Voting to leave the EU was the easy part. When and how to depart is tougher, and a Brexit may not happen after all.

The U.K. faces a complex set of negotiations to clarify its future relationship with the EU, and it’s starting with some serious handicaps.

Gamblers who predicted a result in favor of continued British membership in the EU missed the signs that undecided voters would break for a Brexit.

Betting markets show a break in favor of "remain" in the European Union ahead of Thursday’s British referendum on European Union membership.

Opinion polls may show Britons are ready to abandon the European Union, but betting markets tell a different story — and they have a better track record.

China has little to show in the way of a data storage and analysis. But big ideas are hard to write off, especially when the Communist Party backs them.

Swedes like the European Union with the British inside it, so if the Brits vote to leave June 23, sentiment in the Scandinavian country for staying could change dramatically.

At this weekend's Strategic and Economic Dialogue, U.S. officials will take up the matter of China’s relatively closed market for U.S. investment.

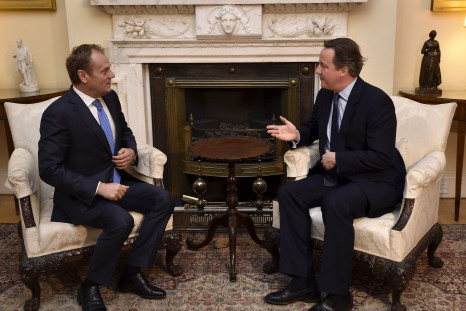

The British prime minister’s unlikely association with London’s new Labour mayor makes a break with the EU look less likely.

The highest risk is associated with non-military vessels, said Rear Adm. Mark Montgomery, director for operations of the U.S. Pacific Command.

Investors cheered the first step in impeaching Brazilian President Dilma Rousseff, but a government headed by Vice President Michel Temer won’t have it easy.

After decades of low growth and near deflation, Prime Minister Shinzo Abe's government is planning new public works initiatives and tax incentives to juice the economy.

Brazil was booming in 2009 when Rio de Janeiro won its bid to host the 2016 Summer Olympics. Now the country is gripped by political scandal and facing its worst recession since the 1930s.

The Treasury’s new rules on inversion-type transactions torpedoed the pharmaceutical deal, but a tough debate about corporate tax reform remains.

Europe faces fairly short-lived economic damage from the deadly bombings, but the political backlash could be much more severe.

Brazil’s President Dilma Rousseff — with her mentor, former President Luiz Inácio Lula da Silva — could embrace pro-worker policies in a bid to cling to power.

This week's stimulus moves by the European Central Bank could steer the continent toward Japan-style stagnation, critics say.

Chinese imports fell precipitously in February, a potent indicator that countries betting on Chinese growth face a disappointing 2016.

Markets that rallied after Brazil's former president was detained for questioning in a corruption case involving the energy company may see a reversal.

The U.K. government says recasting Britain’s international trade deals after leaving the European Union would lead to uncertainty and costs, a point independent experts validate.

A top Fed official says greater threats to U.S. growth are coming from abroad, suggesting global developments could slow the Fed’s march to higher interest rates.

Beijing just made it easier for Chinese banks to lend money, a step it hopes will juice the economy without encouraging capital flight.

Ahead of the G-20 finance ministers meeting in Shanghai this week, the U.S. is pushing other countries, including China, to boost the global economy.

Falling oil prices used to juice consumer spending, but the emergence of a massive oil sector in the U.S. has scrambled that once-reliable calculation.

Despite the economic benefits Britain derives from the EU, Britain's leader is likely to focus on noneconomic issues covered in a deal he reached in Brussels last week.

The most important economic variable of 2016 might be whether American consumers are strong enough to withstand the cold winds blowing in from abroad.

Meetings in Brussels on Thursday and Friday with fellow European leaders is the prime minister’s chance to sell his new version of Britain’s EU membership.

Central banks are resorting to negative interest rates to stimulate growth — Fed Chair Janet Yellen is considering them — but they are not as effective as investors had hoped.

European Union members are facing a controversy over the proposed construction of a natural gas pipeline under the Baltic Sea and the potential effects on the region.

Apart from being a self-inflicted blow, a possible British departure from the European Union is already having ill effects on confidence.

Editor's pick