AUD/USD slips to 5-day low amid live Korea concerns; targets 0.9723 (S1), 0.9707 (S2)

After falling as low as 0.9779 from its previous close of 0.9827, AUD/USD is now targetting 0.9723 (S1) before hitting a relatively stronger support line at 0.9707 (S2).

AUD/USD breaks above key 0.9952, targets 1.0006 amid hawkish market talks

Fundamentals for the commodity currency now back AUD/USD targeting 1.0006, as the 61.8 percent fibonacci from 1.0181 to 0.9723 projects.

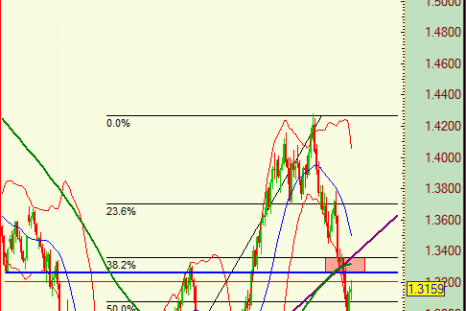

Euro bond uncertainties keep EUR/USD within downward channel

The struggle of EUR/USD to free from the downward channel formed early November intensified after Friday's weak US jobs data, but the pair is finding it really difficult to break above the key long-term support-turned resistance of 1.3422.

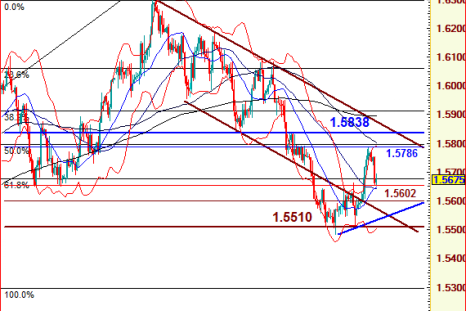

GBP/USD forming a short-term uptrend? This week's data, BoE to decide

If the pair consolidates above 1.56 levels, it might help confirm an intermediate short-term upward trend, and in that case, next important target for GBP/USD will be 1.5838 (R2), a medium term support-turned resistance for the pair.

EUR/USD falls within channel; aims 1.3113 (S2) after 1.3199 (S1) amid debt woes

Despite a dovish Bernanke, EUR/USD's attempt to break above the upper limit of a downward channel from early November highs on the back of a weak non-farm payrolls data proved unsuccessful as debt-related worries of euro-zone continued to weigh on the single currency.

USD/JPY off day's lows; poised for rebound to 83.4 (R1) before 83.7 (R2)

Momentum indicators MACD and RSI on 4-hour chart suggest the pair is in oversold zone and up for a rebound. The first stop up (R1) for USD/JPY could be 83.40 as indicated by 100-day SMA and 23.6 percent Fibonacci and further higher, the pair has resistance near 83.7 (R2), as shown by the 50-day SMA.

PRECIOUS ROUNDUP - Gold at highest weekly close; silver at new 30-year high as dollar falls on weak NFP

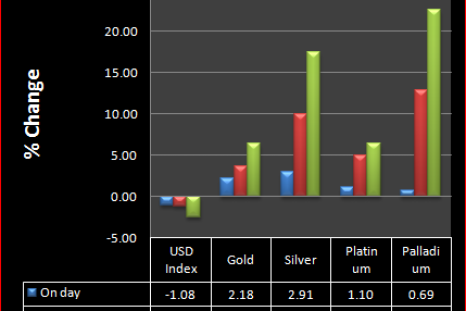

A weaker-than-expected US jobs data on Friday forced investors to sell dollars and seek shelter in precious metals, helping silver and palladium post two-digit weekly rise and reach fresh multi-year highs in the week to December 3. An IB times study on gold and dollar index suggests investor interest to sell dollar for buying gold probably increased in the week.

EUR/USD breaks above 100-day SMA , aims key 1.3446 post-weak US jobs data

Weaker-than-expected US jobs data helped the EUR/USD break above its 100-day SMA and pair is now heading toward key long-term resiatnce of 1.3446 (R1 on daily chart).

USD/CAD sees 0.9976 (S1) post-data; may rebound to 1.0112 (R2) on big surprise

USD/CAD is technically poised for a bounce back from current levels just above parity, but given the uncertainty about key data due later in the day, one should also be prepared for a move on the other side, which could easily take the pair to 0.9976 (S1) support.

