Gold and Silver Technicals: Wait and buy gold at $1,300, bears say showing charts

Precious metals dropped to fresh multi-week lows on Tuesday helped by a view that rising overall investor confidence will cut safe-haven demand for the commodities while chartists turned history pages and 'decided to wait' for an additional discount of $30 for an ounce of gold, which is already $100 down from its peak seen less than two months ago.

PRECIOUS - Gold hits 3-mo low, silver 14 pct down in Jan; charts suggest more losses

Precious metals fell on Tuesday as a slew of data suggested better global economic environment, reducing investors' need to lock in their money in safer but less profitable avenues like metals while technical analysts see further room southward for the commodities.

Gold and silver technicals: Good entry points at 150, 100 SMAs?

The yellow and white precious metals have pared most of Monday's Asian gains in North American trading but the metals see strong supports at current levels as the sharp correction in recent days have already brought them to technically justified points of entry.

EUR/USD Technical Analysis - Off 18-day low, targets 1.3285 (R1) before 1.3447-97 (R2)

EUR/USD gained ground on Tuesday and moved off an 18-day low it hit on Monday. The pair now has immediate resistance around 1.3285, a Fibonacci retracement level which comes just above 50-day and 100-day SMAs on 4-hour chart. RSI also suggests bullishness for the pair.

AUD/JPY technical analysis-Heading to new multi-month high?

AUD/JPY added to Monday's gains on Tuesday and is currently trying to retest the 7-month high of 83.66 hit early last week. A break above that level may take the pair to 85.3 before marching towards 88.035, the 1-1/2-year high it hit late April.

GBP/USD up but holds near 3-mo low; aims 1.54 (S1) and 1.53 (S2) before 1.51(S3)

GBP/USD held just above Friday's 3-month low early Monday in Europe amid fresh tensions in the Korean peninsula that fed the greenback with safe-haven demand while the sterling awaited a less important mortgage approvals data by the Bank of England, due later in the session.

EUR/USD at 18-day low on Korea, Ireland; targets 1.2887 (S1) before 1.2587 (S2)

With war tensions in Korea strengthening the dollar and rating tensions in Ireland weakening the euro, EUR/USD continued southwards and touched an 18-day low on Monday.

GBP/USD may fall to 1.53 zone and stabilise before a rebound

Given the long-term importance of 1.53 area, chances of GBP/USD consolidating there until getting an opportunity to bounce back to 1.63 zone are high.

Euro rises on positive leaders; EUR/USD may fall to 1.326 before rebound to 1.3497

The Euro rose across the board on Friday helped by its leaders' positive response to creating a facility to safeguard its nations from debt issues like Ireland's, but a rating downgrade by Moody's on the troubled country dampened the sentiment, limiting gains by the single currency.

NZD/USD breaks below 100-day SMA to 11-wk low; targets 0.7212 (S2)

NZD/USD broke below the 100-day SMA and plunged to a 11-week low late Thursday in New York on concerns about the kiwi currency's weakening fundamentals while a lack of confidence in euro added to the relative strength of the greenback.

AUD/USD may fall within short-term upchannel to 0.9860

Australian dollar has been trending higher against the US dollar since early Wednesday in New York and the pair seems to be up for a fall within the trending channel, study on AUD/USD 10-minute chart shows.

EUR/USD forming short-term uptrend? Then see resistance at 1.3572

EUR/USD probably freed itself from a falling channel and entered a slightly progressing uptrend, inside which the pair is now poised for a rebound.

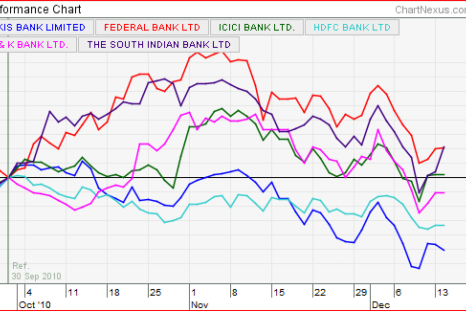

Indian banks tapping overseas depositors perform better despite high domestic rates

It is inevitable for Indian banks to compromise on margin as the country is going through a rising interest rate scenario, which has pushed most banks' stocks below their end-September levels, but at least three main private banks are still selling at a higher price, probably helped by valuation advantage and mostly steady pricing of deposits by Indians residing abroad.

PRECIOUS ASIA - Dollar strength due to Fed decision weighs on metals; gold, platinum steady

Precious metals were down in Asian trade on Wednesday, as dollar's gains following Tuesday's FOMC decision to keep the US quantitative easing program uninterrupted weighed on the investment appeal of the commodities.

Australian dollar off parity vs greenback on profit booking

The Australian dollar that rose above parity on Tuesday helped by renewed risk appetite after the US Fed's decision to keep its accommodative policy intact for an extended period of time, but was down across the board in Asian trade on Wednesday as investors booked profit.

