Silver, palladium, smarter metals on TOCOM, heading for weekly gains

Silver and palladium futures posted sharper gains on Tokyo Commodity Exchange (TOCOM) on Friday after stronger than expected data from the world's largest economy on Thursday weakened the US dollar and increased investment appeal for risky assets.

Rubber rallies 3.7 pct on supply concerns

Rubber futures rallied on Tokyo Commodity Exchange (TOCOM) on Friday, on expectations China may top off its stocks and on continued supply concerns.

Silver up 4 pct, gold rises 1.7 pct on day; analysts say short-covering helps white metal

Silver rallied sharper than gold on Thursday and some analysts see the trend to continue as many big global players are yet to cover their huge short positions in the white metal. A broadly weak US dollar, growing expectations that Ireland will soon be bailed out by the EMU and an absence of fresh cues from China about it raising the policy rates also helped an across-the-board rise of commodities on the day.

Rubber up 4.5 pct since Tuesday on low Thai output, weak US dollar

Rubber recovered most of the losses it suffered on China rate hike fears, partly helped by a broadly weak US dollar and speculative buying interest on the commodity. The benchmark April futures on Tokyo Commodity Exchange settled Thursday at 369.2 yen per kilogram, 7.1 yen up on the day and nearly 4.5 percent higher from Wednesday's close.

China's yuan not 'free enough' to be part of SDR - IMF

A day after cutting the weighting of US dollar and yen in the SDR, the International Monetary Fund (IMF) said it did not include China's yuan in the basket as the currency does not meet the freely usable criteria.

US dollar slides on weaker-than-expected CPI

The US dollar dropped against its major counterparts on Wednesday after data showed October consumer price inflation was slower than expected with housing starts data for the same month also coming in at a weaker-than-expected level.

Commodities drop across the board on fresh hawkish signals from China, EU woes

Commodities slid across the board on Wednesday on fresh signals from China that it will soon raise rates with lingering Euro area debt woes also helping keep investors away from risky assets. Gold and silver traded near their 2-week lows while copper and platinum fell to their lowest since late September. Also, December and January crude fell to its lowest since Oct. 29.

IMF cuts value of dollar, yen in SDR basket; euro, pound value hiked

The US dollar and Japanese yen lost a part of their weighting while that of euro and British pound increased in the basket of currencies that make up the International Monetary Fund's (IMF) Special Drawing Right (SDR), the Fund said on Tuesday. The changes will be effective on January 1 next year.

Forex-GBP/USD-First support seen around 1.6; key US data awaited

* GBP/USD immediate target downside around 1.60, next 1.58

* Sterling hit by weak housing data while dollar awaits better sales figures

* US Fed's Lacker, Treasury's Brainard to speak on Monday

Dollar rises on expectations, but weak numbers may trigger QE3 move

US dollar strengthened across the board on Monday on expectations of good data signaling recovery, but investors are also cautious that any negative surprise could trigger market worries about more bond buyback by the Fed, sparking off the quantitative easing (QE3) talks.

Australia, New Zealand dollars at fresh lows on EU debt concerns; China, EU officials watched

Concerns over Europe's debt risks felled Australian and New Zealand dollars - Asia Pacific's major risky currencies - on Monday, while growing fears that China may raise rates further dampened the sentiment. Market is keen on any fresh developments from Europe, with many important EU officials, including Alex Weber of ECB, scheduled to speak on the first day of the Euro Finance Week held November 15-19 in Frankfurt, Germany.

Will China raise rates? Will US data guide QE talks? – Next week’s forex questions

The dust of G-20 has settled. World leaders sat around a large table set this time in South Korea, searched for that magic wand in their suit pockets, and then looked at each other's face with disappointment. They didn't get one to 'calm down' the emerging fears of a 'world war' on trade and currencies. They did not 'direct' China and/or US as some hoped.

Euro off day's lows, but heading for weekly losses versus majors as EU woes persist

Euro rose across the board and pulled off 1-1/2-month lows against the US dollar and British pound on Friday on news EU leaders reassured the holders of outstanding bonds that they would not be forced to take losses. The day's gains, however, did not prevent the single currency from heading for weekly losses versus the majors as investors are still worried that Ireland may default on its bonds.

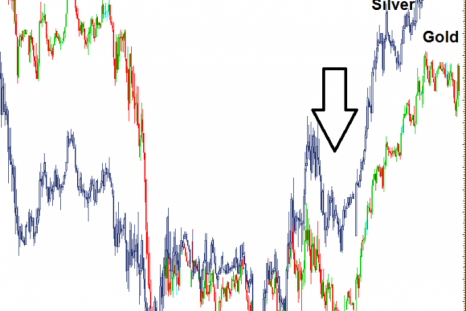

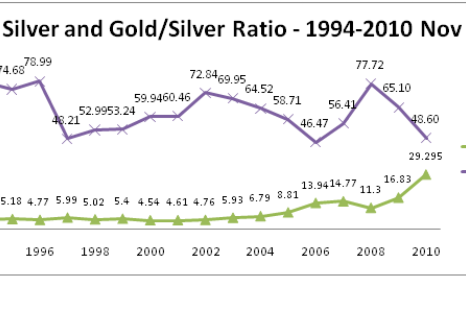

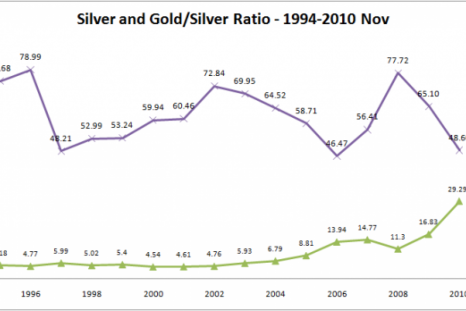

Silver outshining gold is old story, technicals project

A study on charts shows that silver may not continue to enjoy the status of being better investment alternative over gold in the short-to-medium-term period. And not only that, any correction in both the metals will happen with the white metal falling much steeper than its yellow counterpart.

Gold, copper, platinum at 1-week low, oil off 2-yr high on worries China may raise rates

Commodities dropped on Friday as higher-than-expected Chinese inflation triggered rate hike worries in the world's second largest economy pushing gold, copper and platinum to 1-week lows and cutting December crude by more than $2 on the day.

Copper rallies to fresh highs on buoyant China, drop in supplies

Copper hit record highs in London and jumped to a 30-month high in New York on Thursday as strong Chinese data suggested higher demand for the metal by the world's biggest consumer.

Oil prices touch 25-month high on US data

Oil rallied to its highest in more than two years on Thursday on reports that major oil consumers may use more of it next year. Oil rose despite a strong dollar on the day, which analysts largely attributed to the latest demand-supply equations of the commodity.

Euro falls versus majors on Spanish data, hits new 6-wk low vs GBP

The euro dropped across the board on Thursday as weak data from the region showed the crisis-hit EU member countries will continue to pressurize the single currency.

Is it time to be cautious on silver? Technicals say yes

A study on charts shows that silver may not continue to enjoy the status of better investment alternative over gold in the short to medium term period.

Fed’s QE2 is a gamble, can lead to asset bubble: Top Indian official

The US Federal Reserve' s quantitative easing can lead to asset bubbles as the money goes in search of equity, property and other such assets in a low-interest rate scenario, said Kaushik Basu, chief economic advisor to India's finance minister.