EUR/USD has 1.3283 nearest target ahead of key data; to end bearishness above 1.3697

Market is widely prepared for better readigs for both the EU indicators due Friday, and as of now, 1.3283 works out to be the nearest target upside on the 4-hour chart.

EUR/USD may jump to 1.3266-1.3357 region for a strongly positive ECB

If the ECB lives up to market expectations, the pair could rise further but a strong resistance area is up there, between 1.3266 (key long-term resistance) and 1.3357 (38.2 fibonacci retracement from June 7 lows), between which the 100-day SMA (1.3323) is also falling.

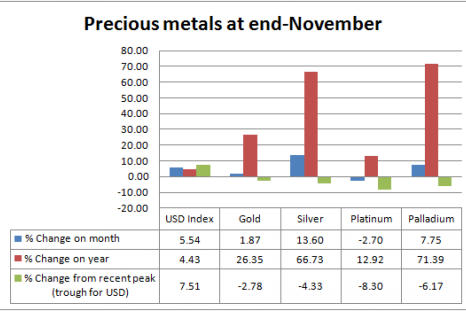

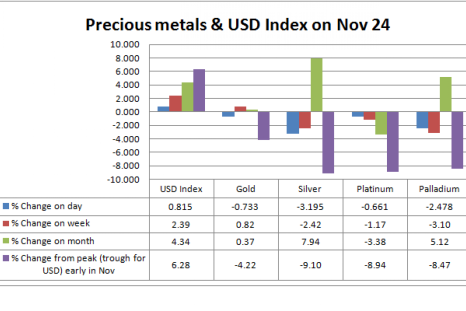

PRECIOUS MONTHLY- Silver, metal of the month; palladium most shining year-to-date

The precious metals were mixed in November, with silver outshining the rest with a 13.6 percent jump, followed by palladium which rose 7.75 percent. Gold managed to end the month with marginal gains of 1.87 percent while platinum fell 2.7 percent from its end-October level.

NZD/USD breaks below key support to near 2-mo low; eye risk appetite return for reversal

NZD/USD has broken below its key support level on Tuesday as dollar's across-the-board strength weighed on the kiwi currency, and at a near 2 month low, the pair is now testing its 100-day SMA on the daily chart. Momentum indicators clearly suggest the pair is in the oversold zone but a strong technical reversal also need the support of good news from the Euro-zone, traders said.

GBP/USD at 2-mo low; strong US data may push it to 1.535 (200-day SMA)

GBP/USD has fallen to a 2-month low on Tuesday helped by safe-haven interest in the US dollar and investors are now seeking nearest supports for the pair as they await positive-looking economic data from the US, due later in the day.

USD/CAD in ascending mode ahead of data; 1.030 seen key resistance

USD/CAD is currently holding near its 200-day moving average but the formation of an ascending triangle from start of this month has made the situation ripe for a jump on Tuesday, especially ahead of key data from the US and Canada.

EUR/USD in oversold zone, may rebound to 1.320-327 (R1), 1.336(R2)

Below the 30-mark, RSI on both day and 4-hour charts suggest the pair is in the oversold territory and any fundamental signal showing weakness for the greenback could push the pair up to 1.320-1.327 (R1) before marching ahead to 1.336 (R2), its 38.2 percent Fibonacci. Further up, 1.344 (R3) is seen as a strong resistance for the pair.

PRECIOUS ROUNDUP- Silver set to be best performer in November

The week to November 24 was marked by tensions in Korean peninsula that prompted investors to flee from risky assets to safer avenues like US dollar and gold, helping the yellow metal outshine its colleagues in the precious group. However, silver and palladium remained strong in the month, mainly helped by demand for cheaper alternatives in jewelry and industrial applications.