PRECIOUS TECHNICAL - Gold, silver off 1-week highs after US data; strong SMA supports seen

Gold and silver fell off day's highs after stronger-than-expected US data released Tuesday morning in New York strengthened the greenback, losses in which had helped the metals rose to 1-week highs earlier in the day, but both metals held on to the SMA support strongly.

GBP/USD hits fresh 3-wk high on higher CPI; targets 1.5952 (R1) before 1.5996/1.6104 (R2)

The British pound strengthened on Tuesday on a higher-than-expected inflation reading for November, with the sentiment also supported by a view that the US Federal Reserve may expand its bond buyback program at its monetary policy later in the day, supplying more dollars into the system.

EUR/USD off falling channel to 3-wk high ahead of Fed; aims 1.363 (R1), 1.3697 (R2)

The EUR/USD distanced itself from a falling channel ahead of the Fed policy and rose to a three-week high on Tuesday. The single currency, however, pared some of its gains after data at 10:00 am GMT showed the region's industrial output rose at a lower-than-expected pace in October.

USD/CHF breaks channel support to 1-mo low; aiming 0.9724 (S1) before 0.9463 (S2) record low

USD/CHF fell below a channel support as concerns of the US Fed expanding its $600 billion bond buyback at a policy announcement later Tuesday. The pair extended its losses to hit its lowest in more than a month early in the day in Europe before recovering partly.

GBP/USD off 2-week high to below 100-day SMA, targeting 1.5649 (S1), 1.5483 (S2) before 1.5295

GBP/USD that rose above the key 1.5838 level to a 2-week high of 1.5860 on Friday slipped on Monday despite a stronger-than-expected data and is now targeting 1.5649 as immediate support (S1).

Despite intra-day losses, USD/CHF holds uptrend after Swiss data

USD/CHF is currently testing the 50-day SMA at 0.9784 and targeting the 1.0064-81 region (R1) immediately on the upside. If the uptrend continues, 1.0331-1.0434 region (R2) will form next key resistance level for the pair.

EUR/USD in clear descending channel on 1-hr chart, aims 1.3059 (S1), 1.2968 (S2)

There are many things weakening the single currency. Concerns over a lack of consensus on euro-area bonds, dollar-positive data from the US, fears about China being forced to cool down its economy and now, an ascending channel clearly shaping up on the 60-minute EUR/USD chart.

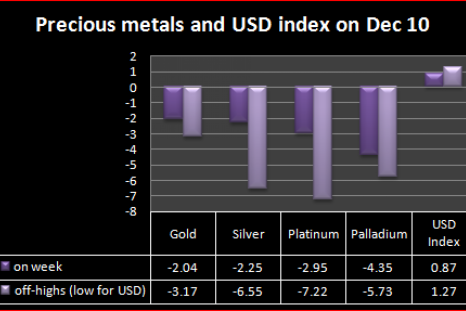

PRECIOUS ROUNDUP - Off highs on Chinese policy action; gold falls least

Precious metals fell across the board in the week to December 10 as a cooling China weighed on demand hopes but the yellow metal remained better alternative in the group amid lingering worries over the euro-zone debt and dollar's ability to play safe-haven.

USD/CAD in descending channel ahead of key US data, S1 seen at 1.0060/40

USD/CAD showed little reaction to the first set of data from the US and Canada on Friday and the pair stayed within a descending channel ahead of a more important consumer sentiment data from the US.

GBP/USD at 2-week high on data; aims 1.5952-1.5996 (R1) before 1.6104 (R2)

Higher-than-expected producer price index released Friday morning in London helped GBP/USD break above the key 1.5838 resistance to a 2-week high and is now targeting the 1.5952-1.5996 region.

EUR/USD widens channel on upside; still trending lower on debt woes

On a 2-hour chart, EUR/USD has next support at 1.3141 (S1), as indicated by the 61.8 percent Fibonacci retracement from 1.3422 to 1.2970. A break below the same could take it to 1.3059 (S2) before retesting the November 30 low of 1.2968.

AUD/USD completing 'right shoulder' seems tough; Chinese, US cues to impact

Despite a very strong jobs data early Thursday, the Austalian dollar looks less energized for a rally above Tuesday's high of 0.9964 to 1.0001, to complete the 'right shoulder' of a 'head and shoulders' pattern with 'head' at 1.0181 formed on November 5.

EUR/USD struck within falling channel, to hold above 1.3157-1.2970 region

At 12:53 GMT, the pair was at 1.3212, off an intra-day low of 1.3179 and from its previous close of 1.3259. With no key data due from the US through the rest of the day, the pair is likely to hold above the 1.3157-1.2970 support region.

Technicals see USD/BRL up at 1.6926 on dollar's strength; cbank, data awaited

Brazilian central bank's commitment to keep currency volatility on check also suggests the market's likelihood to be bullish for the pair at the slightest of real-negative.

USD/CHF in uptrend; aims 1.0331 (R2) above 1.0064 (R1)

The pair seems to have a weak resistance around last week's high of 1.0064 (also 23.6 percent Fibonacci retracement from 1.1729 to 0.9463) and fresh dollar supportive could take it to 1.0331, the 38.2 percent Fibonacci.