top banks to settle claims of foreclosure abuses, left-leaning activist groups have stepped up pressure on the officials to reach a deal that demands more from the banks.

The federal government will soon begin selling government-owned foreclosed properties in bulk to investors as rentals, in a new effort to dispose of its growing portfolio of distressed properties.

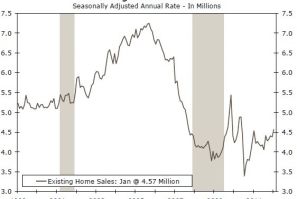

U.S. sales of existing homes were up 4 percent in November to an annual rate of 4.42 million units, according to the National Association of Realtors (NAR), suggesting that a housing recovery is beginning.

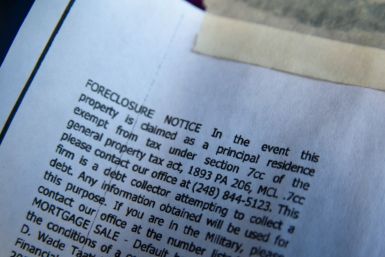

The number of new home foreclosures jumped by more than 21 percent in the third quarter as banks moved more aggressively after a pause that began late last year, according to a report released by a bank regulator on Wednesday.

The Arizona state economy is expected to grow but at a lower gear than that which the state was accustomed to during the housing-market-driven-growth days, as the economy is still recovering from the recession and the collapse of the housing market.

An economist at Wells Fargo Securities expects homebuilding to improve modestly in 2012, with most of the gains coming from apartment construction.

U.S. housing starts increased 9.3 percent in November to the highest level of 2011, according to the Census Bureau and Department of Housing and Urban Development (HUD).

After years of economic turmoil, U.S. homebuilders should see modest gains and a stable outlook in 2012, according to a report from Fitch Ratings.

Overall U.S. foreclosure activity fell in November compared to the previous month, but auctions hit a nine-month high, according to RealtyTrac.

The Federal Housing Finance Agency (FHFA), regulator of Fannie Mae and Freddie Mac, on Monday sued the city of Chicago over its new vacant buildings ordinance.

Anti-Wall Street protesters, seeking a new focus as cities across the country shut down two-month old Occupy encampments, launched a new wave of activism on Tuesday by rallying around homeowners as they try to resist evictions from foreclosed homes.

Occupy Homes, an offshoot of Occupy Wall Street, will protest in foreclosed and vacant properties in around 25 U.S. cities on Tuesday's Day of Action, promoting what organizers call the basic human right of housing.