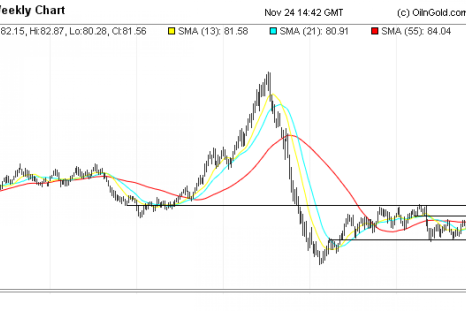

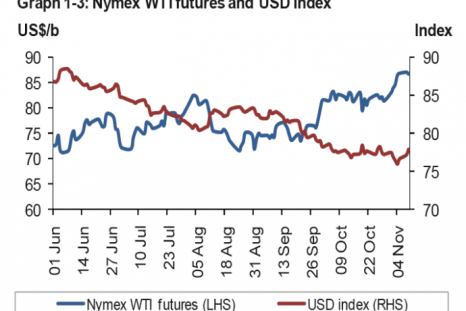

CRUDE OIL- Strategy more fundamental than technical

Performance of the US dollar, Europe's periphery issues, inflation in developing world, consumption by developed ones, and of late, tensions in Korean peninsula- a lot of things are weighing on oil. The net result in recent weeks was positive for the greenback and therefore negative for oil. Still, the commodity is set to end this week with a positive note despite losing more than a dollar from its intra-week high by Friday. So, what is the trend? Where is oil heading?

Euro, precious metals fall on periphery worries; EUR/USD at 2-mo low

Precious metals and euro dropped on Friday as European periphery worries intensified, helping safe-haven interest into the US dollar. EUR/USD touched a fresh 2-month low.

OIL OUTLOOK: How long will it stay ranged? Will it rise above $100?

Dollar, Korea, Ireland, Asian demand, inventories and technicals - a lot of things are weighing on oil now. But market participants find the question if the commodity has reached its bottom technically and on robust demand in some regions, or will a dollar rally or geopolitical developments force it break below the current range, tough to answer.

Patagonia Gold gets environmental approval for El Tranquilo block in Argentina

Patagonia Gold Plc said on Wednesday that it has obtained approval of the the biannual environmental impact report (EIR) for El Tranquilo from authorities of Santa Cruz province of Argentina.

S Korea's won off 11-wk lows as tension eases; BoK pledges support

South Korea's won that dropped to an 11-week low against the greenback following Tuesday's North Korean attack sharply rebounded on Wednesday, registering a 3.3 percent rally from the day's opening level.

US Dollar broadly down in Asia after Tuesday’s Korea-driven rally; steady vs yen

The US dollar slipped in Asian trade on Wednesday, moving off multi-week highs against euro, pound, Aussie and New Zealand dollar, after rising sharply in the previous session which saw an unexpected Korean crisis providing the greenback with safe-haven interests.

Sino-Indian border talk Nov 29-30; BBC reports Indian response to China build-up

Special representatives of China and India are scheduled to discuss Sino-Indian border issue in Beijing later this month.

PRECIOUS – Gold near 1-wk high, silver near Tuesday’s 12-day peak; peace appeal helps commodities

Gold and silver that bounced off key short-term support levels on Tuesday, dropped again as a sudden North Korean attack on South Korean territory sparked dollar buying by cautious investors but an appeal for peace by China and South Korea has helped the commodities recoup some of the losses.

US dollar off highs as China, South Korea plead peace; had hit 6-week high vs yen on news of shelling

The US dollar jumped against its major counterparts in Asian trade on Tuesday, hitting a 1-1/2-month high against the yen, after North Korea shelled a South Korean island, leading worries that the lingering tensions between the countries could worsen. The North Korean move triggered a flight from risky assets into the greenback, which is widely considered a safer bet.

Ireland, China fail to push gold and silver through key supports, gold hits fresh 1-week high

Key technical supports make the way downward bumpy for gold and silver, probably aided by the long-term bullishness for the precious metals while many also expect the US dollar to weaken further.

PRECIOUS ROUNDUP - Silver, palladium post weekly gains; gold, platinum down

In an eventful week, that passed through uncertainty about Ireland's response to a bailout offer, an unexpectedly higher Chinese inflation number and its policy response and largely mixed US data, investors remained cautious about the changing 'risk-friendliness' of commodities. In a mixed precious metals segment, silver rose 5 percent in the week and palladium was up by 4.4 pct while gold fell 1.1 percent and platinum dropped by 0.9 percent from previous Friday.

Chilean uncertainty may offset China rate hike fears, support copper

Continued uncertainty at Chile's Collahuasi, the world's third largest copper mine, is likely to render positives to copper prices on Monday, or maybe well into this week, offsetting the negatives due to an expected China rate move.

Precious metals loose day's gains as focus shifts to hawkish China from comfortable Europe

Precious metals slid from their day's highs on Friday in New York as fears that China will soon raise rates eroded the investment appeal commodities gained on good news from Europe.