“We should be concerned that he has the ability to launch nuclear weapons with literally no checks and balances,” says the bill’s sponsor, Rep. Ted Lieu. “One of the things you want to avoid is a fatal miscalculation.”

As it seeks bids for new headquarters, Jeff Bezos’ company wants to kill a shareholder resolution that would force the retail giant to report on "the risks arising from the public debate over Amazon’s growth."

Ed Perlmutter, a representative from a major oil and gas state, says climate change will likely make the industry less profitable, and that local communities should have some regulatory power.

The Democrats’ bill comes weeks after the Department of Labor issued waivers to convicted banks, including one that owns at least $130 million of debt from President Trump, allowing them to manage funds in federally regulated retirement systems.

Analysis by government researchers finds that trade-ravaged locales saw big increases in mortgage debt — which may have exacerbated the housing crisis.

The industry funneled money to the president and top GOP lawmakers, then Trump officials moved to undo new regulations.

The Yale University expert who briefed Congress tells IBT why a growing number of health professionals are alarmed by President Trump's “unraveling” —and how lawmakers of both parties reacted to her report.

He started his governorship canceling a tunnel project over its $5 billion price tag. Now Christie is ending his tenure pushing to hand a big gift to Amazon.

President Donald Trump owes millions to Deutsche Bank, which was one of five convicted banks that just saw its punishment waived by the Labor Department.

The bank is aiming to prevent a vote on an initiative to require executives to detail their efforts to influence politicians

A former Reagan aide says the Republican tax bill creates deficits deliberately — and that Reagan's image as a tax cutter is a "myth."

Experts argue President Trump could have closed the loophole the same way he has slashed regulations and restricted immigration: through an executive order. But the tax bill he just signed may make it harder to do so in the future.

New data shows the final tax bill could deliver 10 times more tax relief to real estate moguls than did the Senate version of the bill.

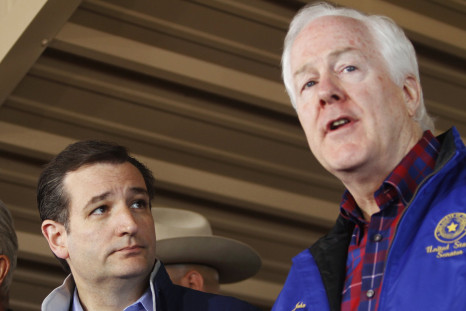

Sen. John Cornyn’s pipeline provision benefits Sen. Ted Cruz and other Republicans. He inserted it into the tax bill as his former chief of staff lobbied on the issue.

The GOP tax bill includes a special real-estate tax cut — a provision that could personally enrich more than a dozen Republican senators who voted on the bill.

The GOP senator's chief of staff has been investing in real estate LLCs that could get new tax cuts under controversial last-minute provision.

Orrin Hatch argued that the tax break was already in the House version of the tax bill. Experts disagree.

In response to IBT’s investigation, the GOP senator is pressing his party for answers about the provision, which could enrich Corker and other GOP lawmakers. Corker also said the provision was in the House version of the bill, a claim experts disputed.

A provision that could enrich key GOP lawmakers was part of effort to “cobble together the votes we needed,” said the Texas senator.

In a series of telephone calls with IBT, GOP senator denies knowledge of a key provision that could enrich him.

President Donald Trump has made tens of millions of dollars of rental income that could be subjected to a special new tax break in the Republicans’ tax legislation released Friday.

The new tax break — slipped into the final bill — specifically benefits people who own large real estate holdings through LLCs and partnerships, experts said.

House Speaker Paul Ryan and 12 other Republicans are crafting tax provisions that could end up making them big money.

On the eve of the FCC’s vote, some prominent GOP lawmakers are now demanding the net neutrality rules be preserved.

GOP’s middle-of-the-night tax break for oil and gas investors would benefit some of the Republican Party’s wealthiest legislators

Following an IBT report on payday lenders' campaign donations to Mick Mulvaney, two Democratic senators —and possible presidential candidates — called out the acting CFPB director's conflicts of interest.

Correspondence obtained by IBT shows Trump's financial regulator went to bat for the finance industry that was bankrolling his campaigns.

Kansas GOP Sen. Pat Roberts represents Koch Industries home state in Congress — and pushed to let the billionaire brothers write off their donations to secretive political groups.

As Republican lawmakers prepare to finalize a sweeping tax cut bill, their former aides are back in congressional offices, now representing the real estate, tech, health care and private jet management industries.

A last-minute provision would give the GOP’s fossil-fuel donors a new tax break.

Editor's pick